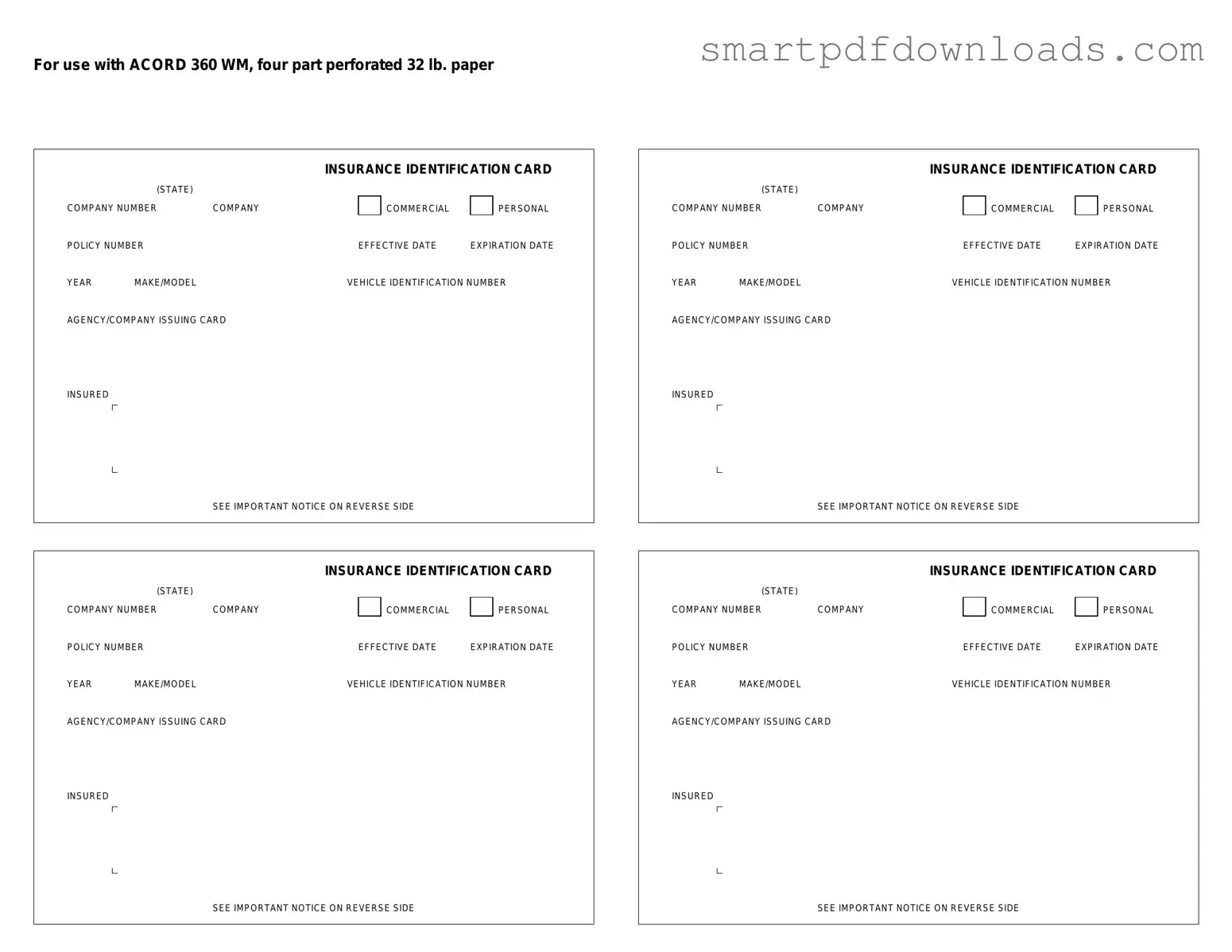

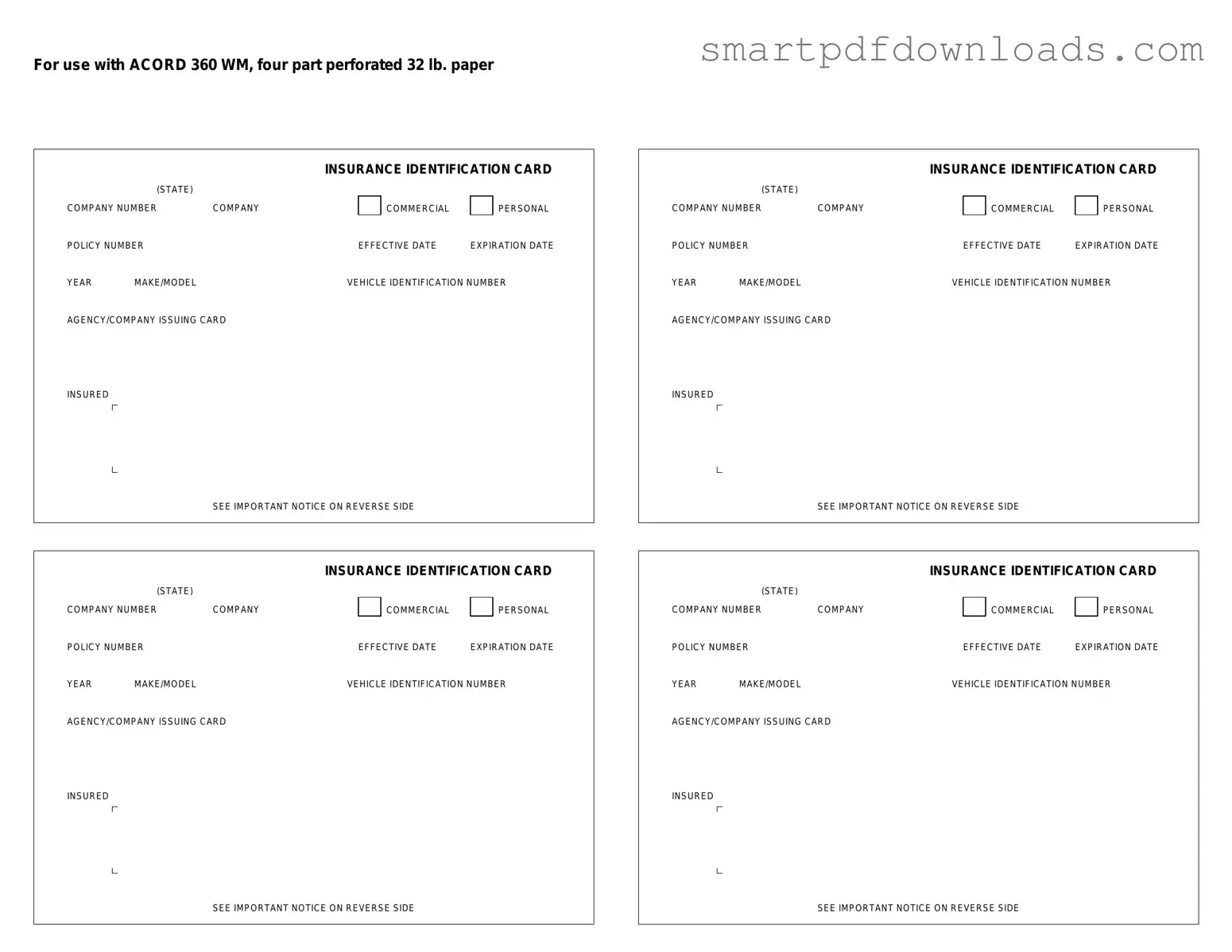

Acord 50 WM Form

The Acord 50 WM form is a standardized document used in the insurance industry to facilitate the reporting of workers' compensation insurance information. This form serves as a vital tool for employers, insurers, and agents, ensuring that essential details about coverage and claims are accurately communicated. Understanding its components and proper usage can significantly enhance the efficiency of the insurance process.

Edit Acord 50 WM Online

Acord 50 WM Form

Edit Acord 50 WM Online

Edit Acord 50 WM Online

or

⇓ PDF File

Finish the form and move on

Edit Acord 50 WM online fast, without printing.