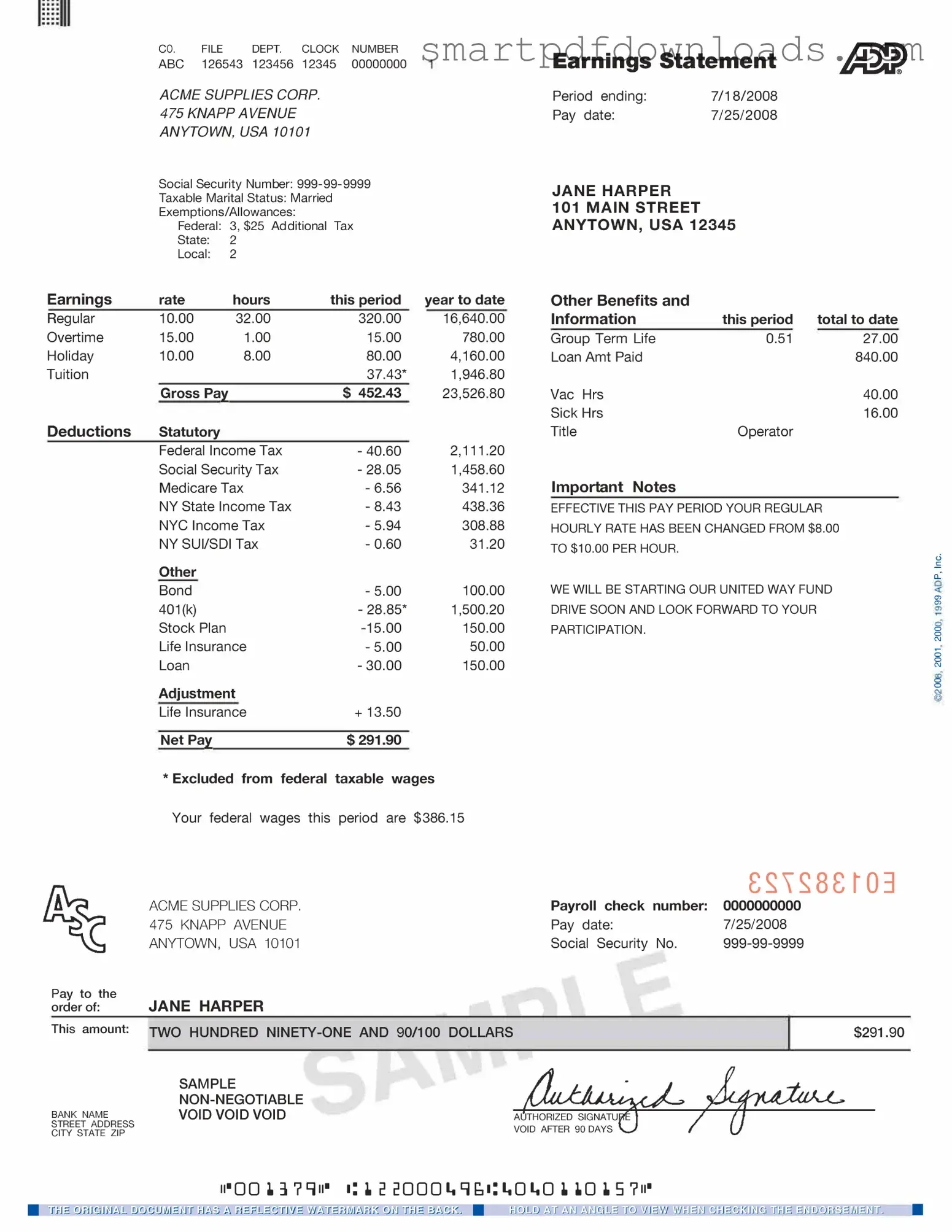

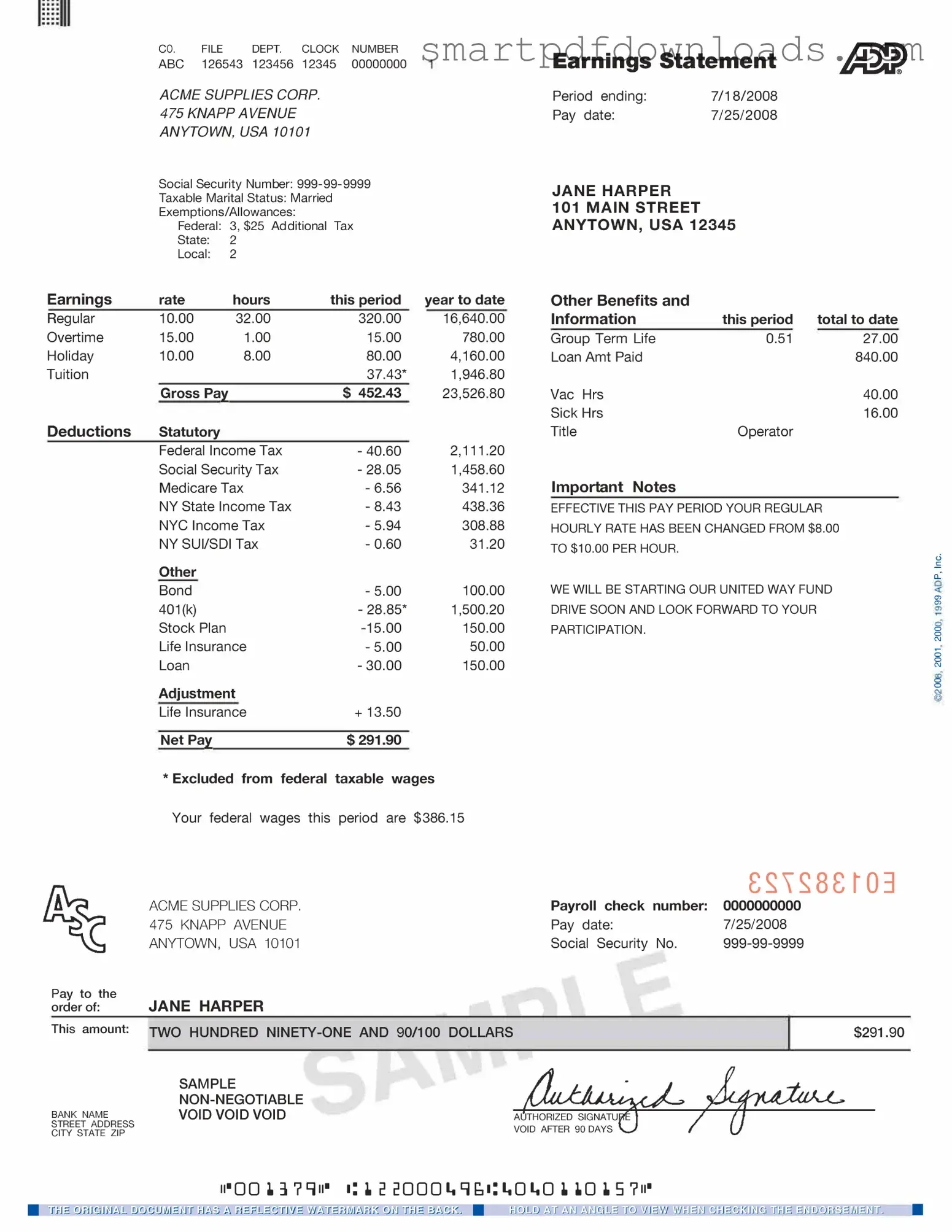

Adp Pay Stub Form

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. This form includes essential information such as gross pay, taxes withheld, and net pay, allowing employees to understand their compensation clearly. Understanding this form is crucial for managing personal finances and ensuring accurate tax reporting.

Edit Adp Pay Stub Online

Adp Pay Stub Form

Edit Adp Pay Stub Online

Edit Adp Pay Stub Online

or

⇓ PDF File

Finish the form and move on

Edit Adp Pay Stub online fast, without printing.