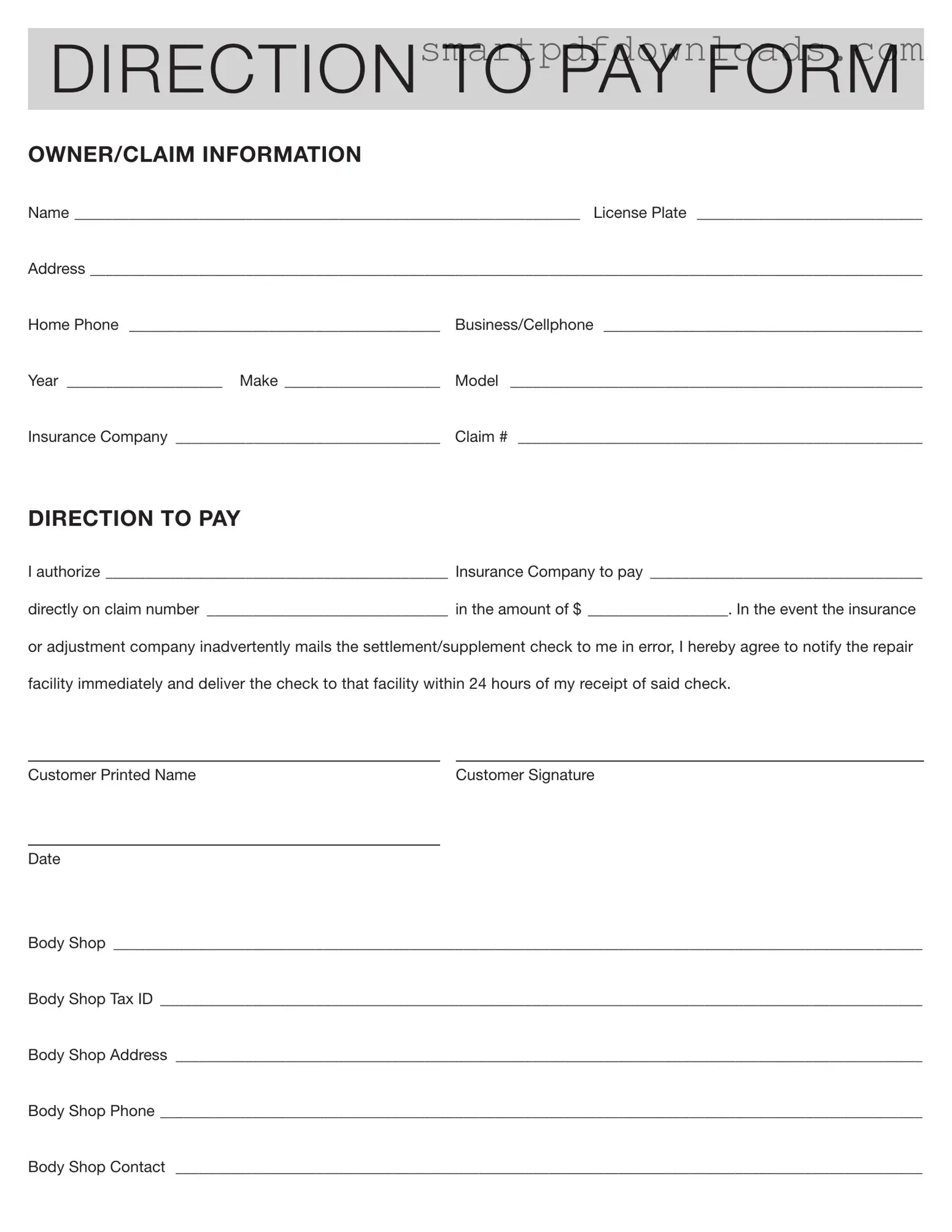

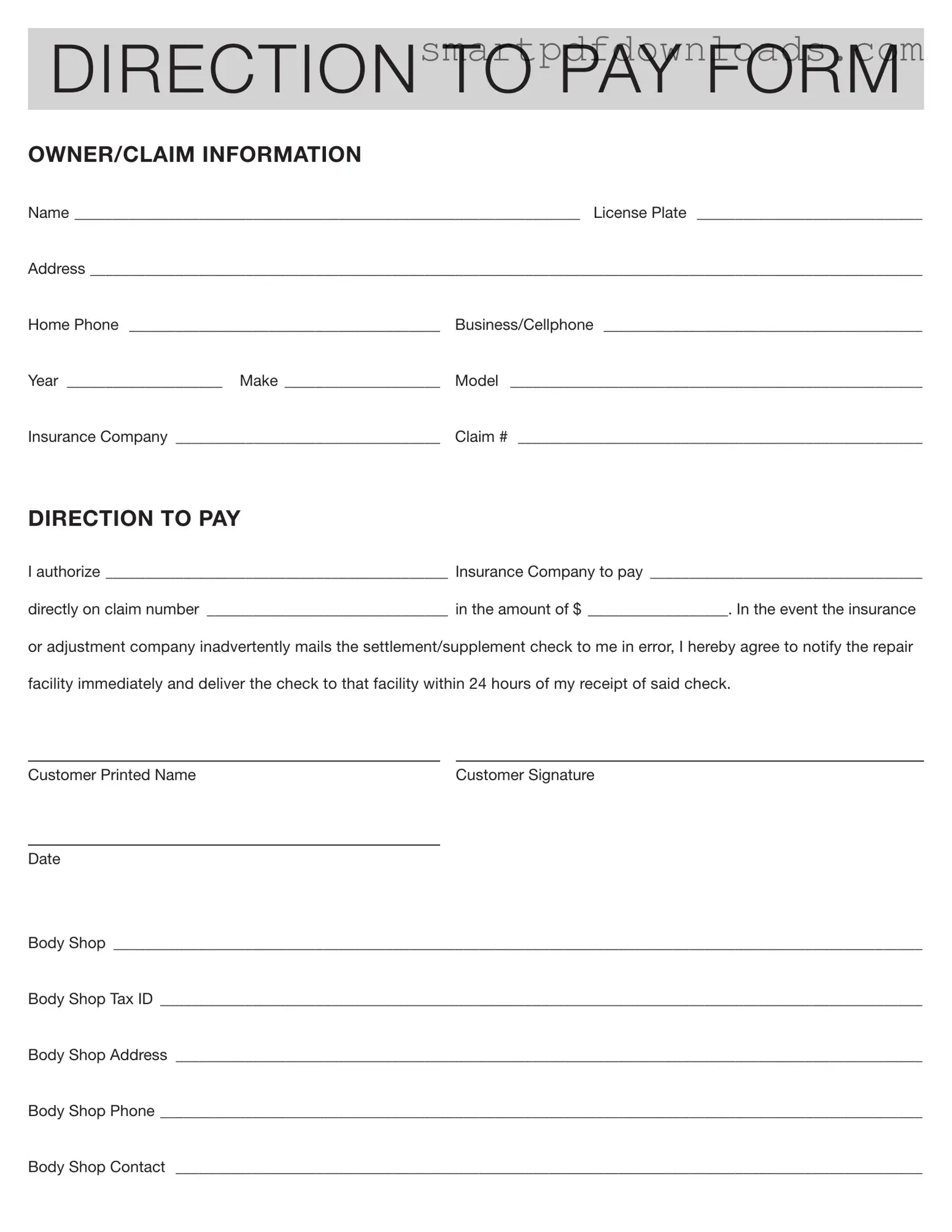

Authorization And Direction Pay Form

The Authorization And Direction Pay form is a document that allows an individual to authorize their insurance company to pay a specific amount directly to a repair facility for services rendered. This form includes essential information such as the owner’s details, vehicle information, and the insurance claim number. By signing this document, the individual agrees to notify the repair facility if a settlement check is mistakenly sent to them, ensuring a smooth payment process.

Edit Authorization And Direction Pay Online

Authorization And Direction Pay Form

Edit Authorization And Direction Pay Online

Edit Authorization And Direction Pay Online

or

⇓ PDF File

Finish the form and move on

Edit Authorization And Direction Pay online fast, without printing.