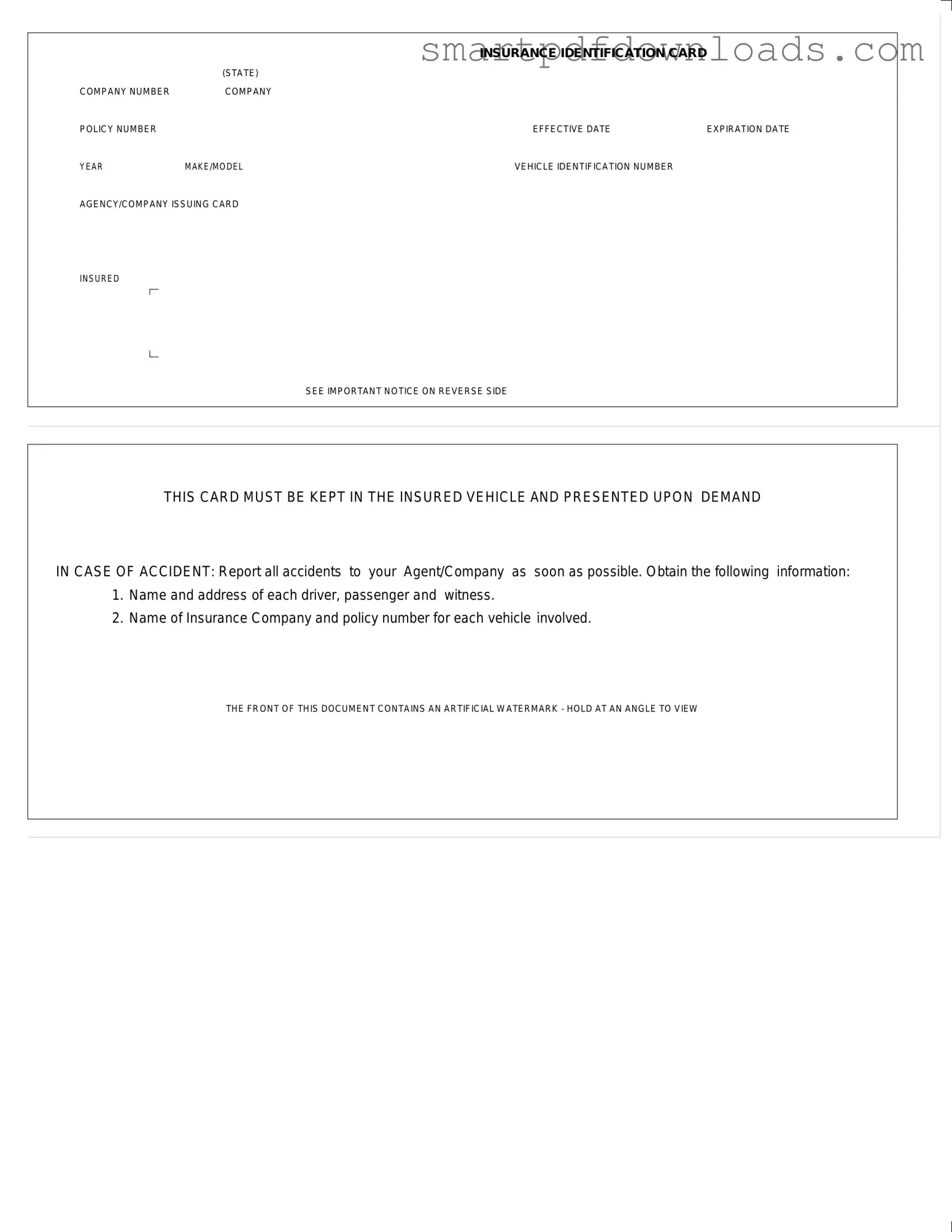

Auto Insurance Card Form

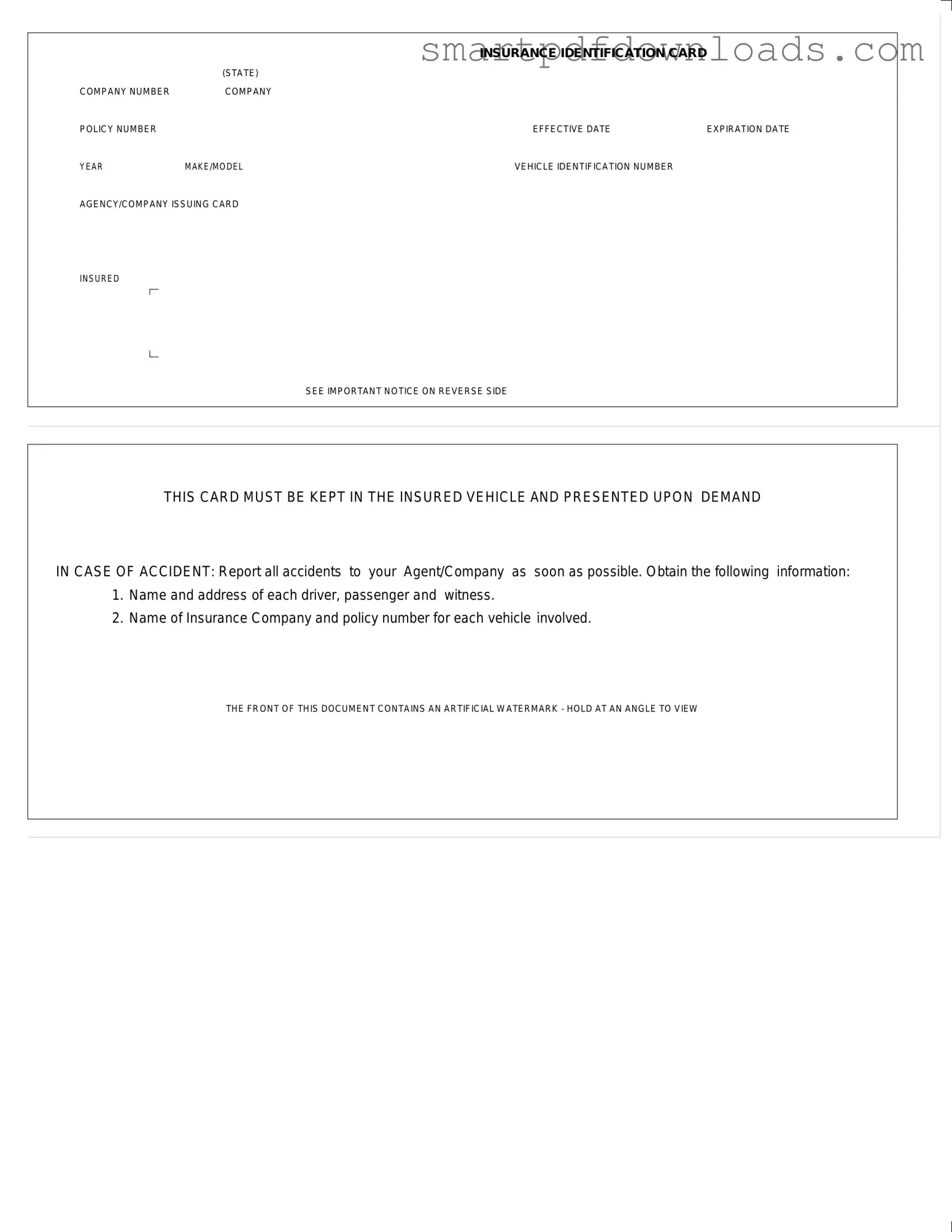

An Auto Insurance Card is an essential document that proves you have the required insurance coverage for your vehicle. This card contains important information, such as the insurance company’s details, policy number, and the vehicle's identification number. It is crucial to keep this card in your vehicle and present it when requested, especially in the event of an accident.

Edit Auto Insurance Card Online

Auto Insurance Card Form

Edit Auto Insurance Card Online

Edit Auto Insurance Card Online

or

⇓ PDF File

Finish the form and move on

Edit Auto Insurance Card online fast, without printing.