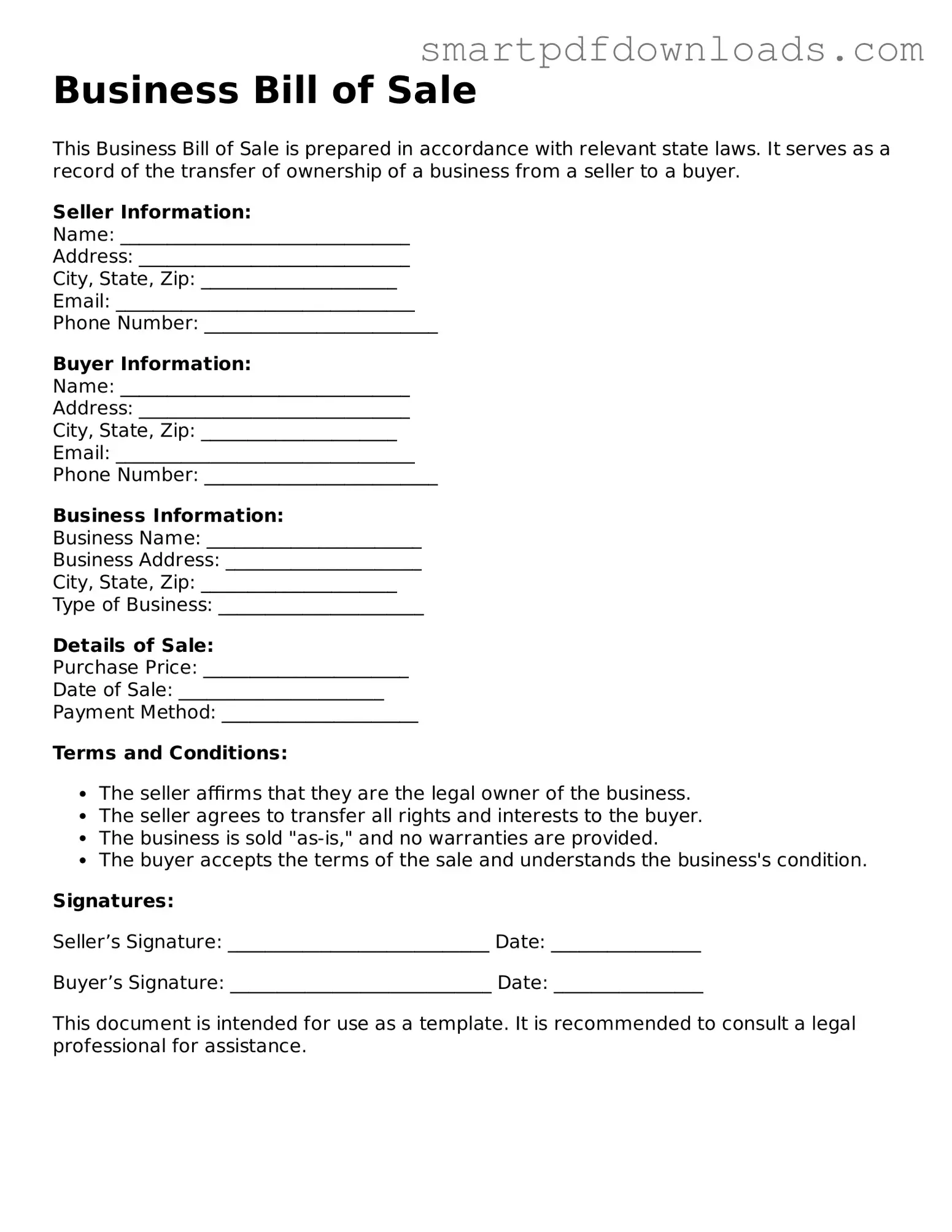

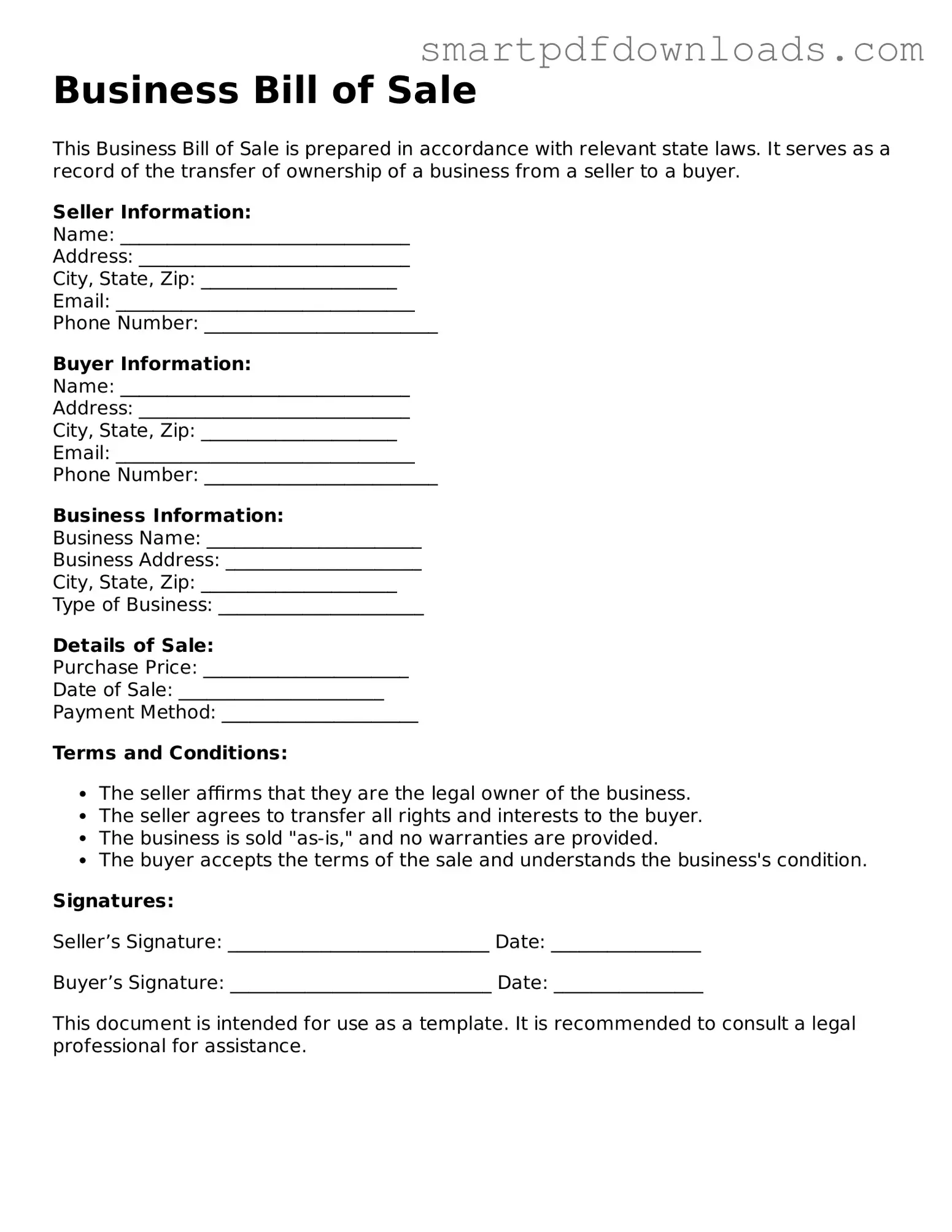

Free Business Bill of Sale Form

A Business Bill of Sale is a legal document that serves as proof of the transfer of ownership of a business or its assets from one party to another. This form outlines the details of the transaction, including the items being sold, the sale price, and the terms agreed upon by both parties. Understanding this form is crucial for ensuring a smooth and legally compliant transfer of business ownership.

Edit Business Bill of Sale Online

Free Business Bill of Sale Form

Edit Business Bill of Sale Online

Edit Business Bill of Sale Online

or

⇓ PDF File

Finish the form and move on

Edit Business Bill of Sale online fast, without printing.