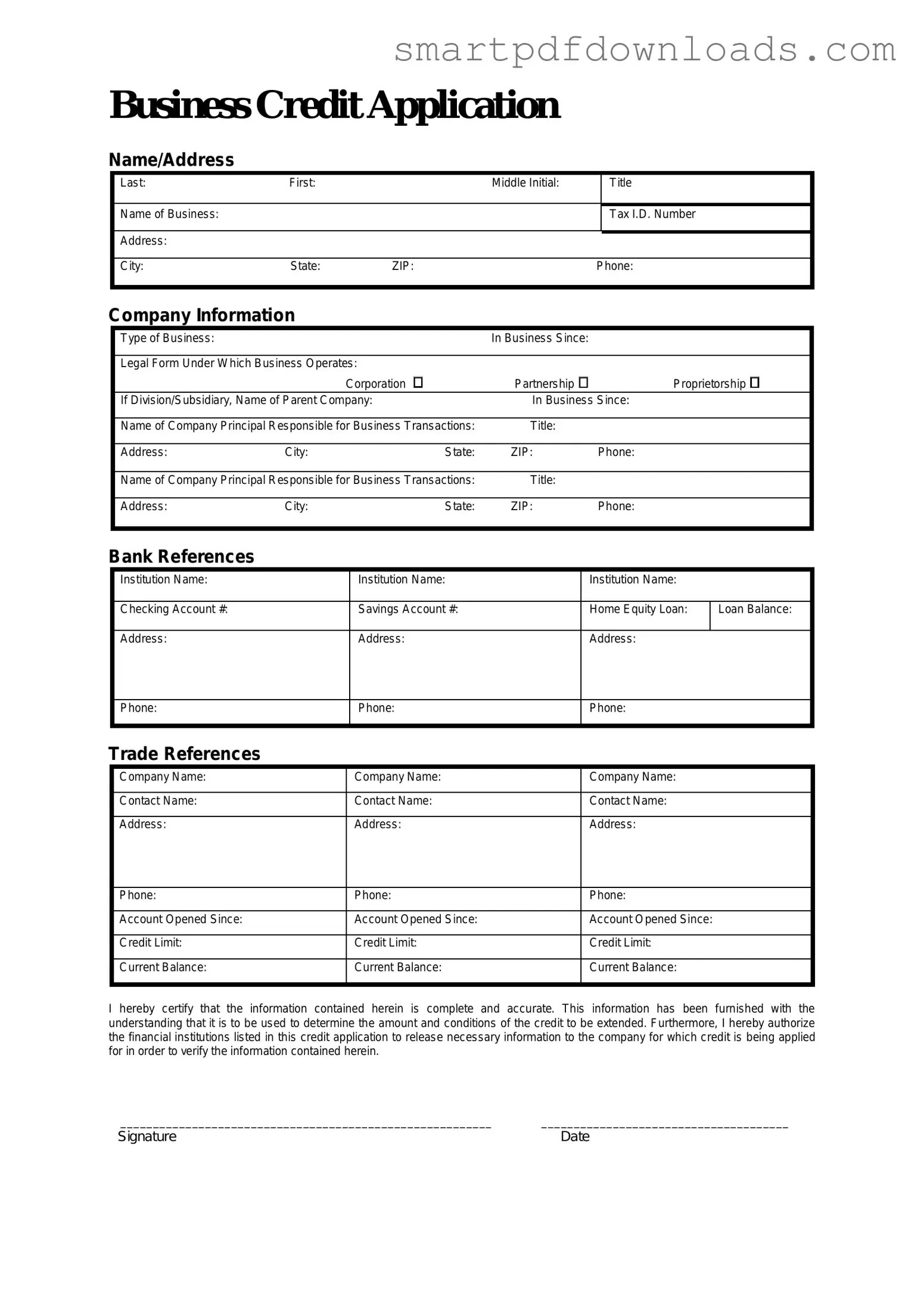

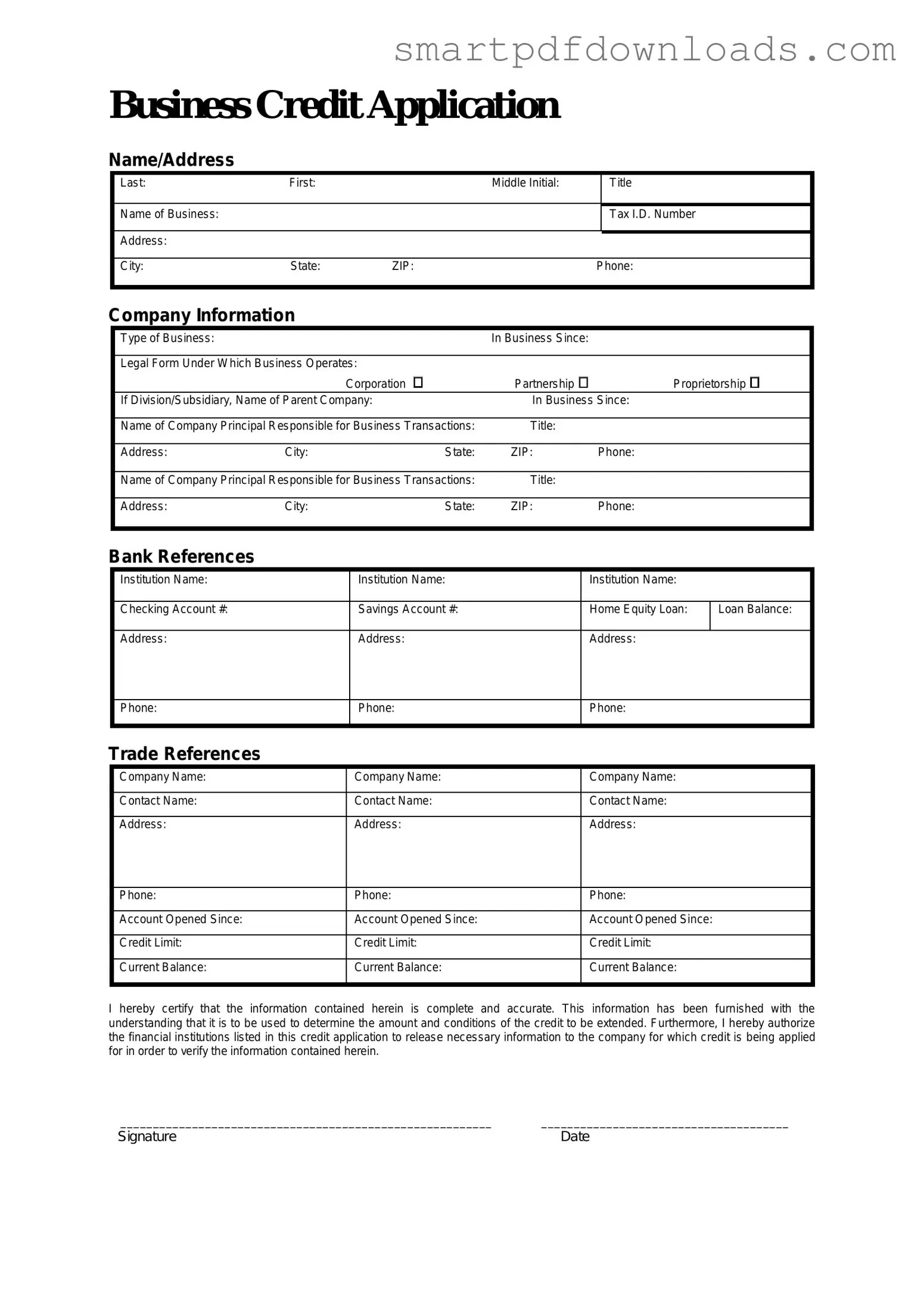

Business Credit Application Form

The Business Credit Application form is a crucial document that businesses use to request credit from suppliers or financial institutions. This form collects essential information about the business's financial status, credit history, and operational details. Completing it accurately can significantly enhance a company's chances of securing the credit it needs to grow and thrive.

Edit Business Credit Application Online

Business Credit Application Form

Edit Business Credit Application Online

Edit Business Credit Application Online

or

⇓ PDF File

Finish the form and move on

Edit Business Credit Application online fast, without printing.