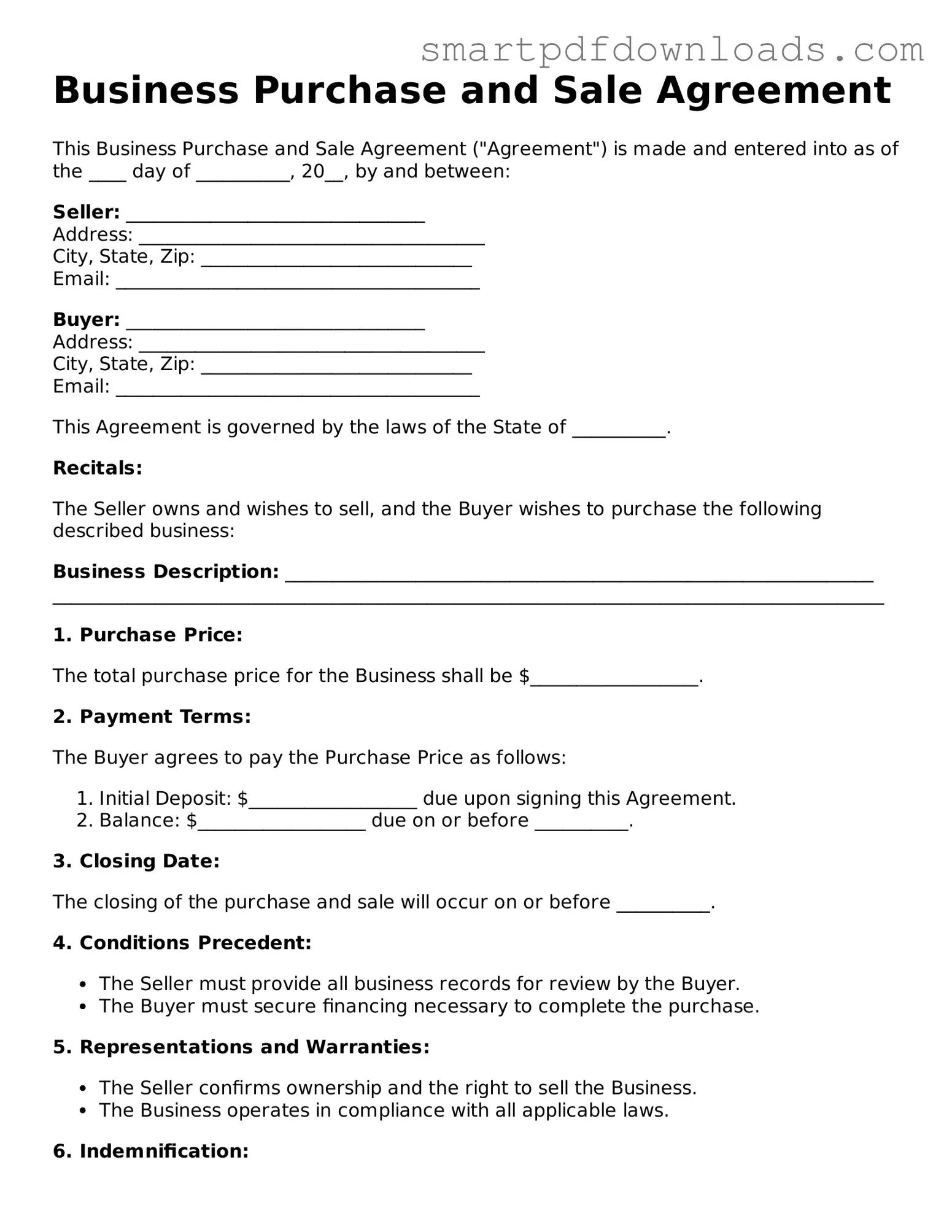

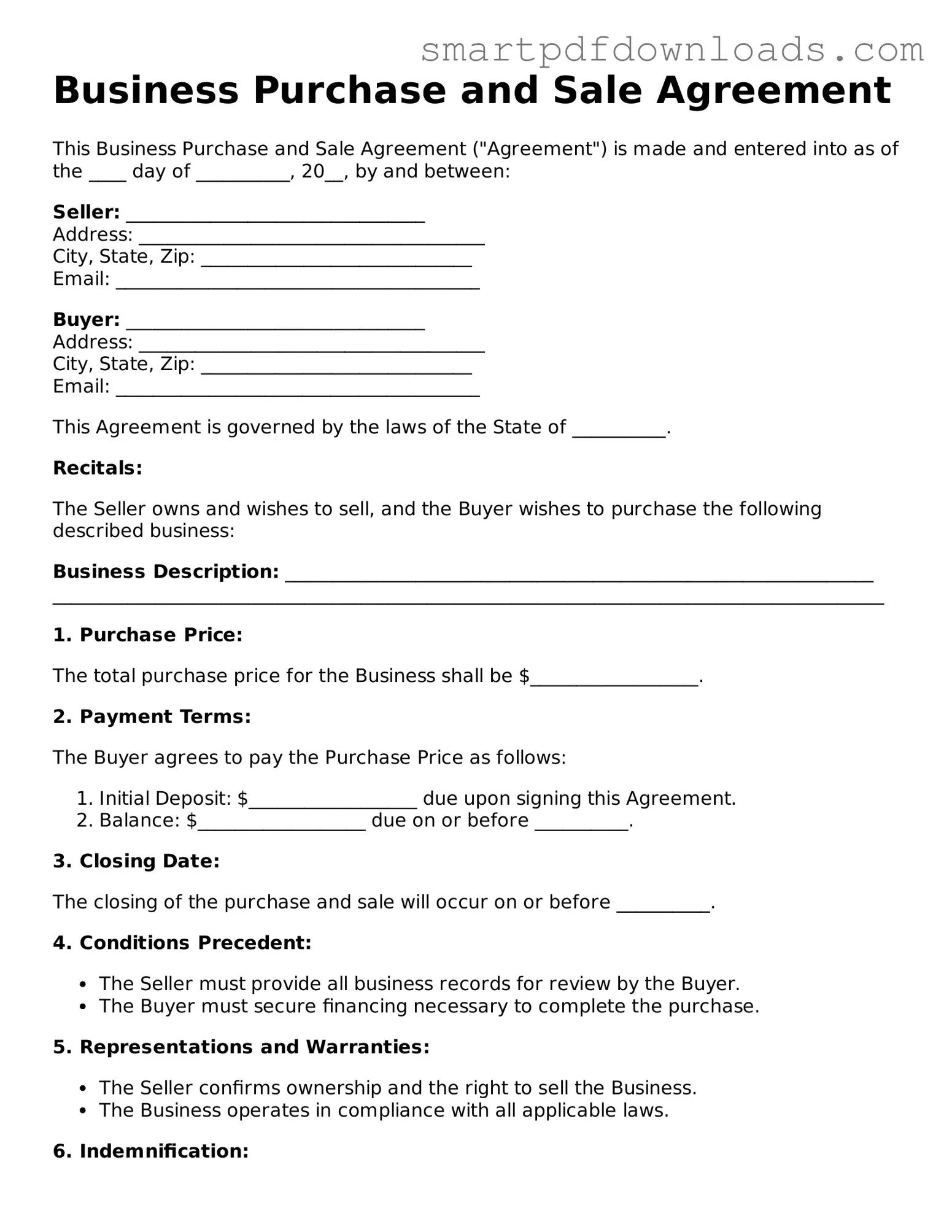

Free Business Purchase and Sale Agreement Form

The Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. This agreement serves to protect both the buyer and the seller by clearly defining their rights and obligations. Understanding this form is essential for anyone involved in a business transaction.

Edit Business Purchase and Sale Agreement Online

Free Business Purchase and Sale Agreement Form

Edit Business Purchase and Sale Agreement Online

Edit Business Purchase and Sale Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Business Purchase and Sale Agreement online fast, without printing.