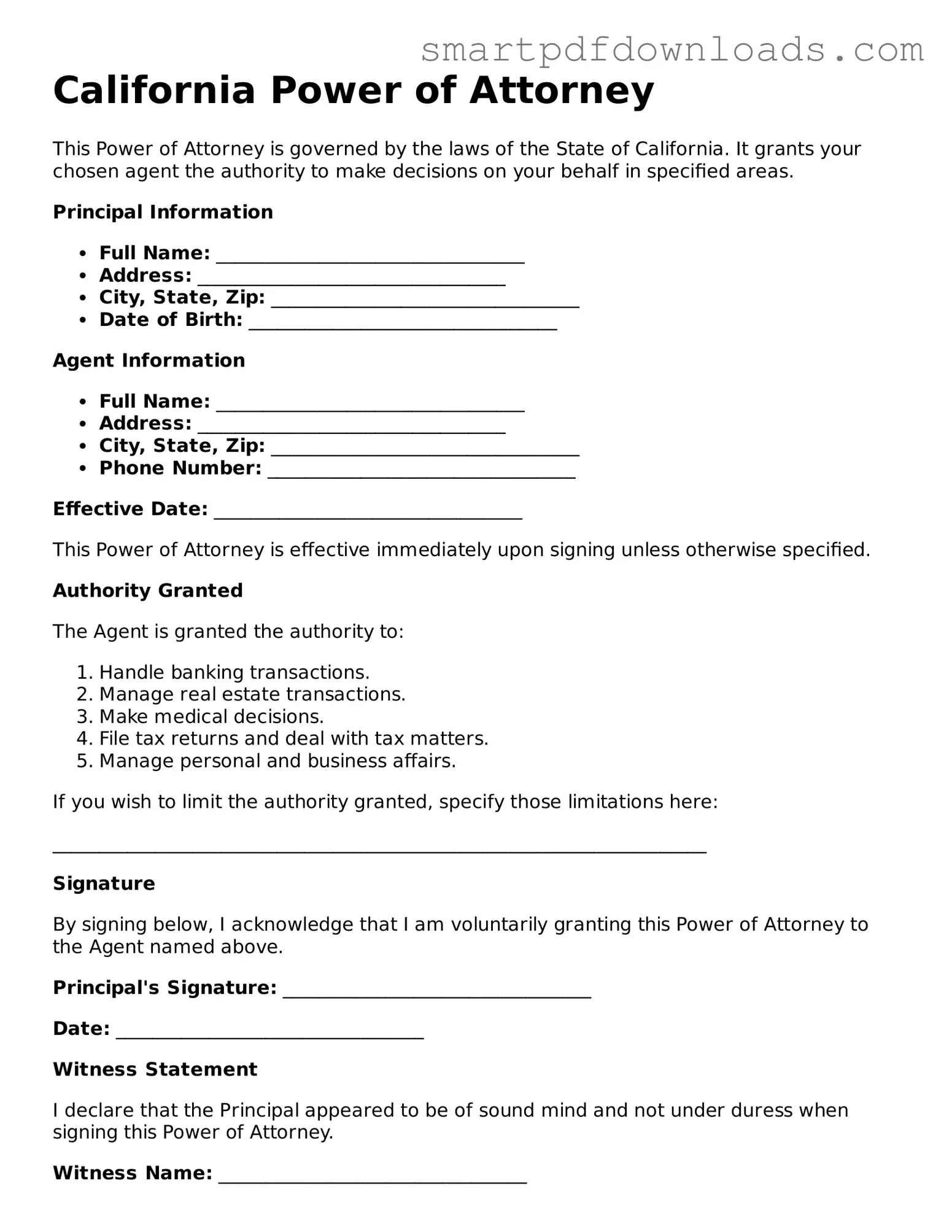

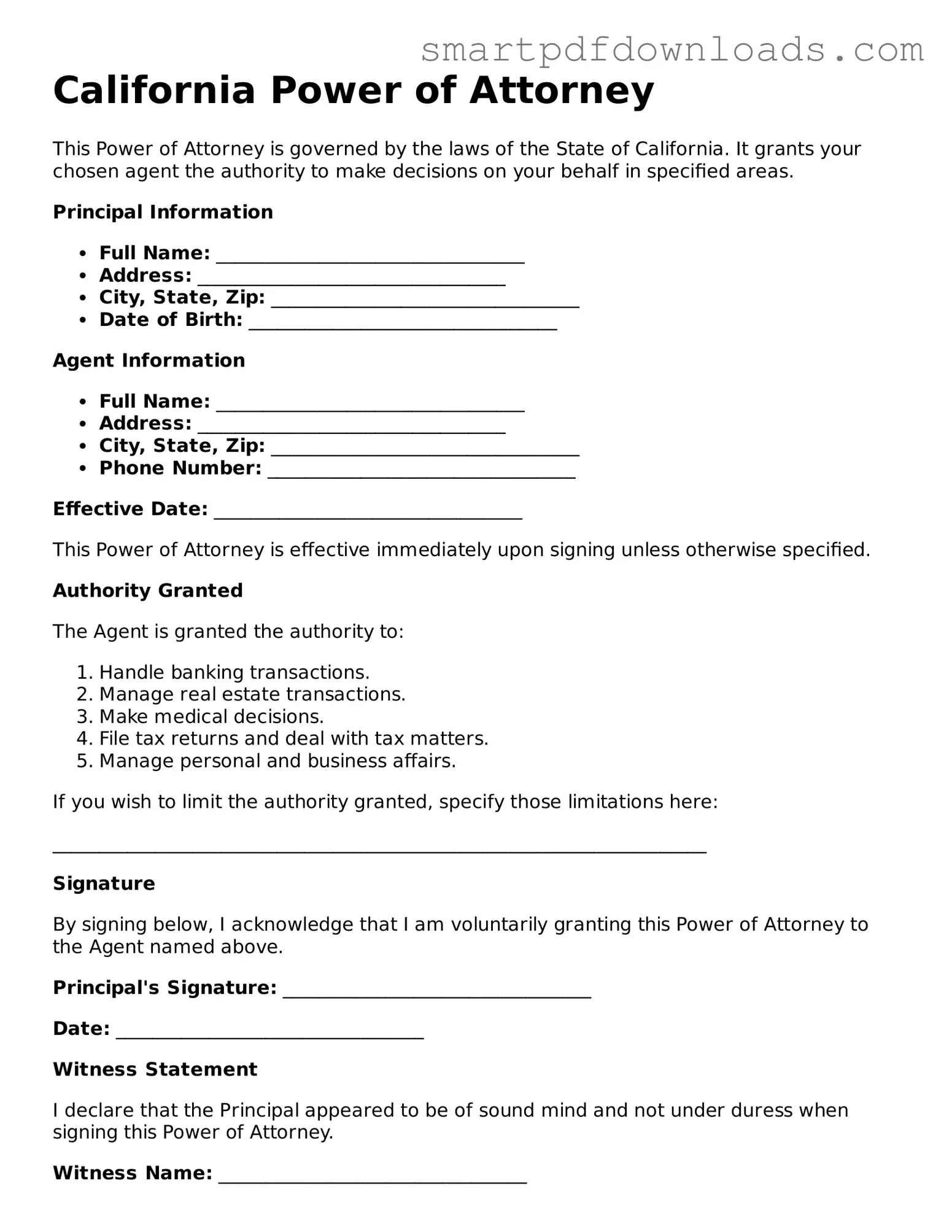

Legal Power of Attorney Form for the State of California

A California Power of Attorney form is a legal document that allows one person to authorize another to act on their behalf in financial or legal matters. This form can be essential for ensuring that your wishes are followed when you are unable to make decisions for yourself. Understanding how to properly use this document can provide peace of mind and security for you and your loved ones.

Edit Power of Attorney Online

Legal Power of Attorney Form for the State of California

Edit Power of Attorney Online

Edit Power of Attorney Online

or

⇓ PDF File

Finish the form and move on

Edit Power of Attorney online fast, without printing.