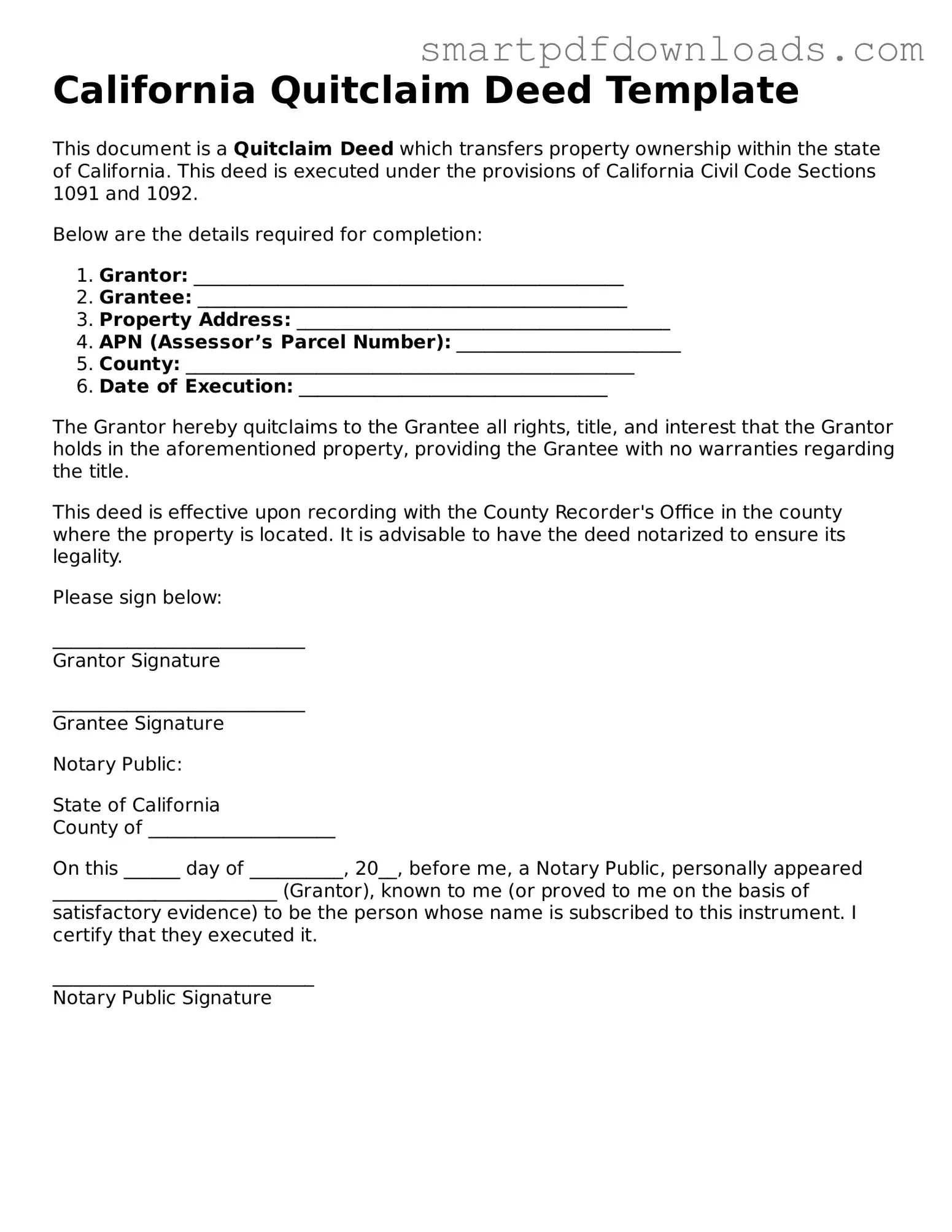

Legal Quitclaim Deed Form for the State of California

A California Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another without any warranties. This form allows the grantor to relinquish their interest in the property, making it a straightforward option for property transfers. Understanding how to properly complete and file this form is essential for ensuring a smooth transaction.

Edit Quitclaim Deed Online

Legal Quitclaim Deed Form for the State of California

Edit Quitclaim Deed Online

Edit Quitclaim Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Quitclaim Deed online fast, without printing.