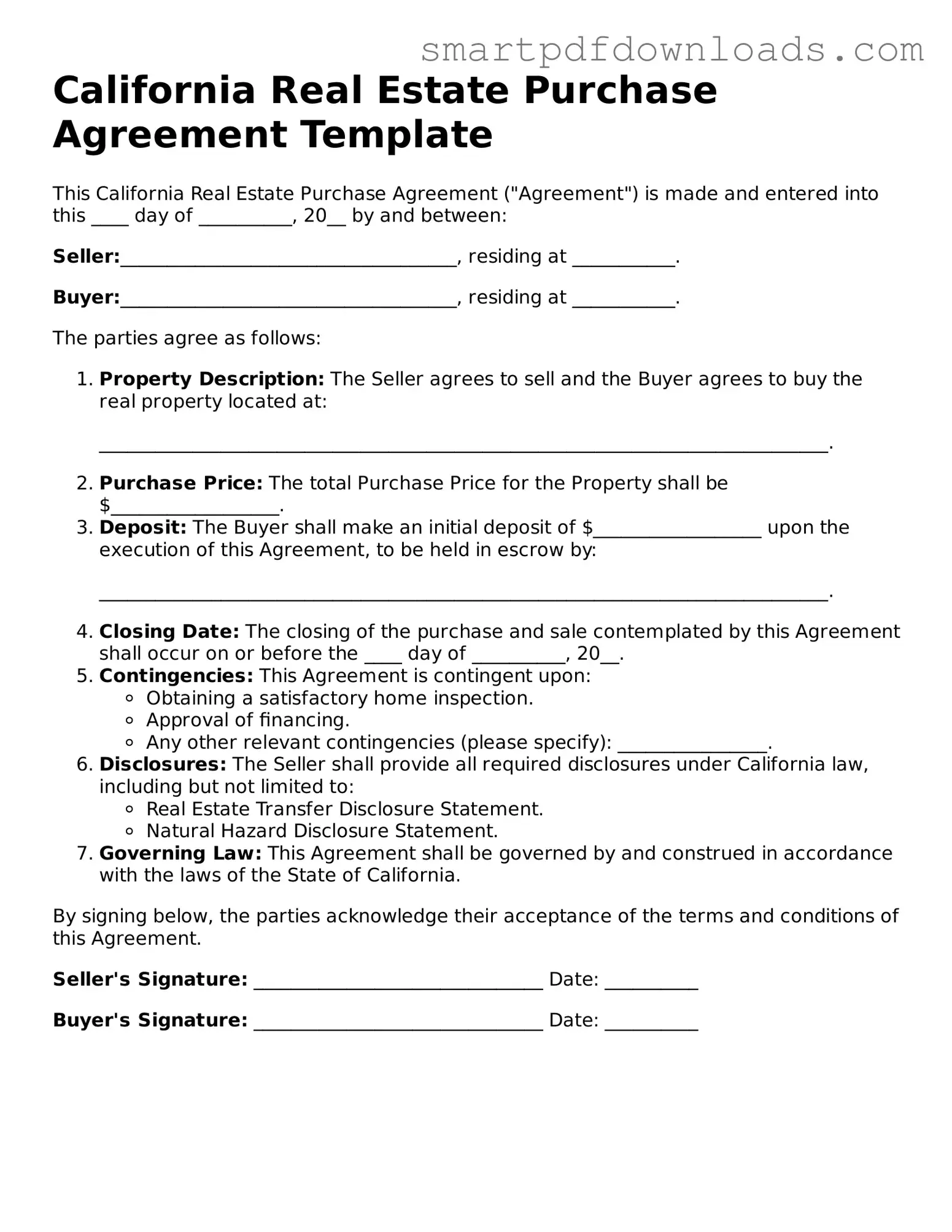

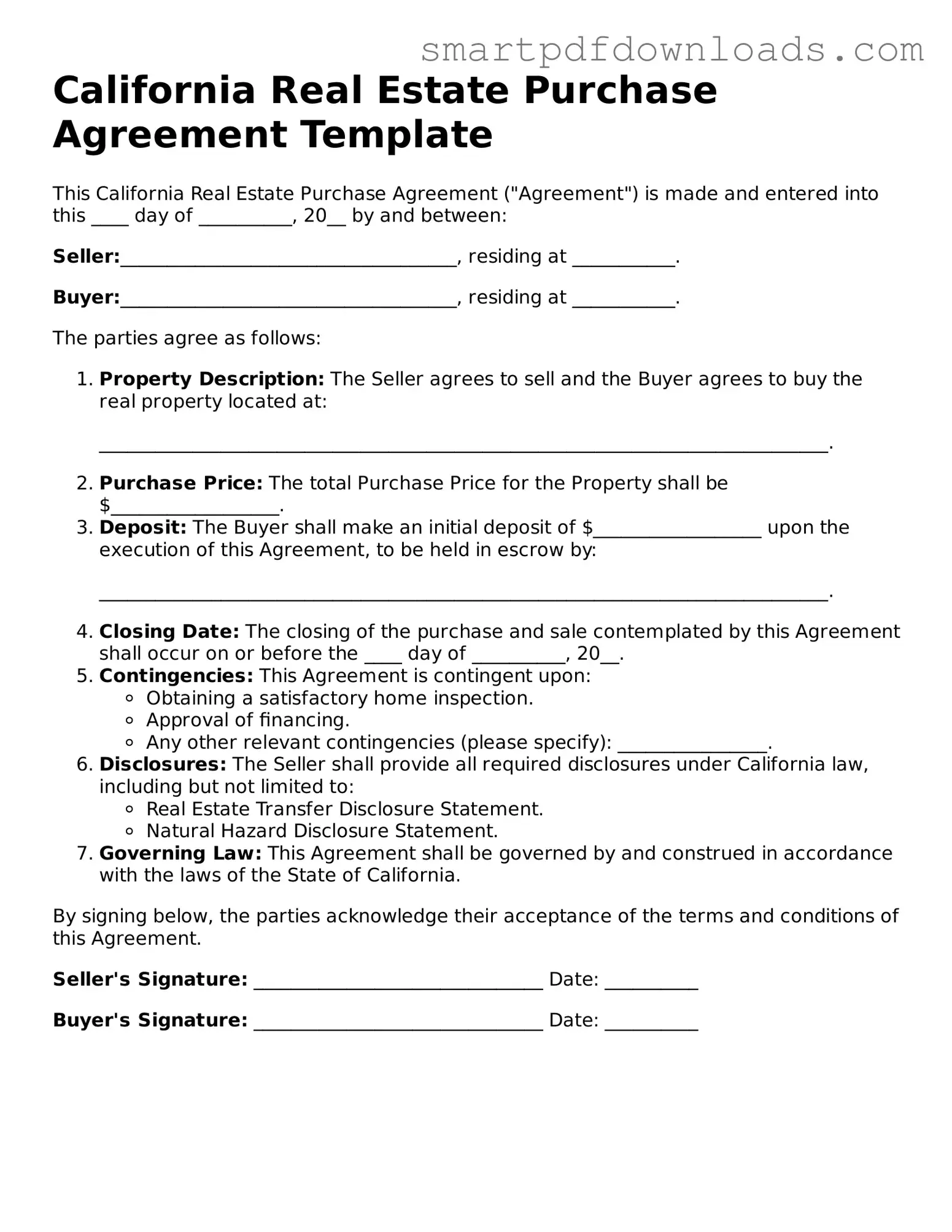

Legal Real Estate Purchase Agreement Form for the State of California

The California Real Estate Purchase Agreement form is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form serves as a crucial tool in real estate transactions, providing clarity and protection for both parties involved. Understanding its components can help ensure a smooth buying process.

Edit Real Estate Purchase Agreement Online

Legal Real Estate Purchase Agreement Form for the State of California

Edit Real Estate Purchase Agreement Online

Edit Real Estate Purchase Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Real Estate Purchase Agreement online fast, without printing.