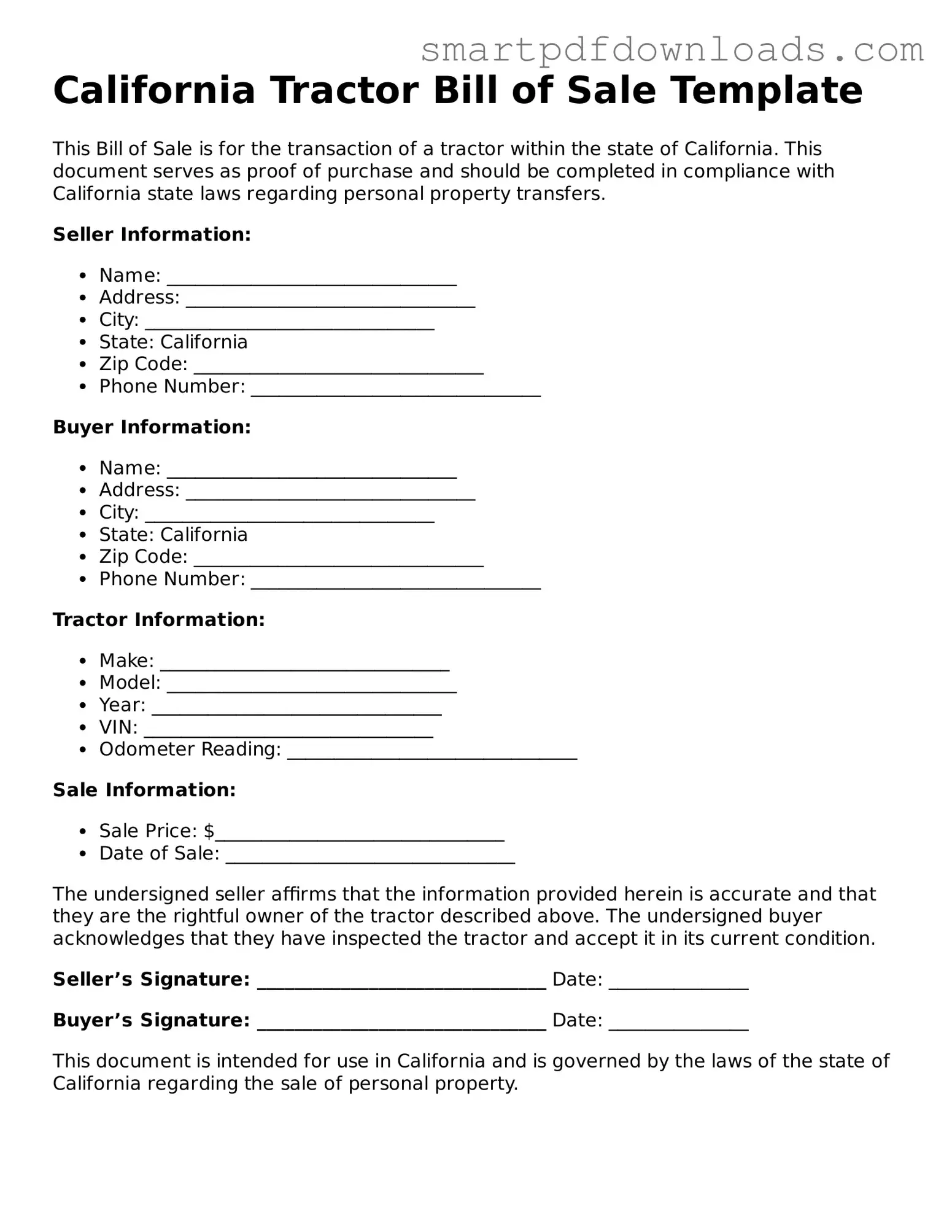

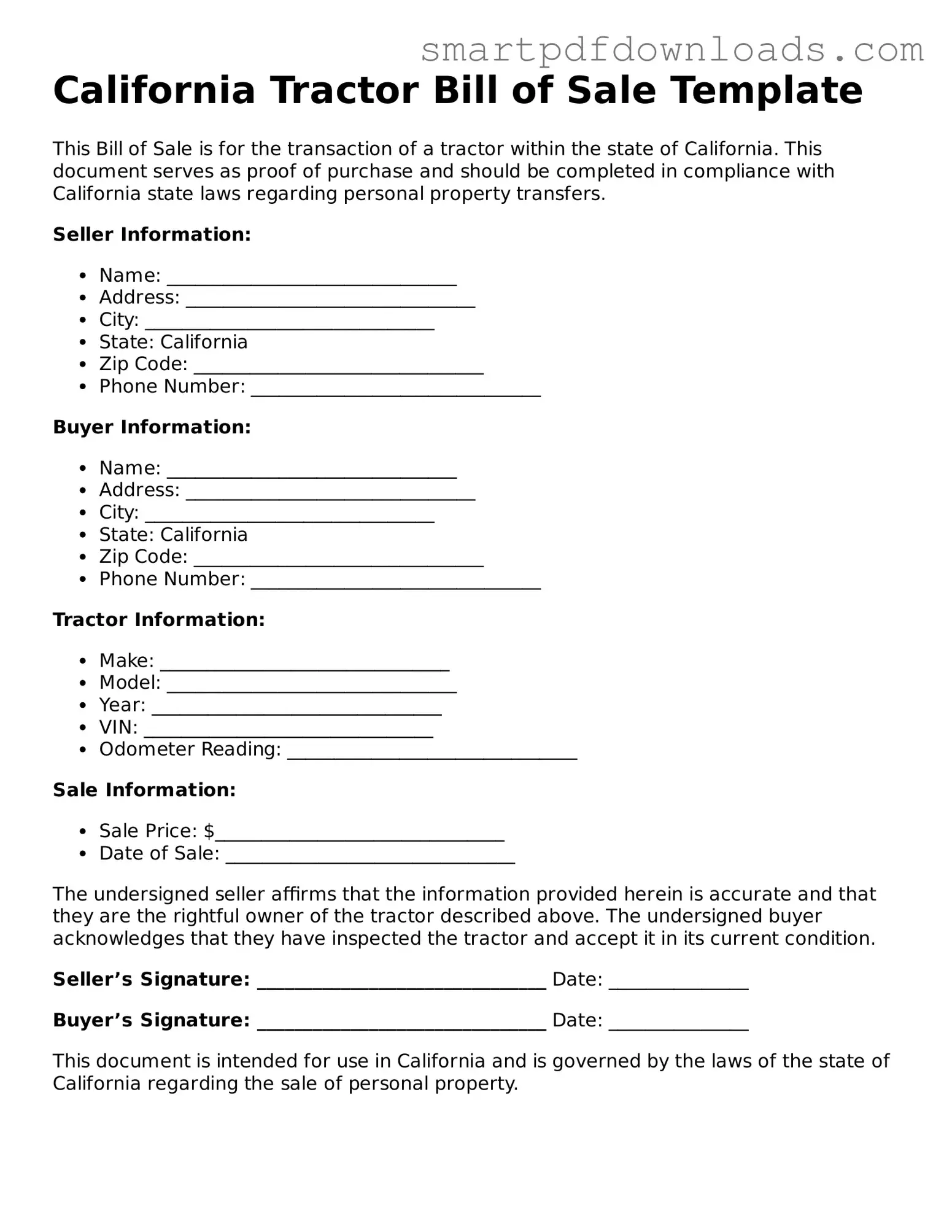

Legal Tractor Bill of Sale Form for the State of California

The California Tractor Bill of Sale form is a legal document that records the sale of a tractor between a buyer and a seller. This form provides essential details about the transaction, including the parties involved, the tractor's specifications, and the sale price. Properly completing this document ensures a smooth transfer of ownership and protects both parties' interests.

Edit Tractor Bill of Sale Online

Legal Tractor Bill of Sale Form for the State of California

Edit Tractor Bill of Sale Online

Edit Tractor Bill of Sale Online

or

⇓ PDF File

Finish the form and move on

Edit Tractor Bill of Sale online fast, without printing.