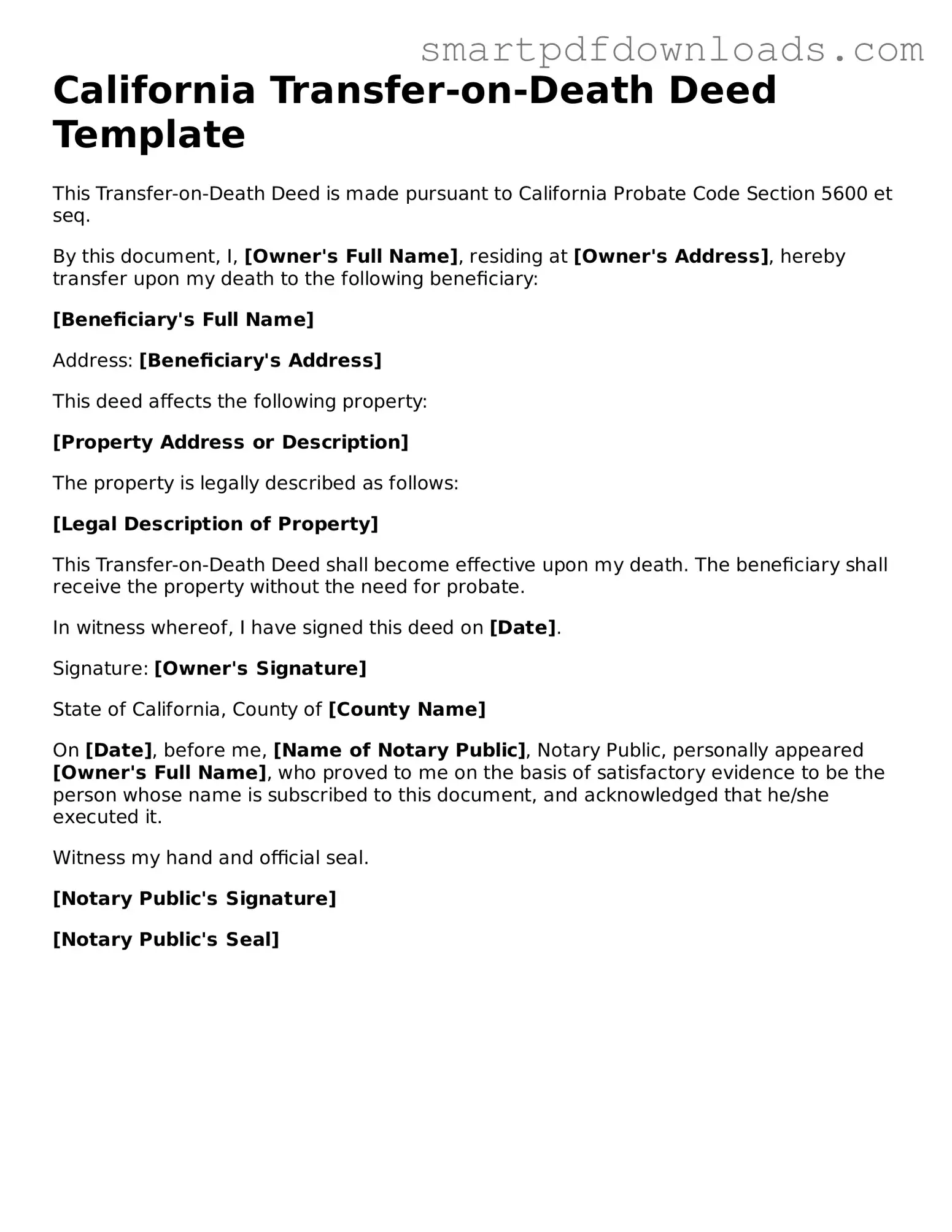

Legal Transfer-on-Death Deed Form for the State of California

The California Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate. This form simplifies the transfer process, ensuring that loved ones receive property directly and efficiently. Understanding how to properly utilize this deed can provide peace of mind and facilitate smoother transitions for families.

Edit Transfer-on-Death Deed Online

Legal Transfer-on-Death Deed Form for the State of California

Edit Transfer-on-Death Deed Online

Edit Transfer-on-Death Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Transfer-on-Death Deed online fast, without printing.