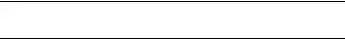

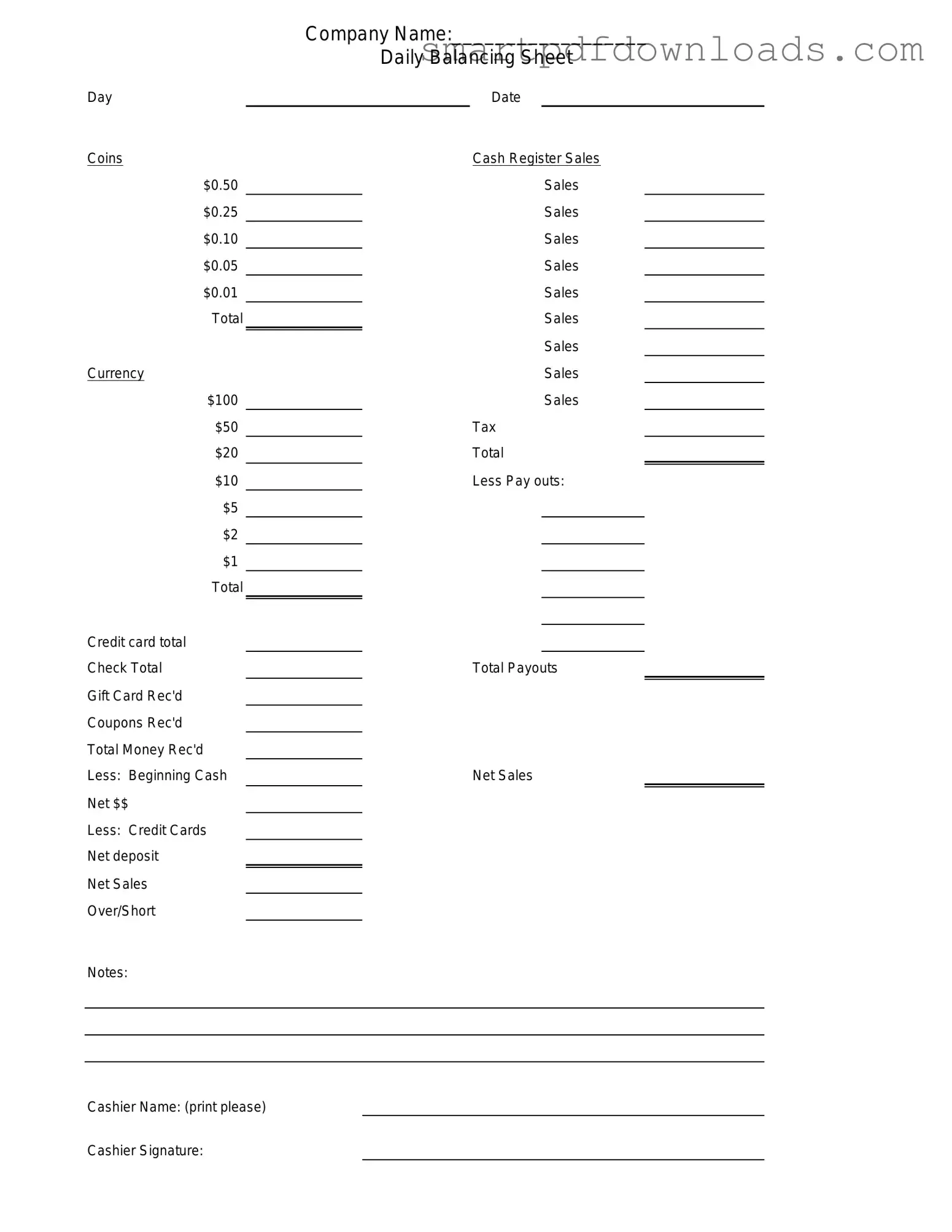

Cash Drawer Count Sheet Form

The Cash Drawer Count Sheet is a vital document used by businesses to track the cash flow in and out of a cash register. This form helps ensure accuracy in financial reporting and accountability among employees. By systematically documenting cash counts, businesses can prevent discrepancies and maintain operational integrity.

Edit Cash Drawer Count Sheet Online

Cash Drawer Count Sheet Form

Edit Cash Drawer Count Sheet Online

Edit Cash Drawer Count Sheet Online

or

⇓ PDF File

Finish the form and move on

Edit Cash Drawer Count Sheet online fast, without printing.