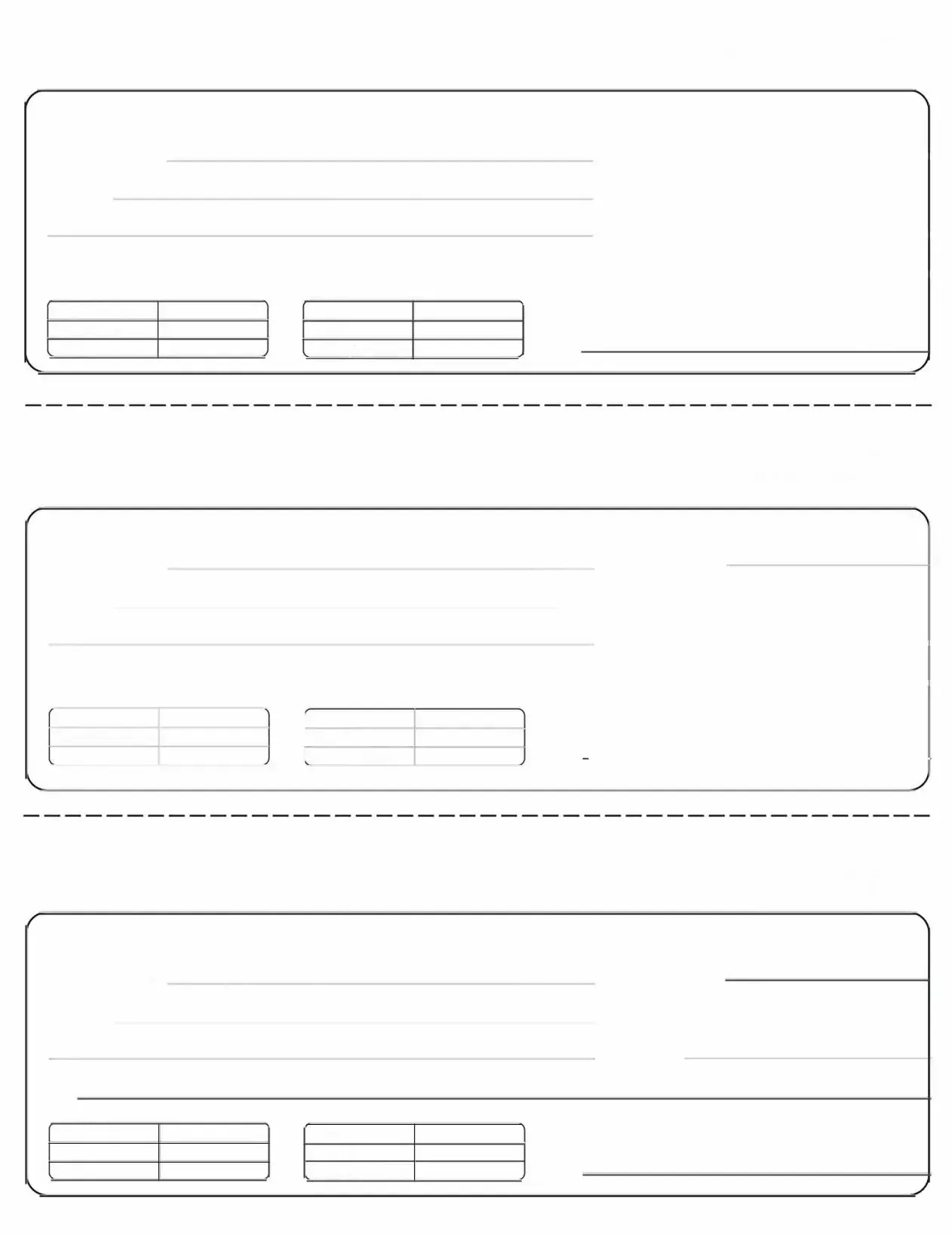

Cash Receipt Form

A Cash Receipt form is a document used to acknowledge the receipt of cash payments from customers or clients. This form serves as proof of transaction and is essential for accurate record-keeping in any business. Understanding its purpose and proper use is crucial for maintaining financial integrity.

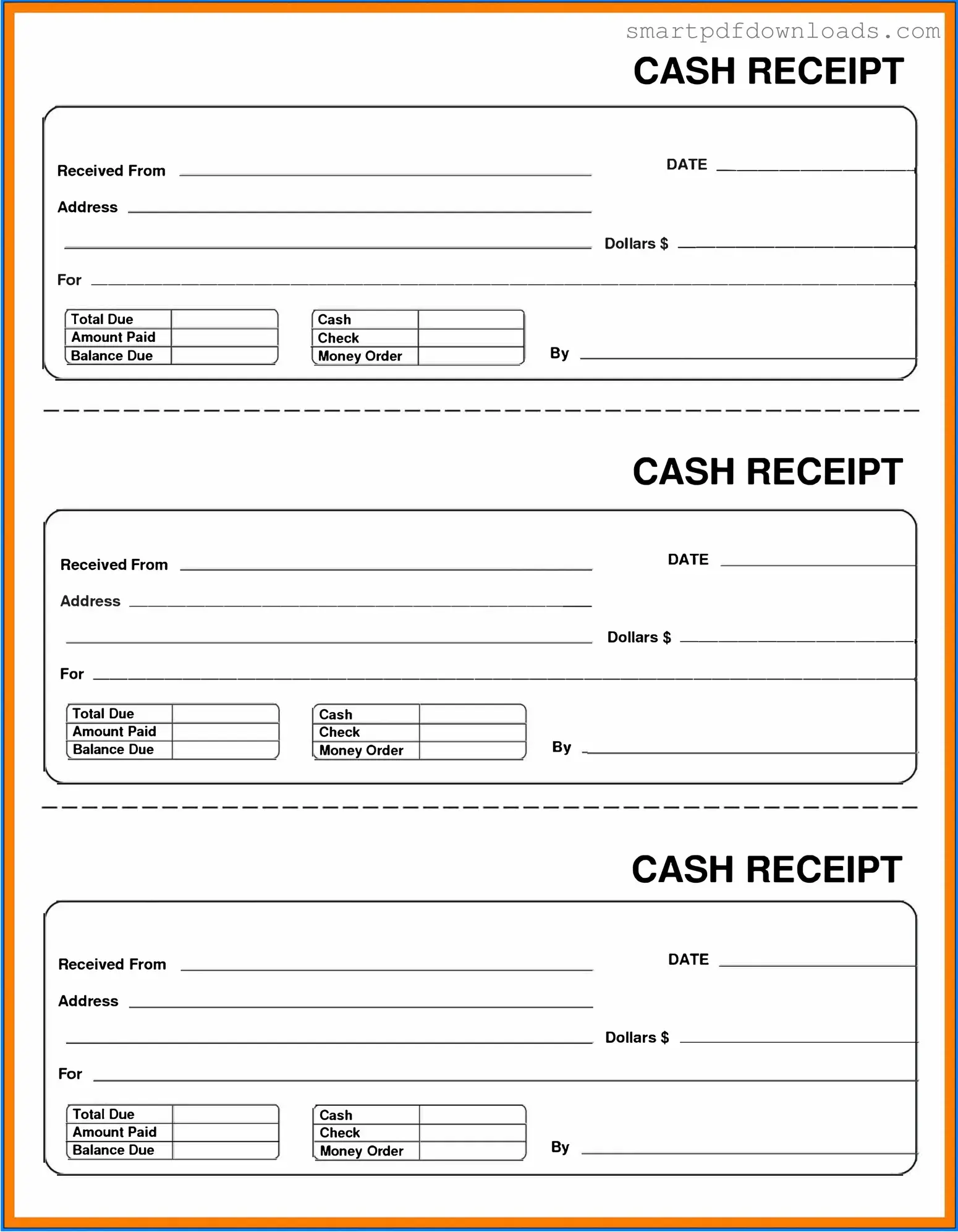

Edit Cash Receipt Online

Cash Receipt Form

Edit Cash Receipt Online

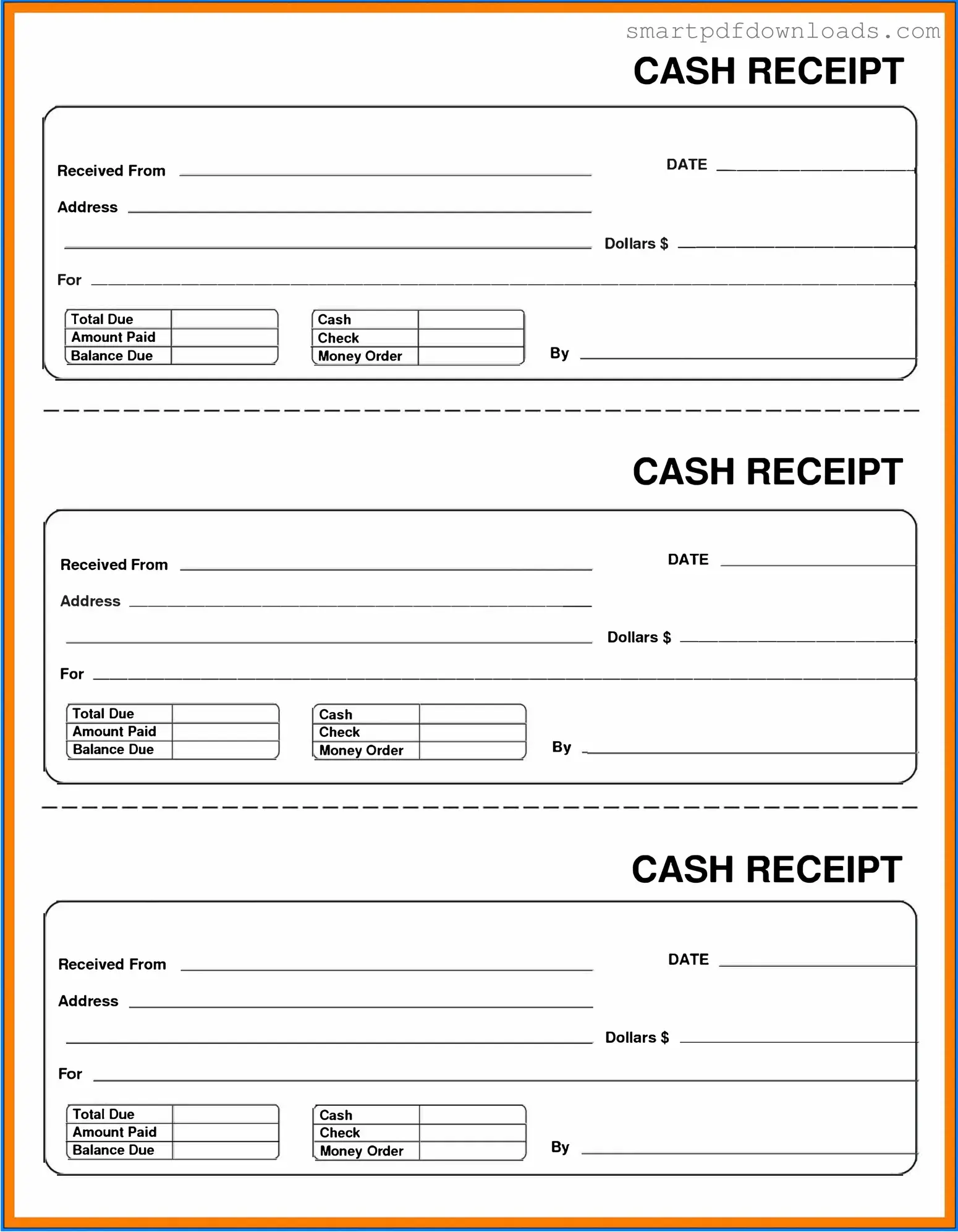

Edit Cash Receipt Online

or

⇓ PDF File

Finish the form and move on

Edit Cash Receipt online fast, without printing.