This Space For Official Use Only

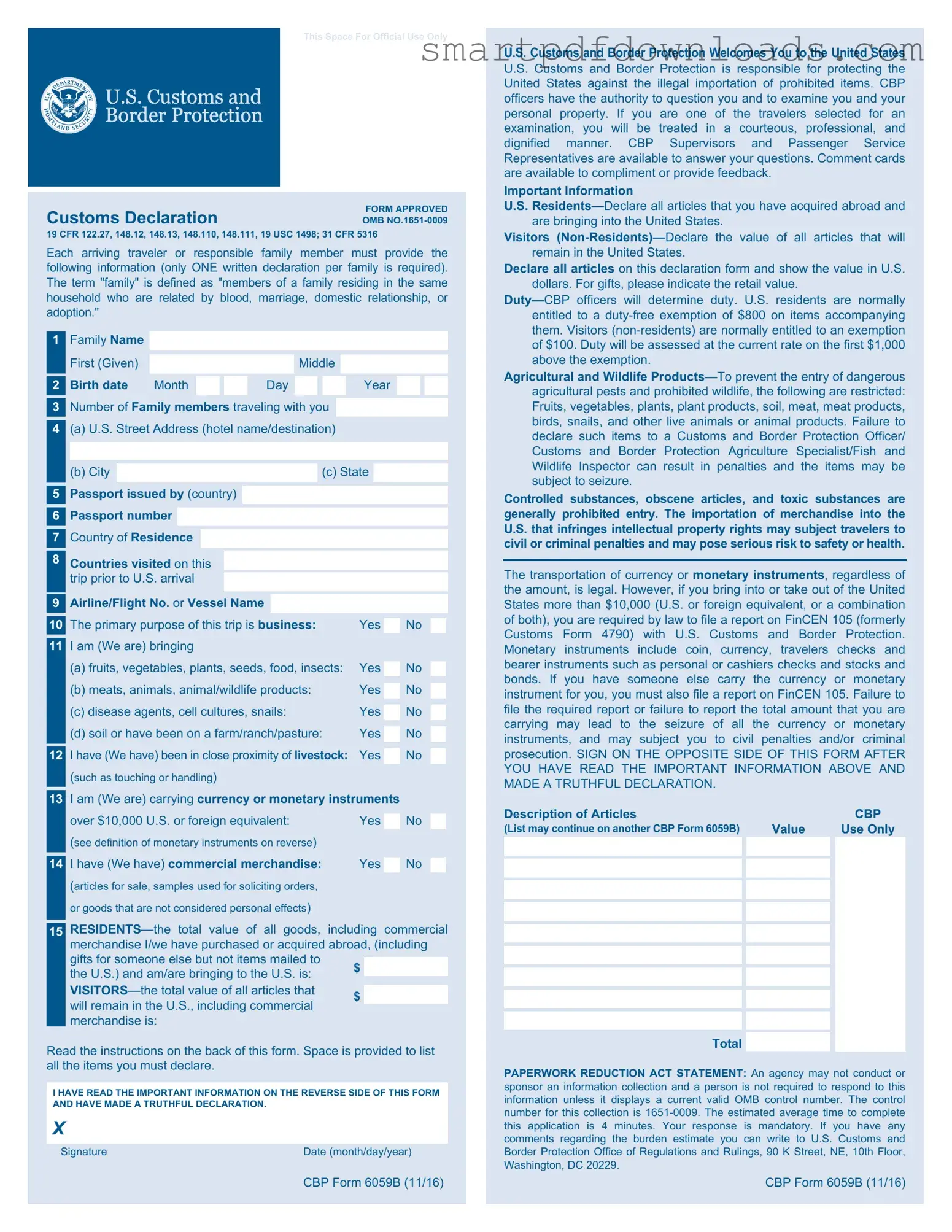

Customs Declaration |

FORM APPROVED |

OMB NO.1651-0009 |

19 CFR 122.27, 148.12, 148.13, 148.110, 148.111, 19 USC 1498; 31 CFR 5316

Each arriving traveler or responsible family member must provide the following information (only ONE written declaration per family is required). The term "family" is defined as "members of a family residing in the same household who are related by blood, marriage, domestic relationship, or adoption."

1Family Name

|

First (Given) |

|

|

|

|

|

Middle |

|

|

|

|

|

Birth date |

Month |

|

|

|

Day |

|

|

|

|

Year |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

3Number of Family members traveling with you

4(a) U.S. Street Address (hotel name/destination)

(b) City  (c) State

(c) State

5Passport issued by (country)

6Passport number

7Country of Residence

8 Countries visited on this

trip prior to U.S. arrival

9 |

Airline/Flight No. or Vessel Name |

|

|

|

|

|

|

|

The primary purpose of this trip is business: |

|

|

|

|

|

10 |

Yes |

|

No |

|

|

11I am (We are) bringing

(a)fruits, vegetables, plants, seeds, food, insects: Yes  No

No

(b) meats, animals, animal/wildlife products: |

Yes |

|

No |

|

(c) disease agents, cell cultures, snails: |

Yes |

|

No |

|

|

|

(d) soil or have been on a farm/ranch/pasture: |

Yes |

|

No |

|

|

|

12I have (We have) been in close proximity of livestock: Yes  No (such as touching or handling)

No (such as touching or handling)

13I am (We are) carrying currency or monetary instruments

|

over $10,000 U.S. or foreign equivalent: |

Yes |

|

No |

|

|

(see definition of monetary instruments on reverse) |

|

|

|

|

|

|

|

|

|

14 |

I have (We have) commercial merchandise: |

Yes |

|

No |

|

|

|

|

(articles for sale, samples used for soliciting orders, |

|

|

|

|

|

or goods that are not considered personal effects) |

|

|

|

|

|

|

|

|

|

|

|

RESIDENTS—the total value of all goods, including commercial |

15 |

|

merchandise I/we have purchased or acquired abroad, (including |

|

gifts for someone else but not items mailed to |

$ |

|

|

|

|

the U.S.) and am/are bringing to the U.S. is: |

|

|

|

|

|

VISITORS—the total value of all articles that |

$ |

|

|

|

|

will remain in the U.S., including commercial |

|

|

|

|

|

merchandise is: |

|

|

Read the instructions on the back of this form. Space is provided to list all the items you must declare.

I HAVE READ THE IMPORTANT INFORMATION ON THE REVERSE SIDE OF THIS FORM AND HAVE MADE A TRUTHFUL DECLARATION.

X

Signature |

Date (month/day/year) |

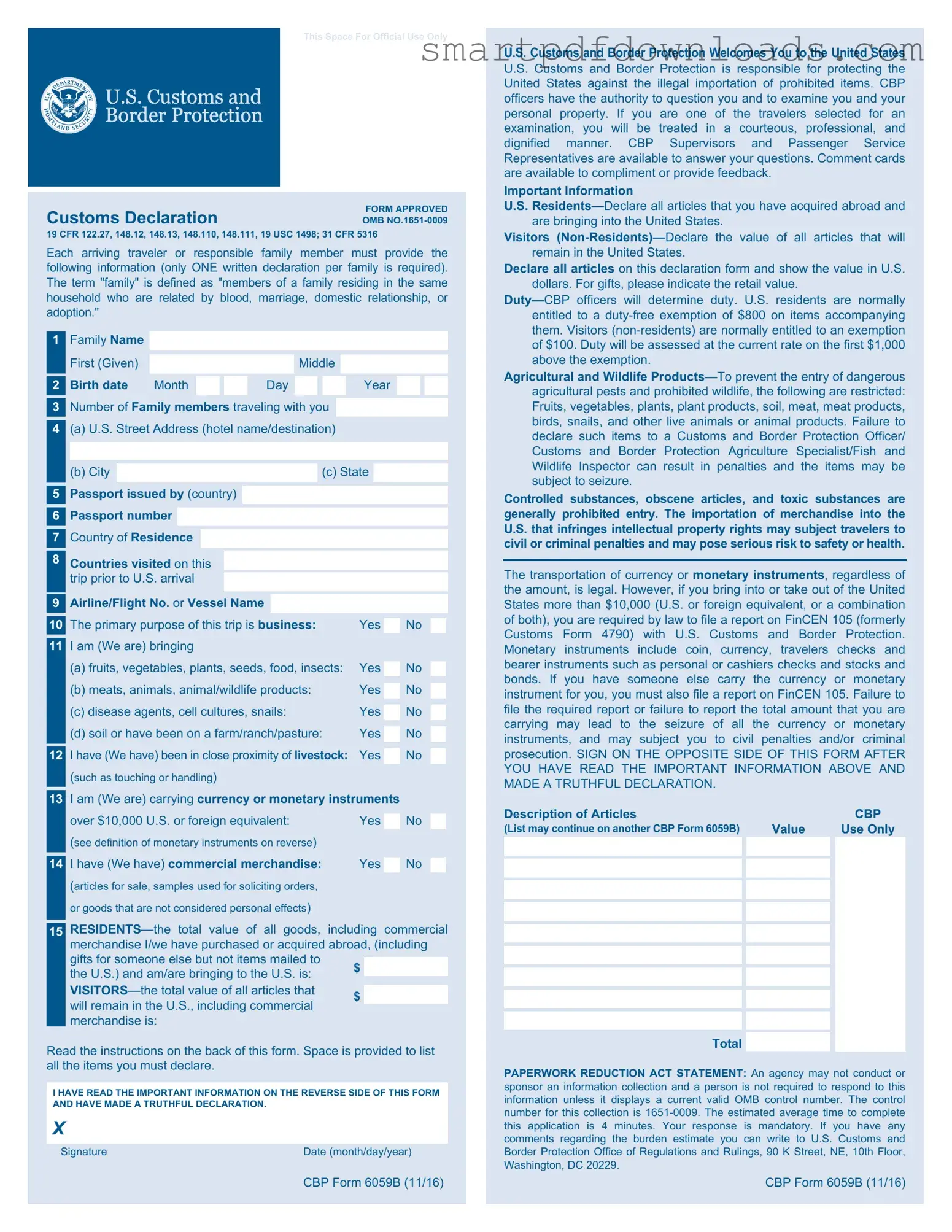

U.S. Customs and Border Protection Welcomes You to the United States

U.S. Customs and Border Protection is responsible for protecting the United States against the illegal importation of prohibited items. CBP officers have the authority to question you and to examine you and your personal property. If you are one of the travelers selected for an examination, you will be treated in a courteous, professional, and dignified manner. CBP Supervisors and Passenger Service Representatives are available to answer your questions. Comment cards are available to compliment or provide feedback.

Important Information

U.S. Residents—Declare all articles that you have acquired abroad and are bringing into the United States.

Visitors (Non-Residents)—Declare the value of all articles that will remain in the United States.

Declare all articles on this declaration form and show the value in U.S. dollars. For gifts, please indicate the retail value.

Duty—CBP officers will determine duty. U.S. residents are normally entitled to a duty-free exemption of $800 on items accompanying them. Visitors (non-residents) are normally entitled to an exemption of $100. Duty will be assessed at the current rate on the first $1,000 above the exemption.

Agricultural and Wildlife Products—To prevent the entry of dangerous agricultural pests and prohibited wildlife, the following are restricted: Fruits, vegetables, plants, plant products, soil, meat, meat products, birds, snails, and other live animals or animal products. Failure to declare such items to a Customs and Border Protection Officer/ Customs and Border Protection Agriculture Specialist/Fish and Wildlife Inspector can result in penalties and the items may be subject to seizure.

Controlled substances, obscene articles, and toxic substances are generally prohibited entry. The importation of merchandise into the U.S. that infringes intellectual property rights may subject travelers to civil or criminal penalties and may pose serious risk to safety or health.

The transportation of currency or monetary instruments, regardless of the amount, is legal. However, if you bring into or take out of the United States more than $10,000 (U.S. or foreign equivalent, or a combination of both), you are required by law to file a report on FinCEN 105 (formerly Customs Form 4790) with U.S. Customs and Border Protection. Monetary instruments include coin, currency, travelers checks and bearer instruments such as personal or cashiers checks and stocks and bonds. If you have someone else carry the currency or monetary instrument for you, you must also file a report on FinCEN 105. Failure to file the required report or failure to report the total amount that you are carrying may lead to the seizure of all the currency or monetary instruments, and may subject you to civil penalties and/or criminal prosecution. SIGN ON THE OPPOSITE SIDE OF THIS FORM AFTER YOU HAVE READ THE IMPORTANT INFORMATION ABOVE AND MADE A TRUTHFUL DECLARATION.

Description of Articles |

|

|

CBP |

(List may continue on another CBP Form 6059B) |

|

Value |

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number. The control number for this collection is 1651-0009. The estimated average time to complete this application is 4 minutes. Your response is mandatory. If you have any comments regarding the burden estimate you can write to U.S. Customs and Border Protection Office of Regulations and Rulings, 90 K Street, NE, 10th Floor, Washington, DC 20229.

(c) State

(c) State

No

No