Free Deed Form

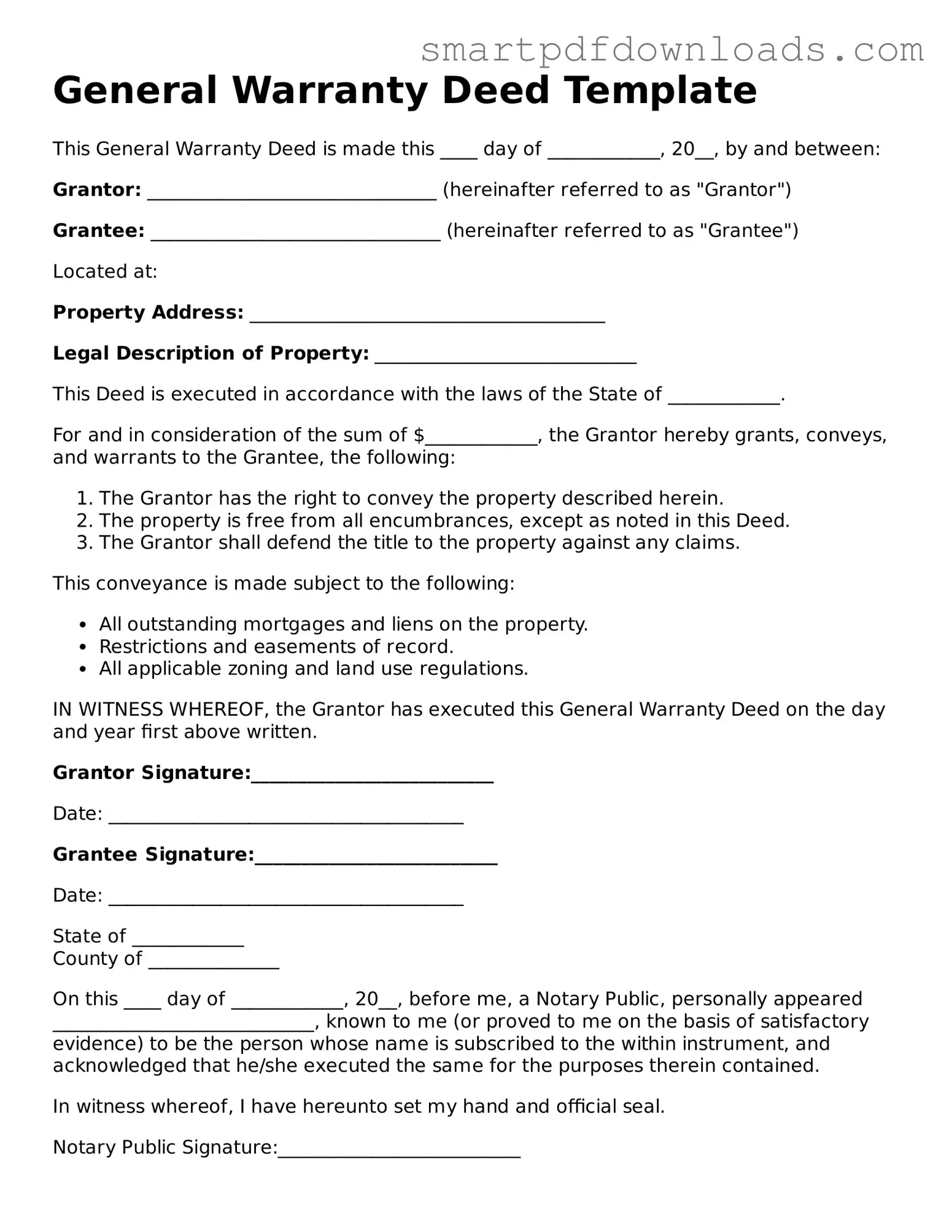

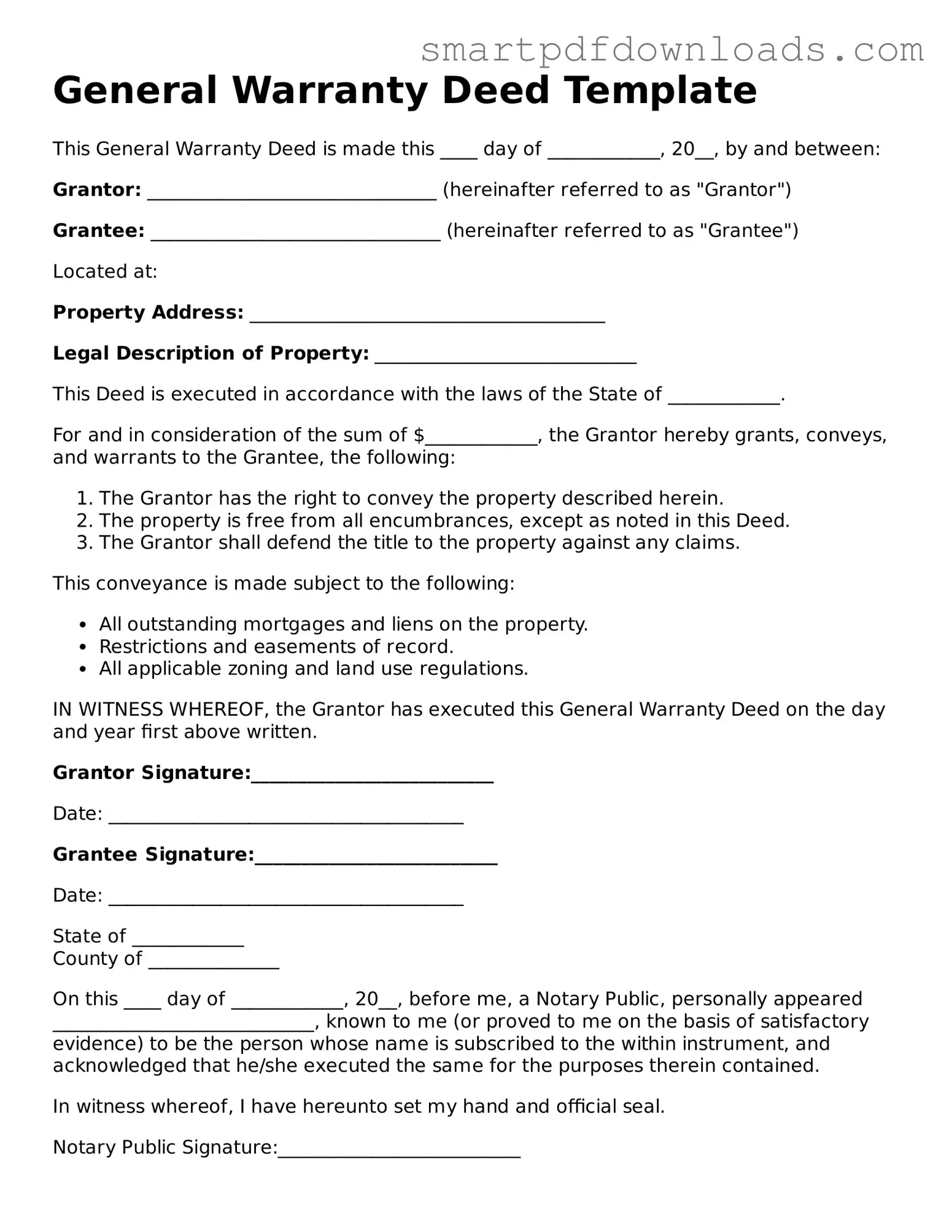

A Deed form is a legal document that signifies a formal agreement or transaction, typically involving the transfer of property or rights from one party to another. It serves as a crucial instrument in real estate and other legal matters, ensuring that the intentions of the parties involved are clearly stated and legally binding. Understanding the components and implications of a Deed form is essential for anyone engaging in property transactions or legal agreements.

Edit Deed Online

Free Deed Form

Edit Deed Online

Edit Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Deed online fast, without printing.