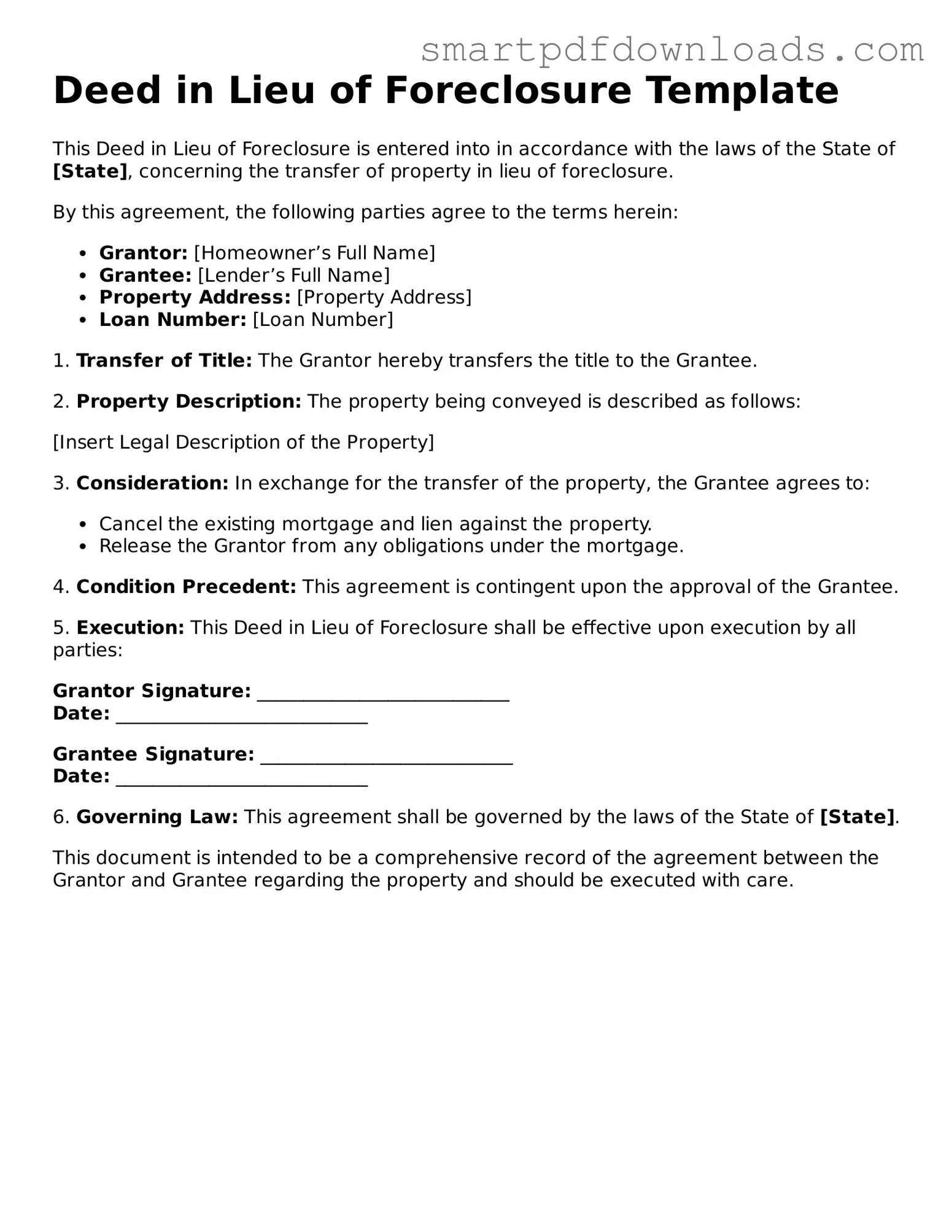

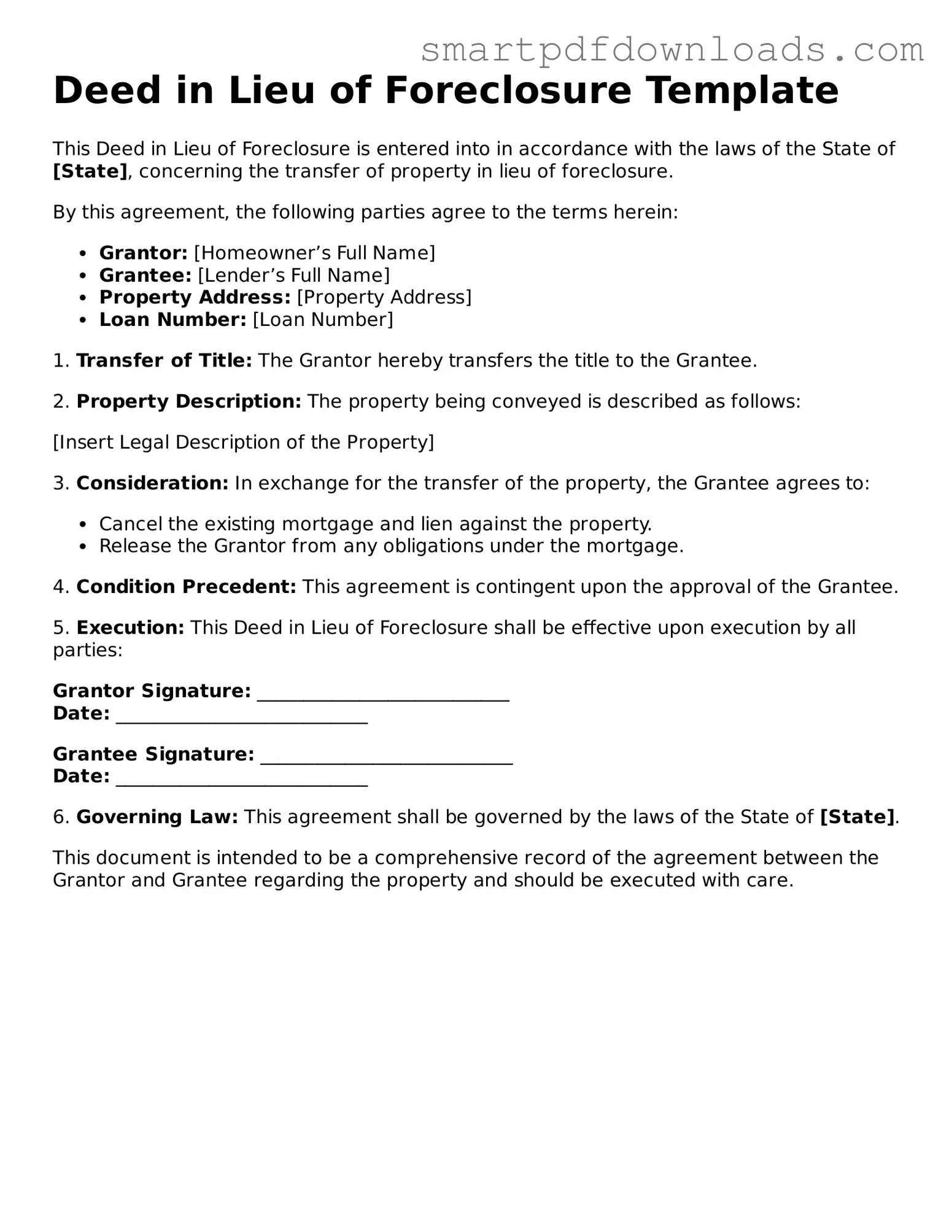

Free Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in exchange for the cancellation of the mortgage. This option can provide a more amicable resolution to a financial hardship, avoiding the lengthy and costly foreclosure process. Understanding this form is crucial for homeowners seeking alternatives to foreclosure.

Edit Deed in Lieu of Foreclosure Online

Free Deed in Lieu of Foreclosure Form

Edit Deed in Lieu of Foreclosure Online

Edit Deed in Lieu of Foreclosure Online

or

⇓ PDF File

Finish the form and move on

Edit Deed in Lieu of Foreclosure online fast, without printing.