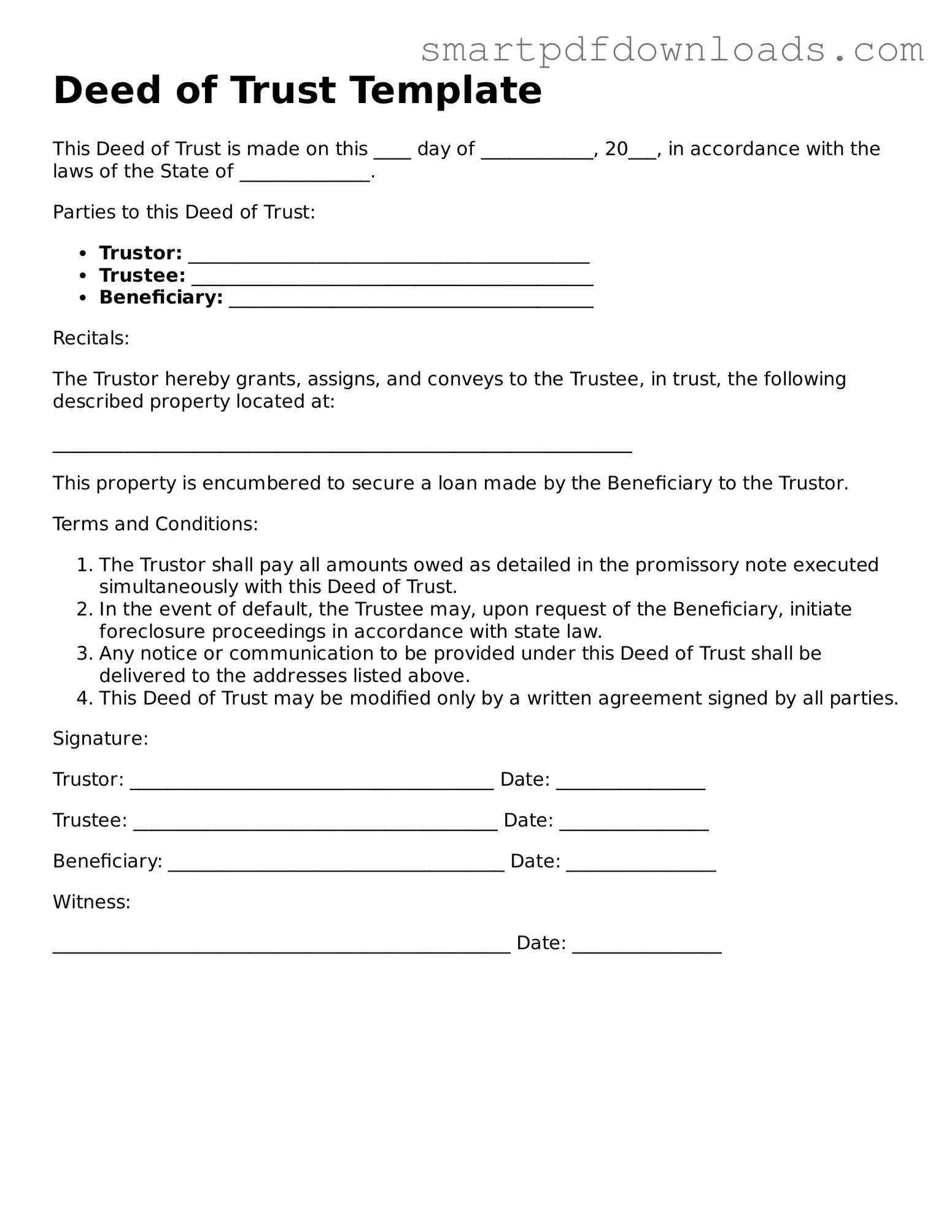

Free Deed of Trust Form

A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a third party, known as the trustee, until the borrower repays the debt. This arrangement protects the lender's interests while allowing the borrower to retain possession of the property. Understanding the nuances of this form is essential for both homeowners and lenders alike.

Edit Deed of Trust Online

Free Deed of Trust Form

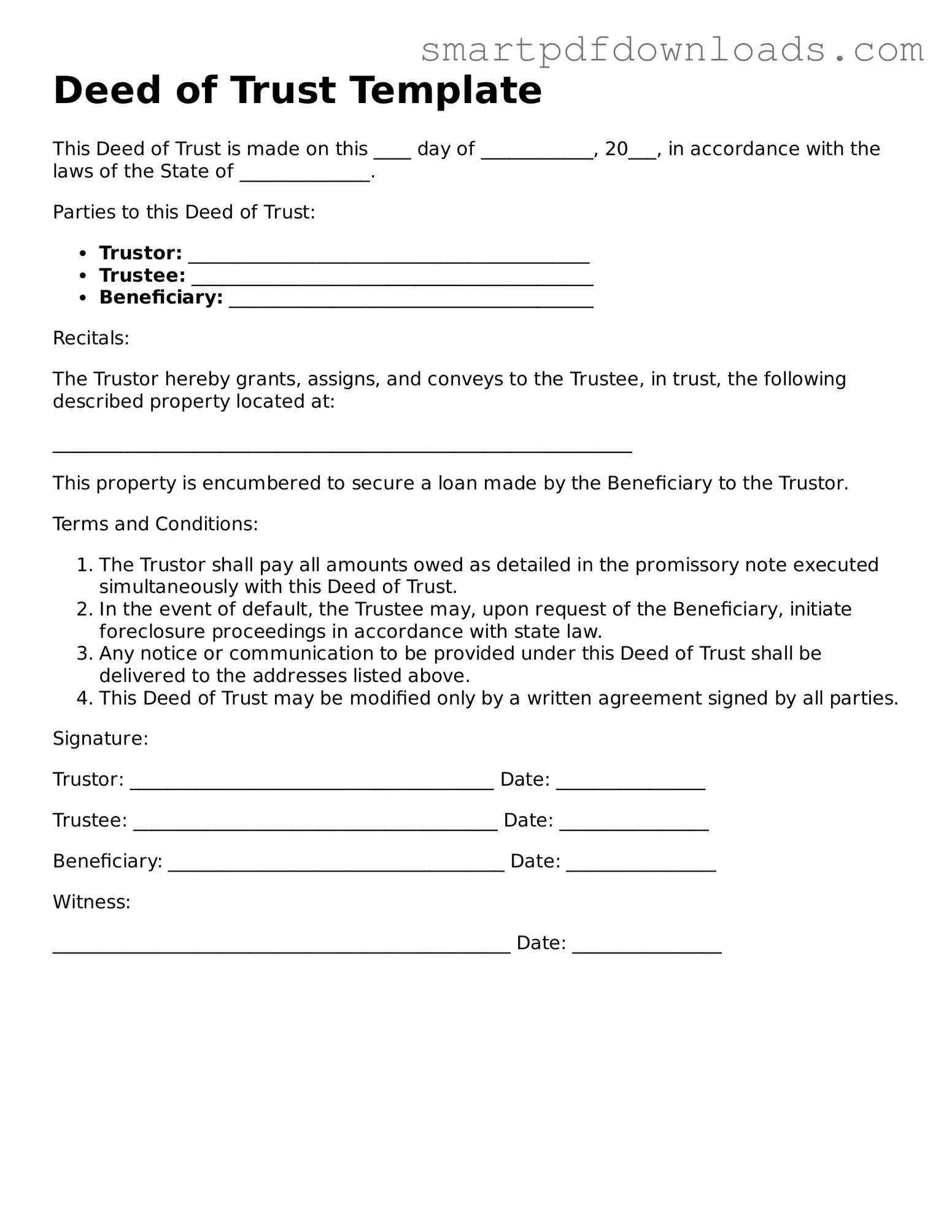

Edit Deed of Trust Online

Edit Deed of Trust Online

or

⇓ PDF File

Finish the form and move on

Edit Deed of Trust online fast, without printing.