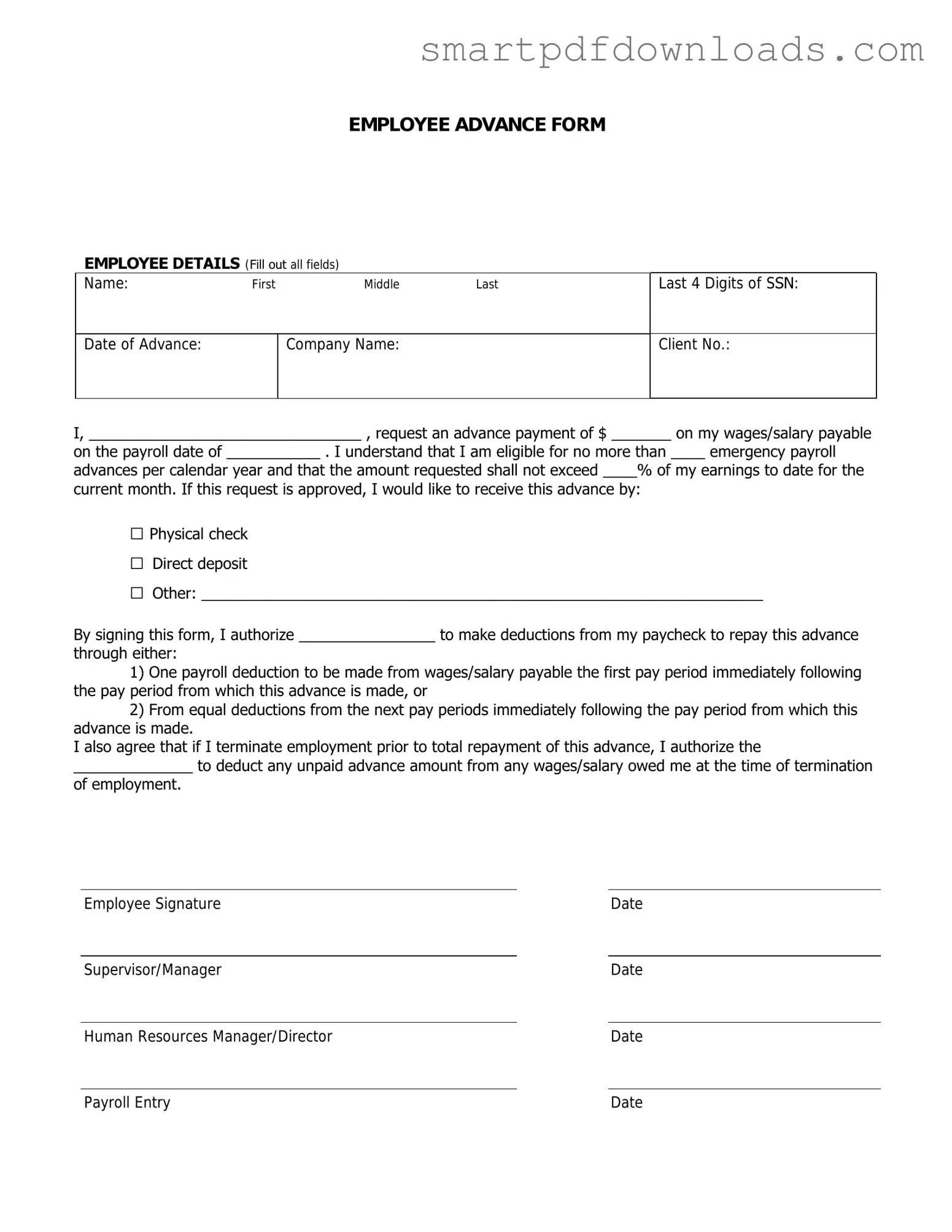

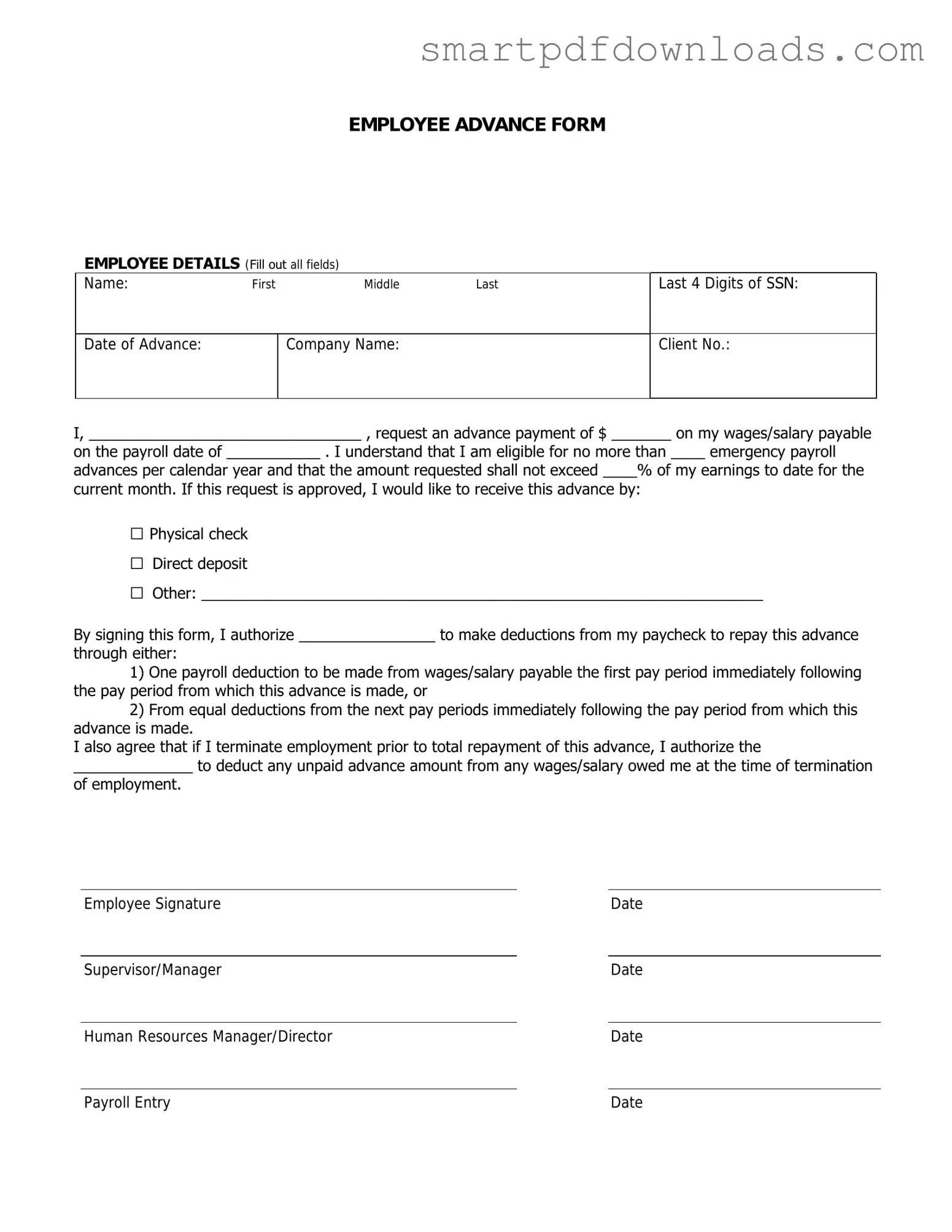

Employee Advance Form

The Employee Advance form is a document used by employees to request funds from their employer before their regular payday. This form typically outlines the amount requested, the purpose of the advance, and any repayment terms. Understanding how to properly complete and submit this form can streamline the process and ensure timely access to needed funds.

Edit Employee Advance Online

Employee Advance Form

Edit Employee Advance Online

Edit Employee Advance Online

or

⇓ PDF File

Finish the form and move on

Edit Employee Advance online fast, without printing.