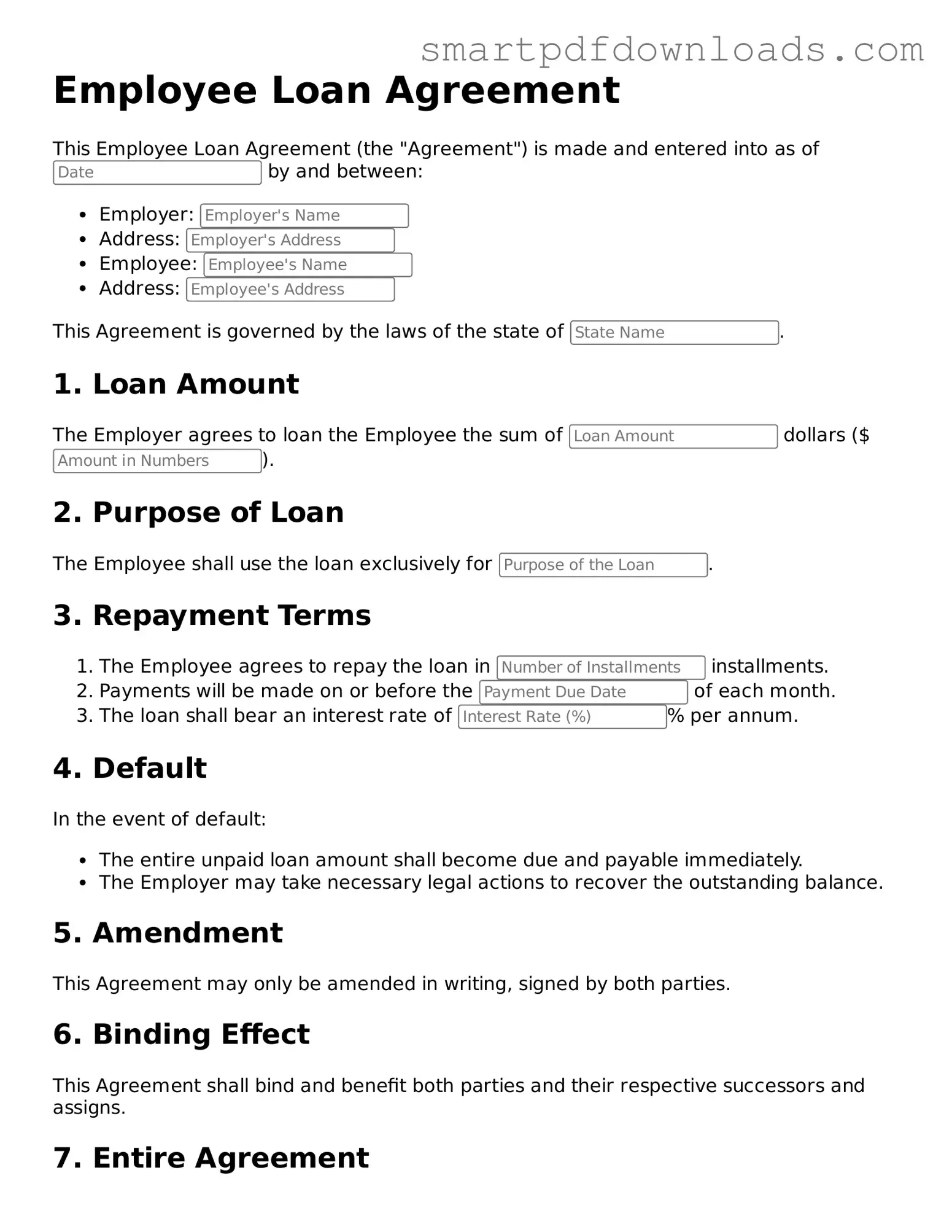

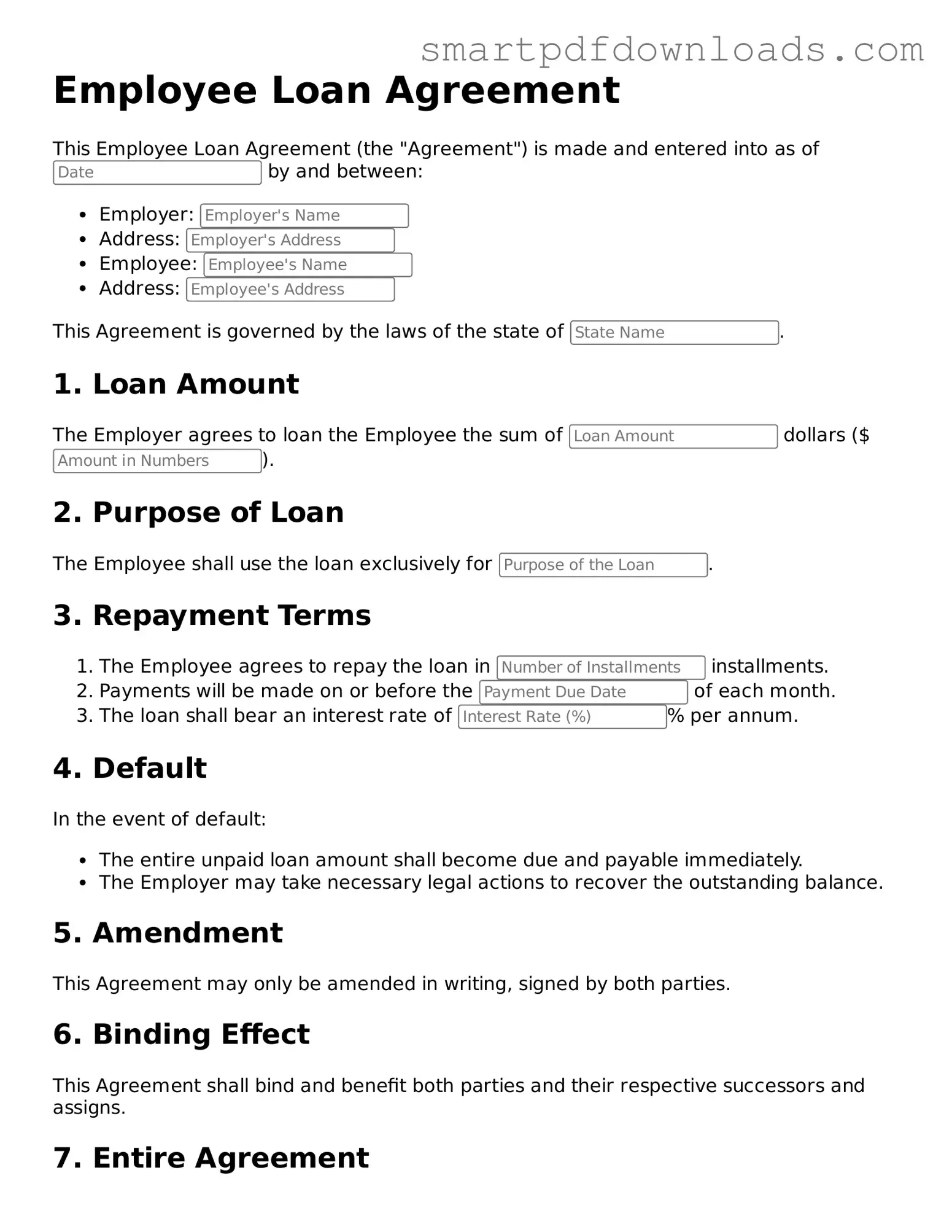

Free Employee Loan Agreement Form

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement typically includes details such as the loan amount, repayment schedule, and any applicable interest rates. Understanding this form is essential for both employers and employees to ensure clarity and protect their respective rights and obligations.

Edit Employee Loan Agreement Online

Free Employee Loan Agreement Form

Edit Employee Loan Agreement Online

Edit Employee Loan Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Employee Loan Agreement online fast, without printing.