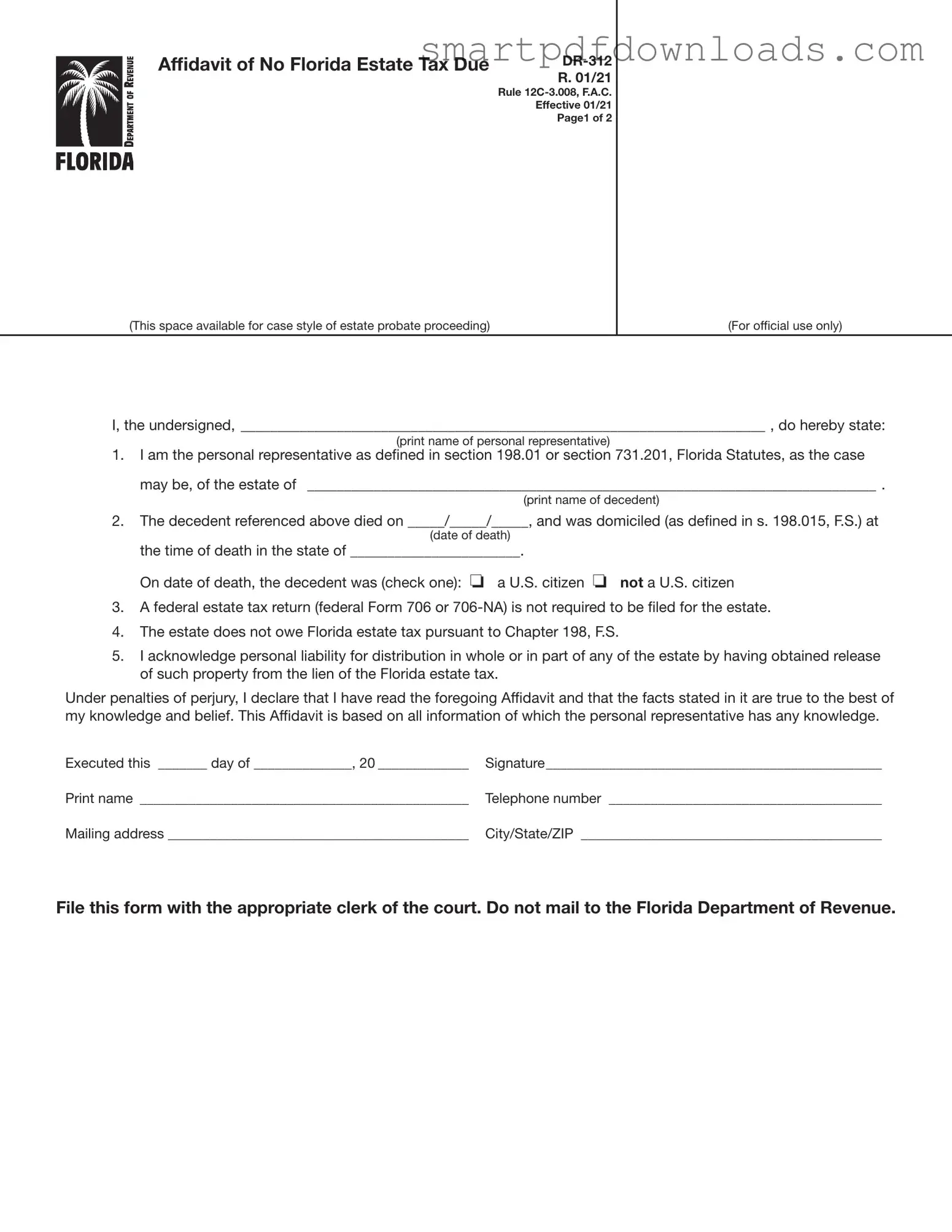

Fl Dr 312 Form

The Florida Form DR-312, also known as the Affidavit of No Florida Estate Tax Due, serves as a declaration that an estate does not owe Florida estate tax. This form is typically used by personal representatives when a federal estate tax return is not required. By completing and filing this affidavit, the personal representative can confirm the estate's non-liability for Florida estate tax and facilitate the release of any associated tax liens.

Edit Fl Dr 312 Online

Fl Dr 312 Form

Edit Fl Dr 312 Online

Edit Fl Dr 312 Online

or

⇓ PDF File

Finish the form and move on

Edit Fl Dr 312 online fast, without printing.