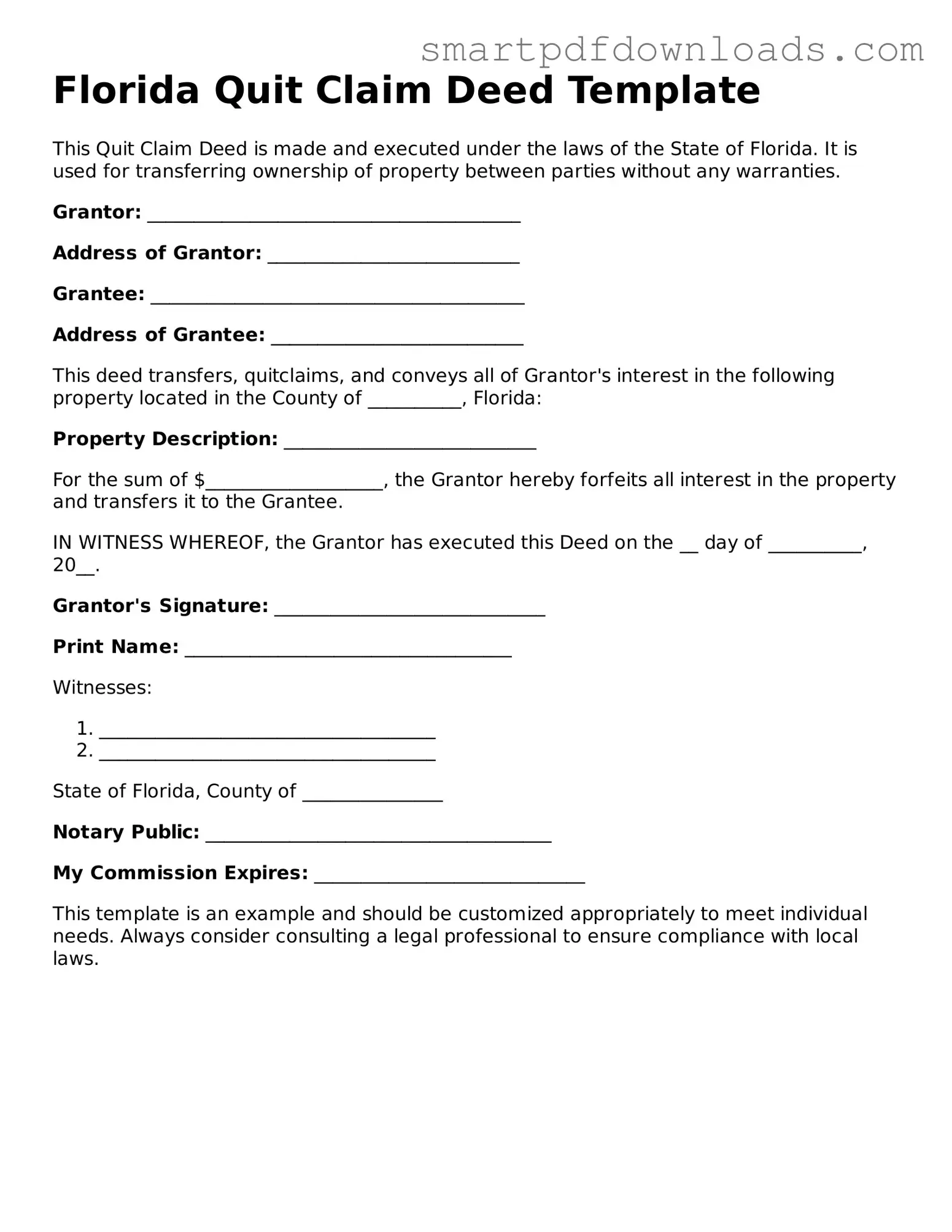

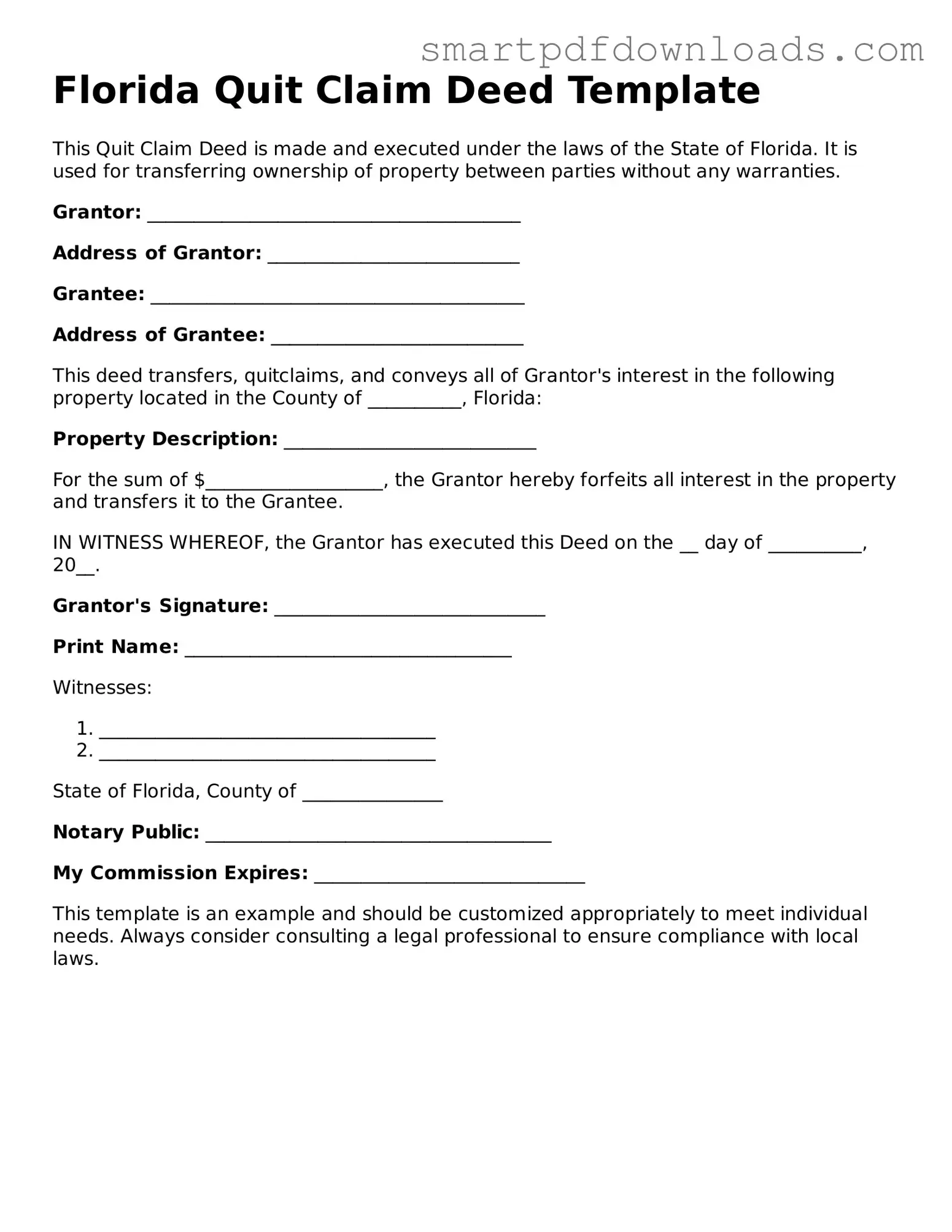

Legal Deed Form for the State of Florida

A Florida Deed form is a legal document used to transfer ownership of real property in the state of Florida. This form is essential for ensuring that property rights are clearly defined and legally recognized. Completing the deed accurately is crucial to avoid future disputes over ownership.

Edit Deed Online

Legal Deed Form for the State of Florida

Edit Deed Online

Edit Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Deed online fast, without printing.