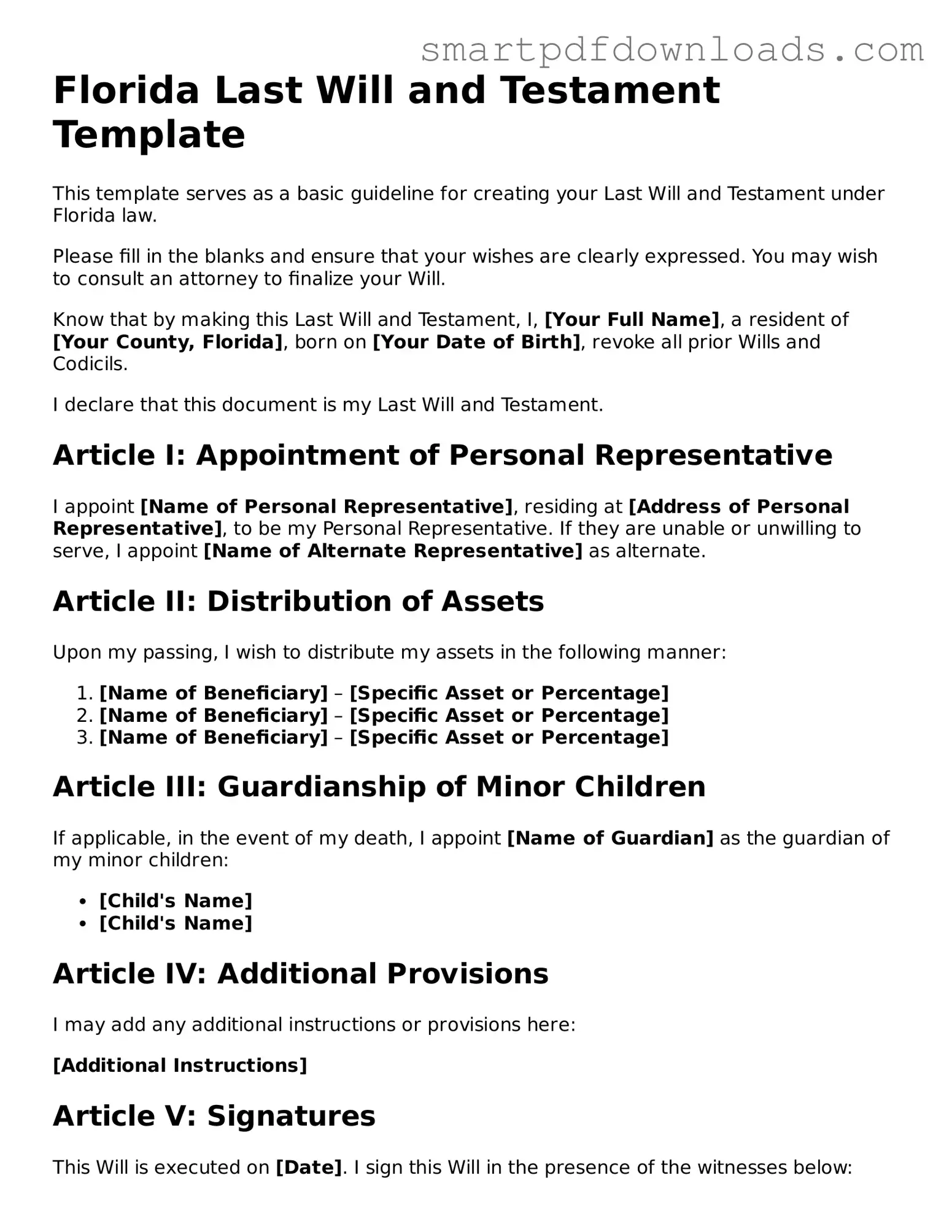

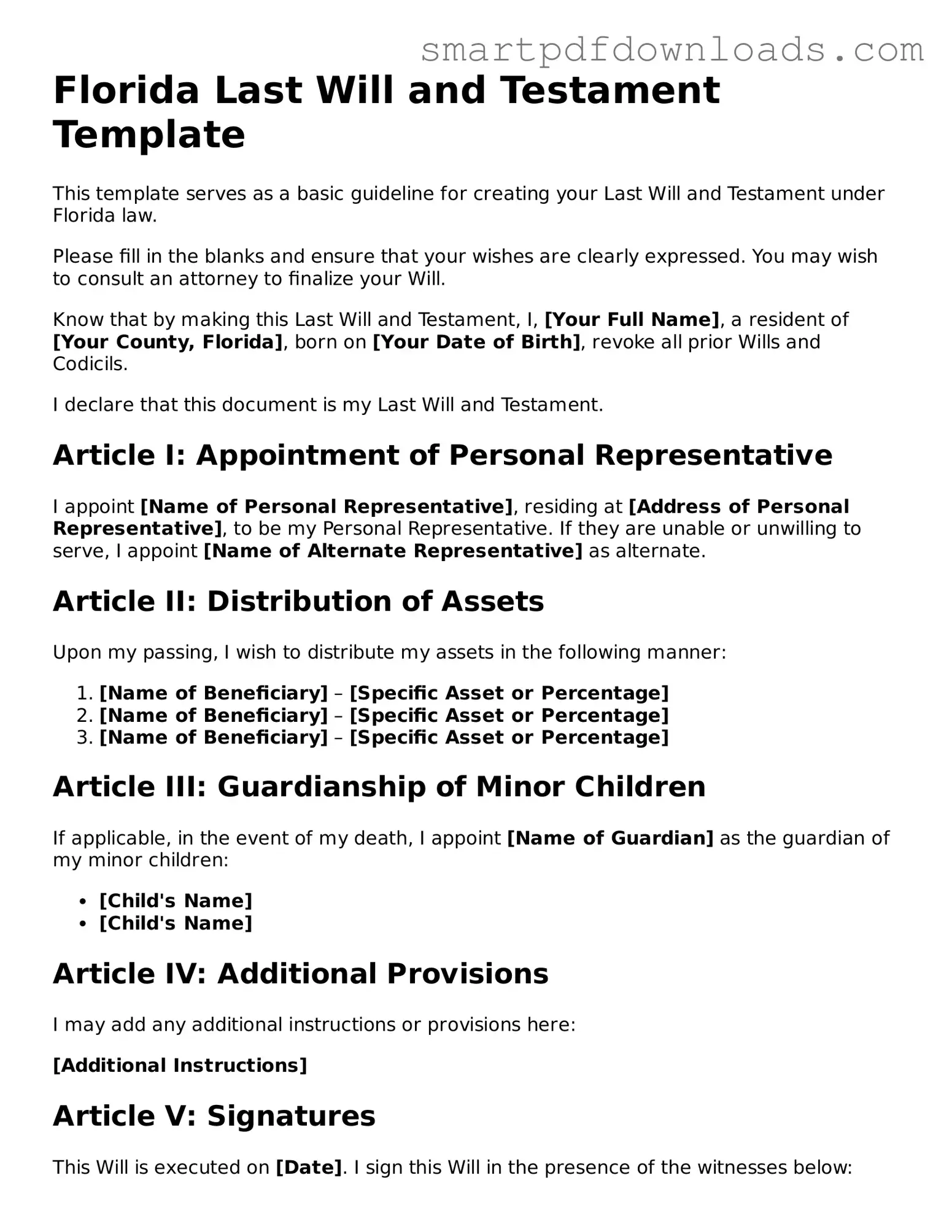

Legal Last Will and Testament Form for the State of Florida

A Florida Last Will and Testament form is a legal document that outlines how a person's assets and affairs should be managed after their death. This essential tool ensures that your wishes are honored, providing clarity and direction for your loved ones during a difficult time. Understanding its components can help you create a will that truly reflects your intentions.

Edit Last Will and Testament Online

Legal Last Will and Testament Form for the State of Florida

Edit Last Will and Testament Online

Edit Last Will and Testament Online

or

⇓ PDF File

Finish the form and move on

Edit Last Will and Testament online fast, without printing.