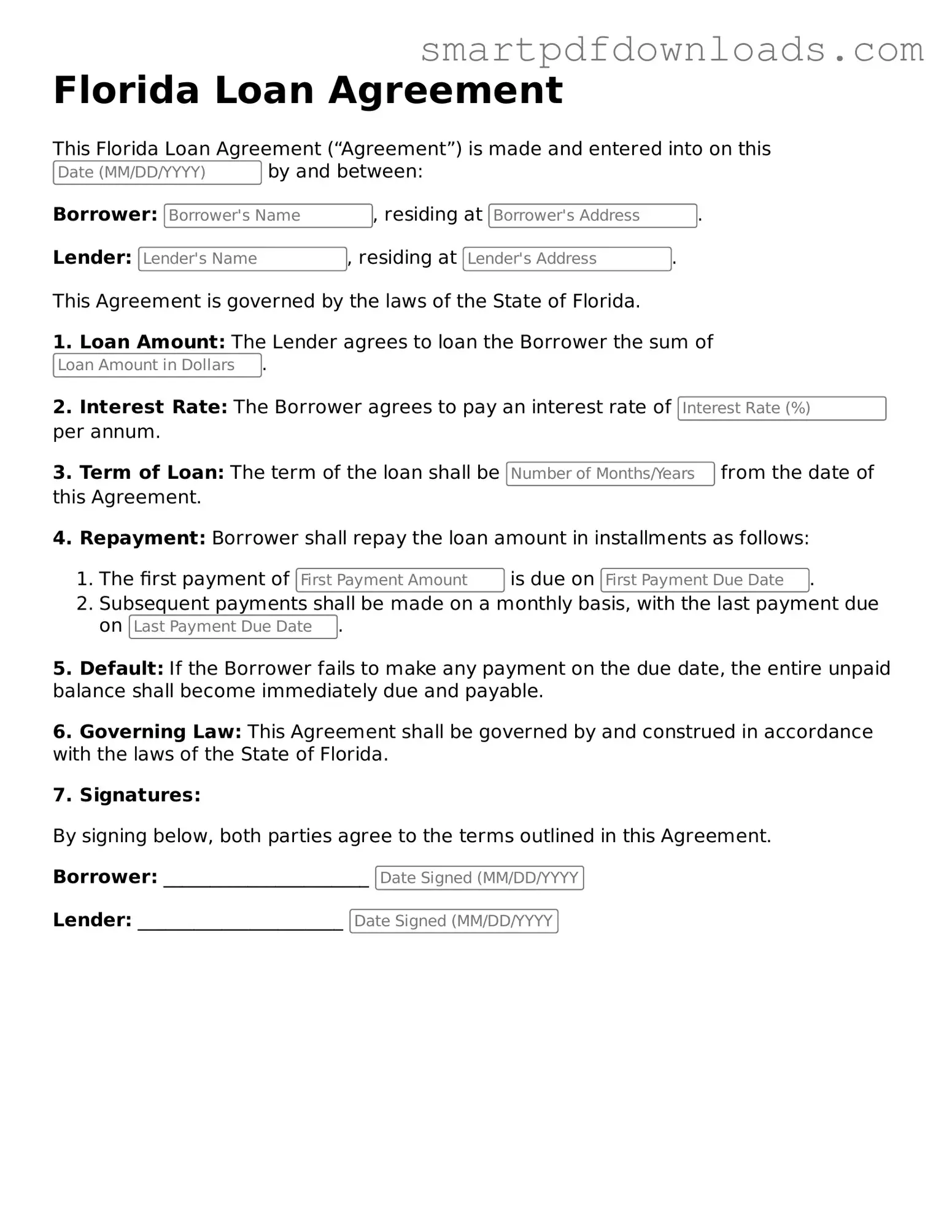

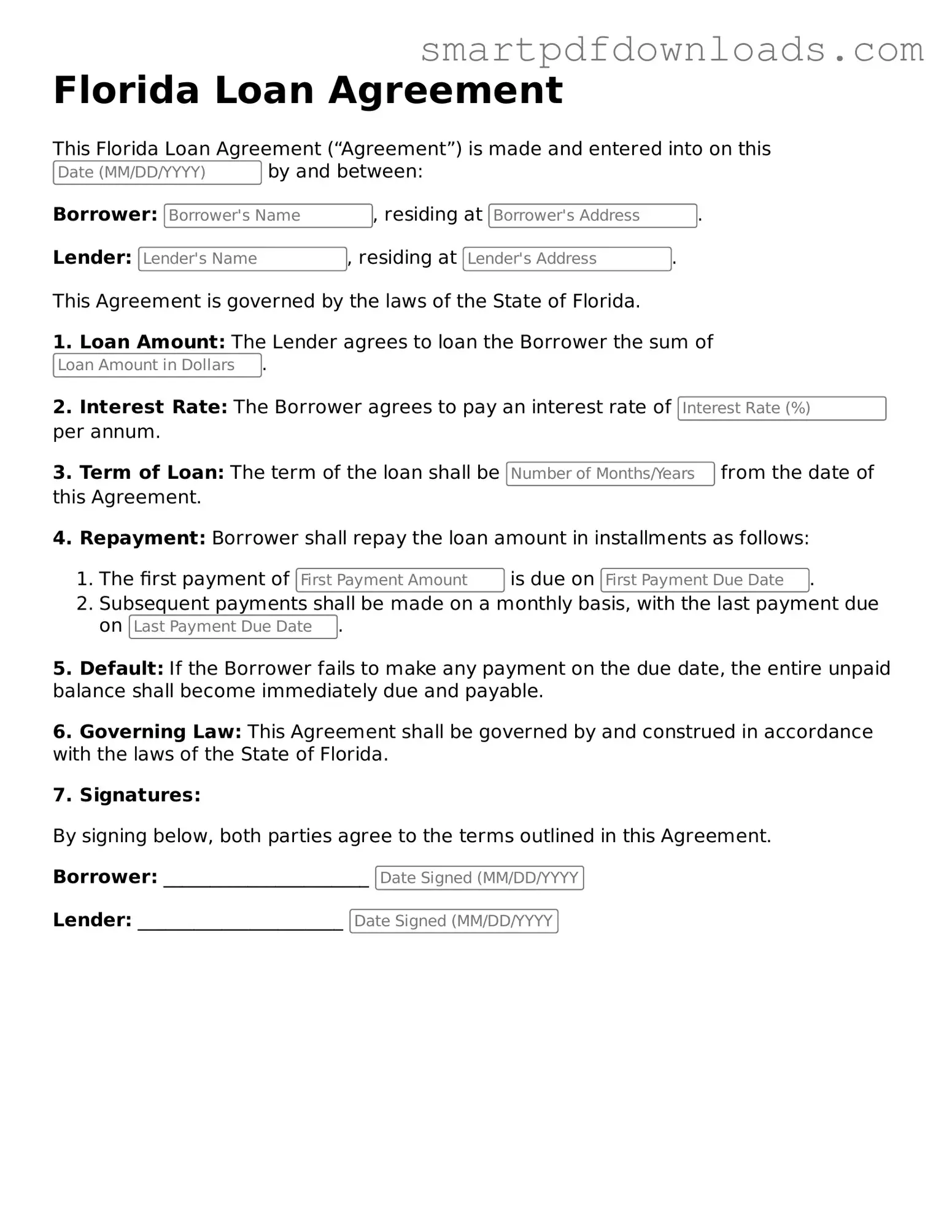

Legal Loan Agreement Form for the State of Florida

A Florida Loan Agreement form is a legal document that outlines the terms and conditions under which a lender provides funds to a borrower. This form serves as a crucial tool for both parties, ensuring clarity and protection throughout the borrowing process. By detailing aspects such as repayment schedules, interest rates, and collateral, the agreement fosters a transparent relationship between the lender and borrower.

Edit Loan Agreement Online

Legal Loan Agreement Form for the State of Florida

Edit Loan Agreement Online

Edit Loan Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Loan Agreement online fast, without printing.