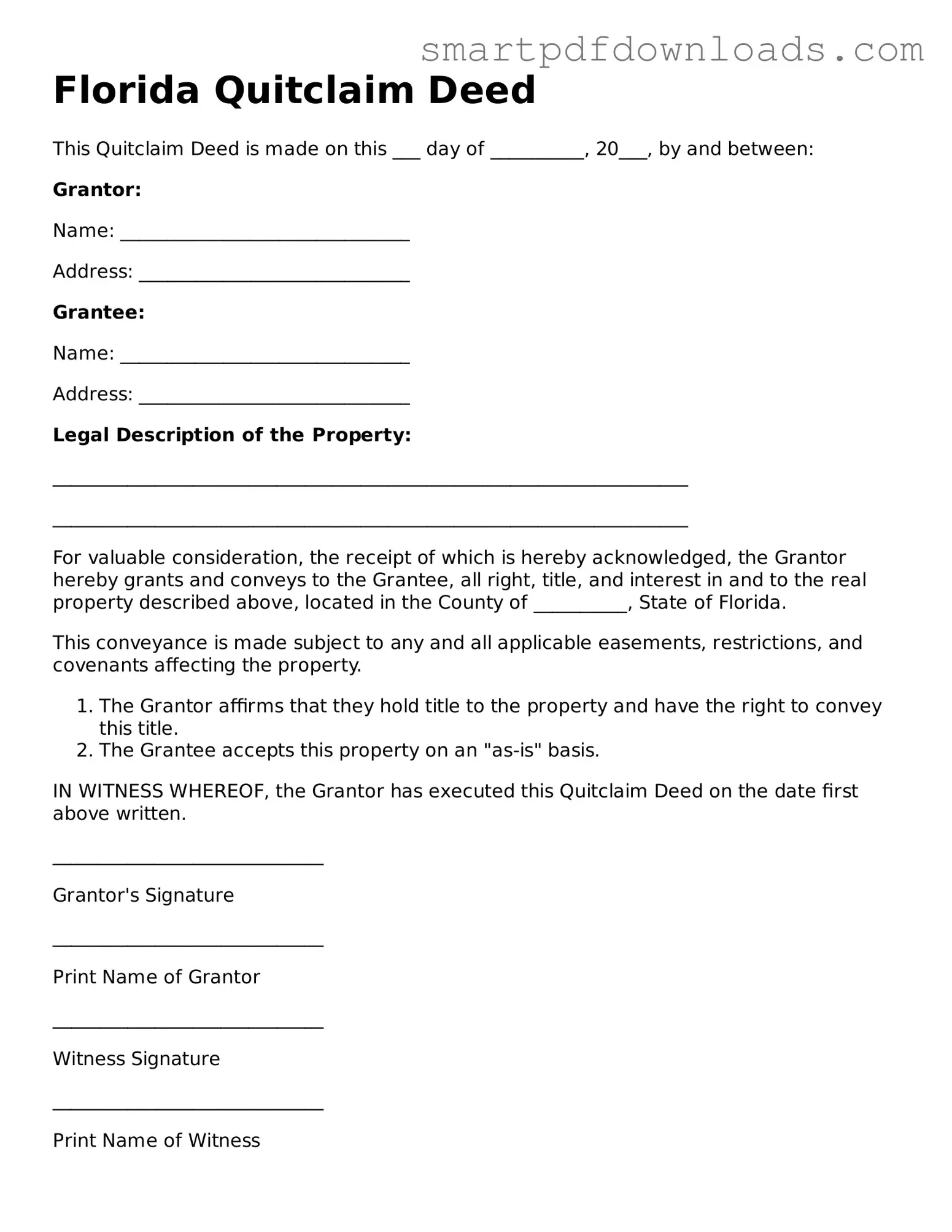

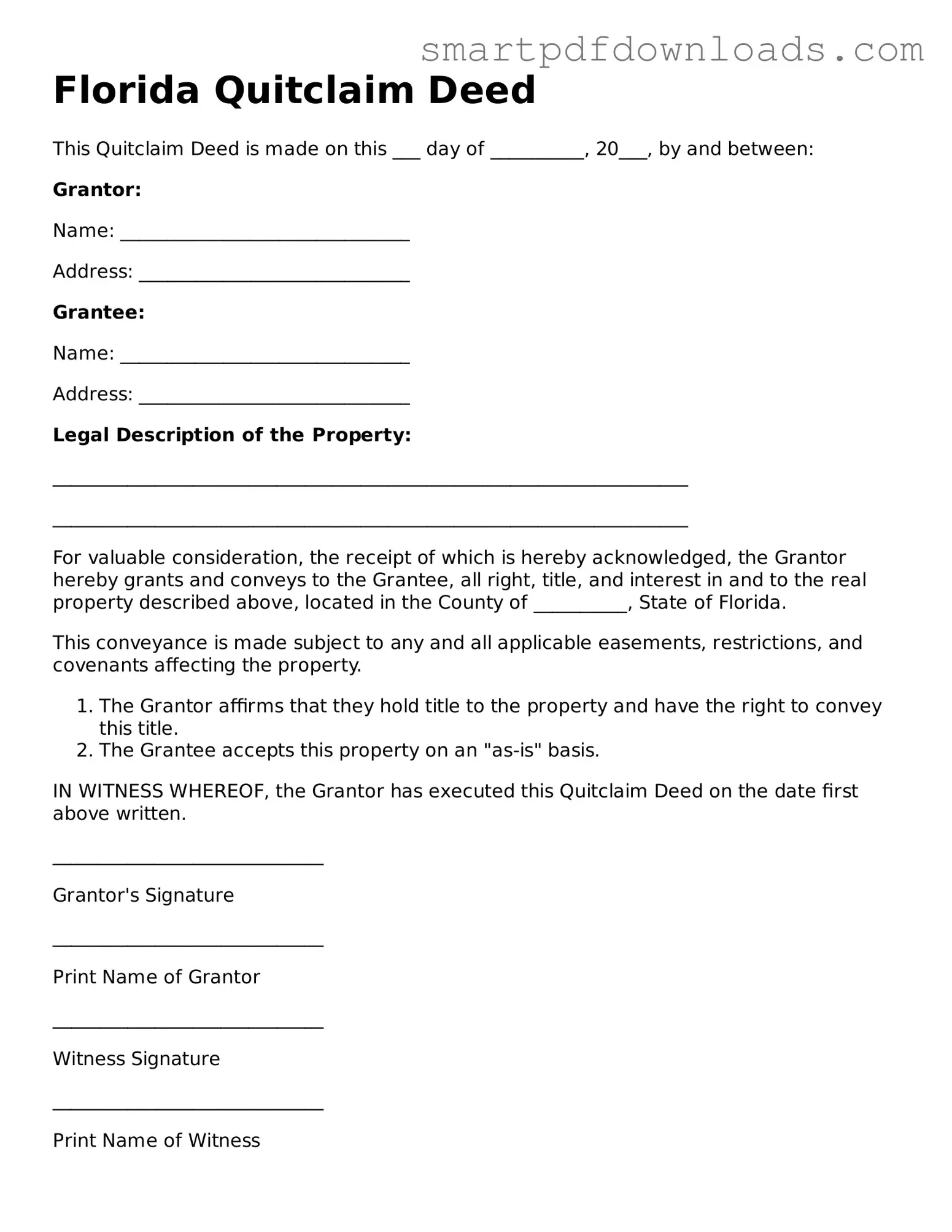

Legal Quitclaim Deed Form for the State of Florida

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form is often utilized in situations like divorce settlements or transferring property between family members. Understanding its purpose and proper usage can simplify the property transfer process significantly.

Edit Quitclaim Deed Online

Legal Quitclaim Deed Form for the State of Florida

Edit Quitclaim Deed Online

Edit Quitclaim Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Quitclaim Deed online fast, without printing.