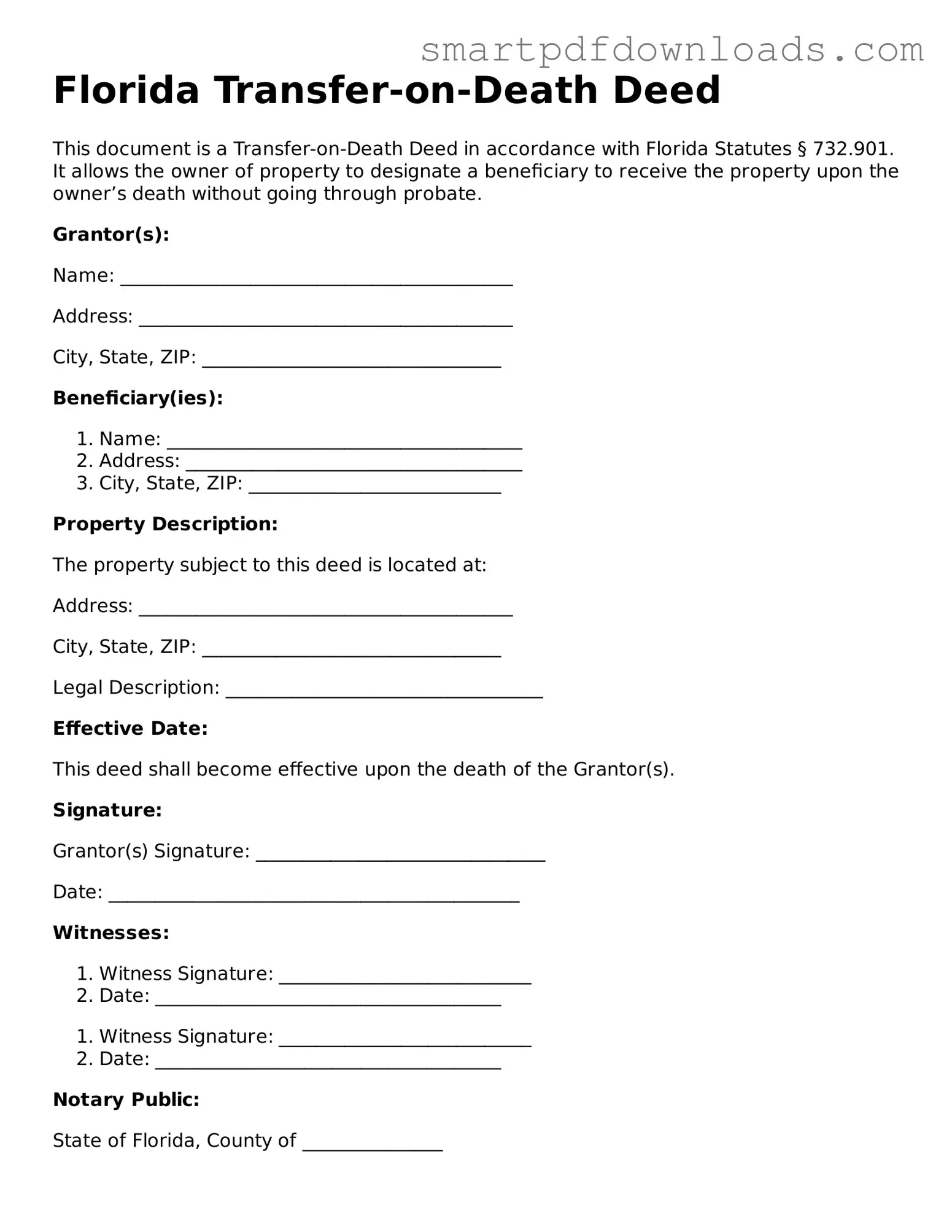

Legal Transfer-on-Death Deed Form for the State of Florida

The Florida Transfer-on-Death Deed form is a legal document that allows property owners to designate a beneficiary who will receive their real estate upon their death, without the need for probate. This form provides a straightforward way to transfer property, ensuring that the owner’s wishes are honored while simplifying the process for loved ones. Understanding how to properly utilize this deed can help individuals secure their estate planning goals effectively.

Edit Transfer-on-Death Deed Online

Legal Transfer-on-Death Deed Form for the State of Florida

Edit Transfer-on-Death Deed Online

Edit Transfer-on-Death Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Transfer-on-Death Deed online fast, without printing.