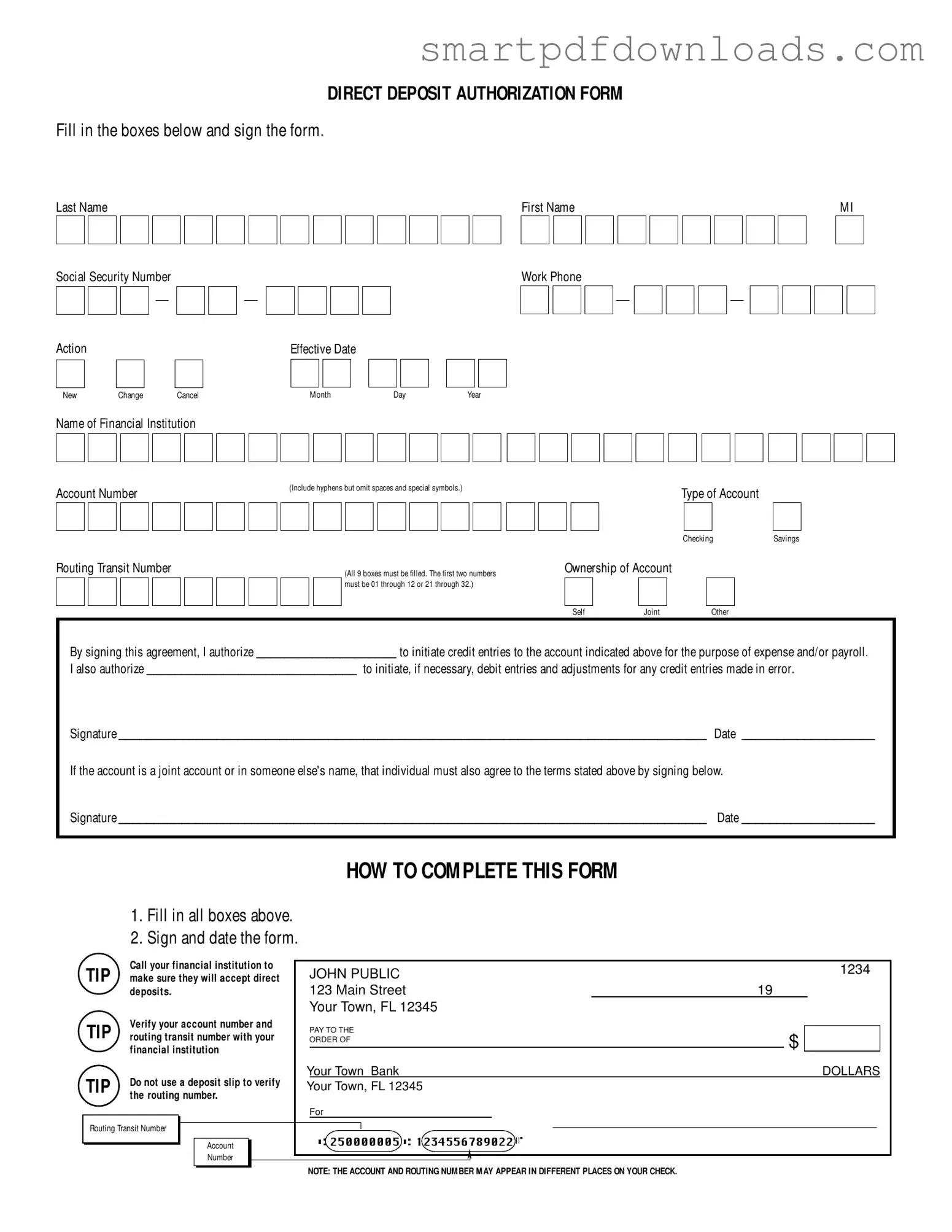

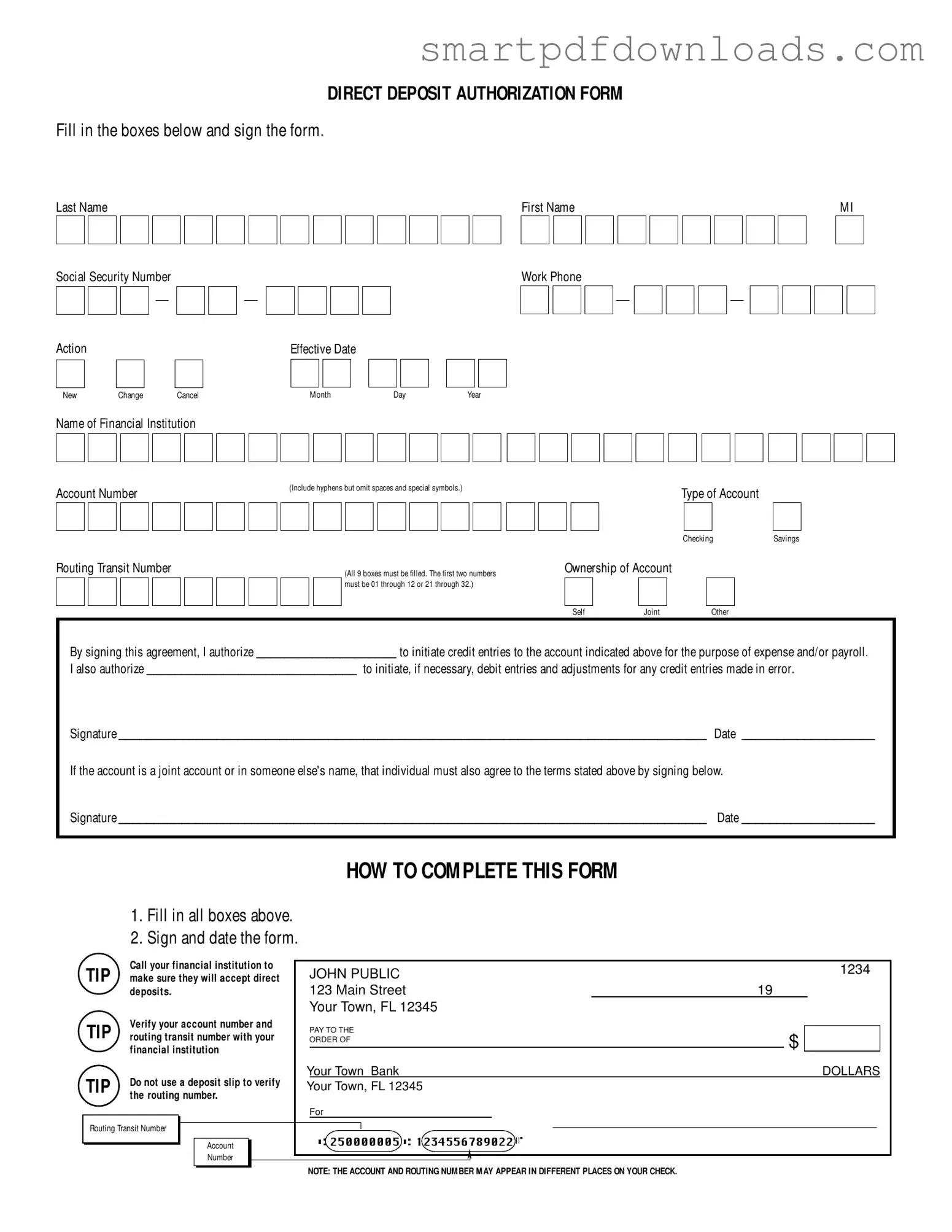

Generic Direct Deposit Form

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or another organization to deposit funds directly into their bank account. This form simplifies the payment process, ensuring that funds are transferred securely and efficiently without the need for paper checks. Completing this form correctly can lead to timely access to your earnings or reimbursements.

Edit Generic Direct Deposit Online

Generic Direct Deposit Form

Edit Generic Direct Deposit Online

Edit Generic Direct Deposit Online

or

⇓ PDF File

Finish the form and move on

Edit Generic Direct Deposit online fast, without printing.

□

□