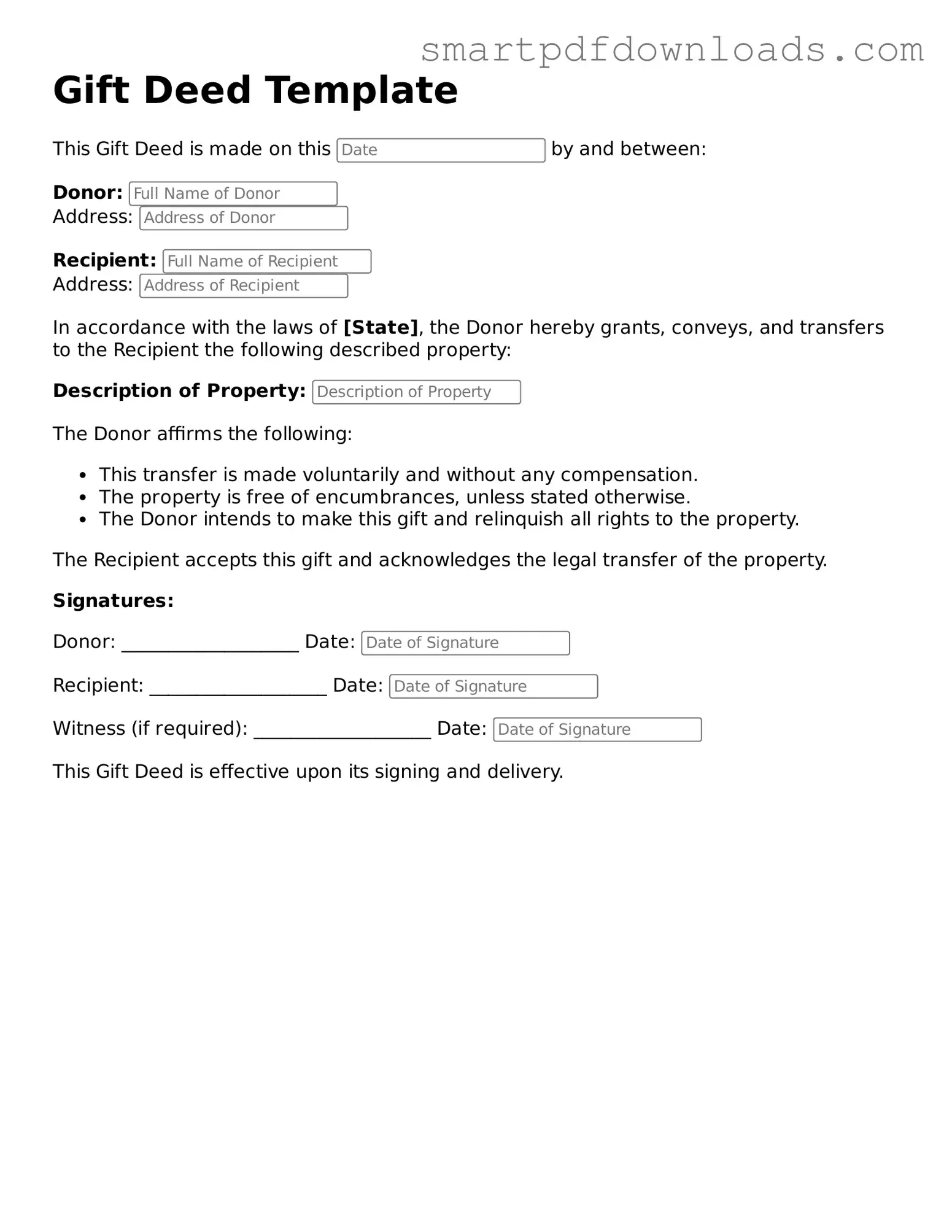

Free Gift Deed Form

A Gift Deed is a legal document that allows a person to transfer ownership of property or assets to another individual without any exchange of money. This form is essential for ensuring that the transfer is recognized by law and provides a clear record of the gift. Understanding the requirements and implications of a Gift Deed is crucial for both the giver and the recipient.

Edit Gift Deed Online

Free Gift Deed Form

Edit Gift Deed Online

Edit Gift Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Gift Deed online fast, without printing.