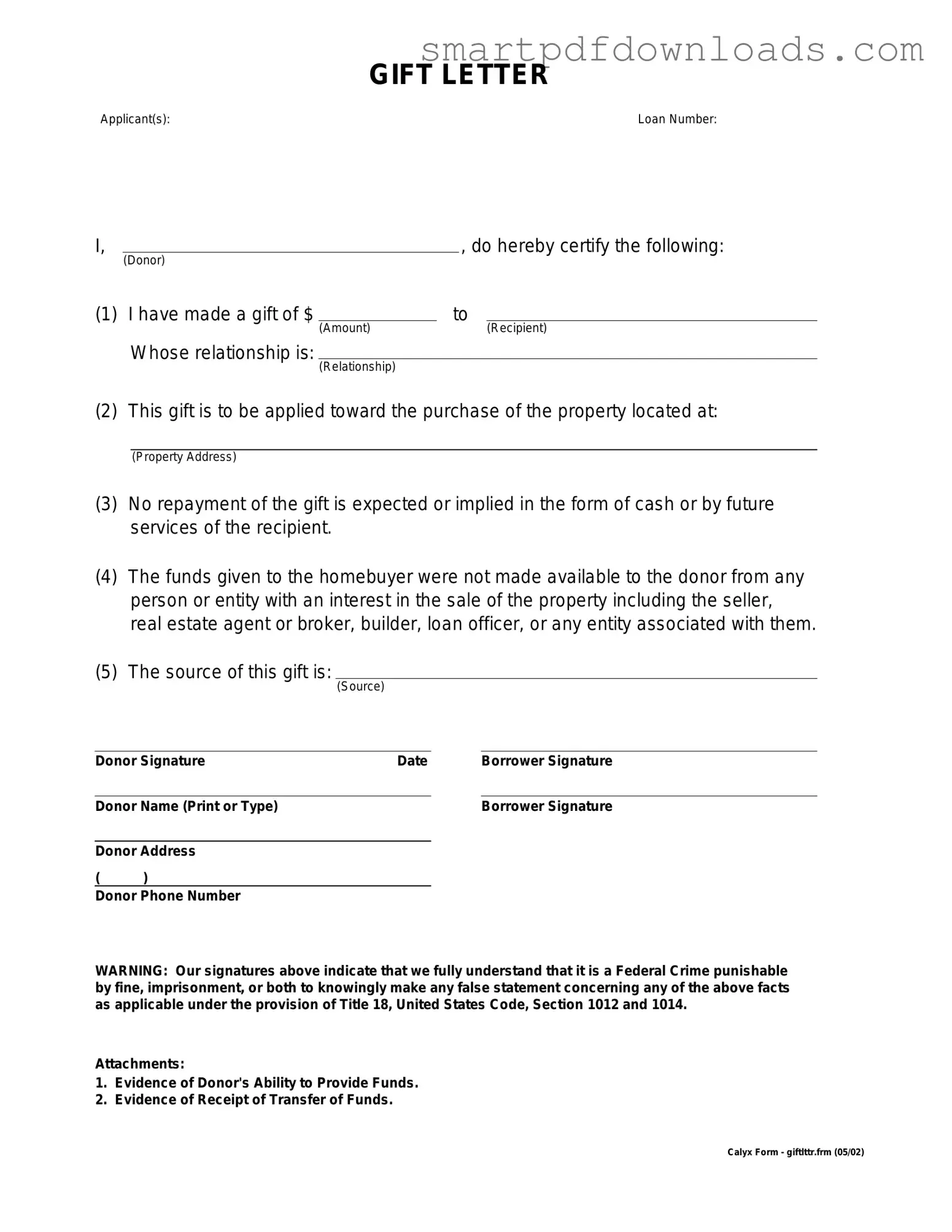

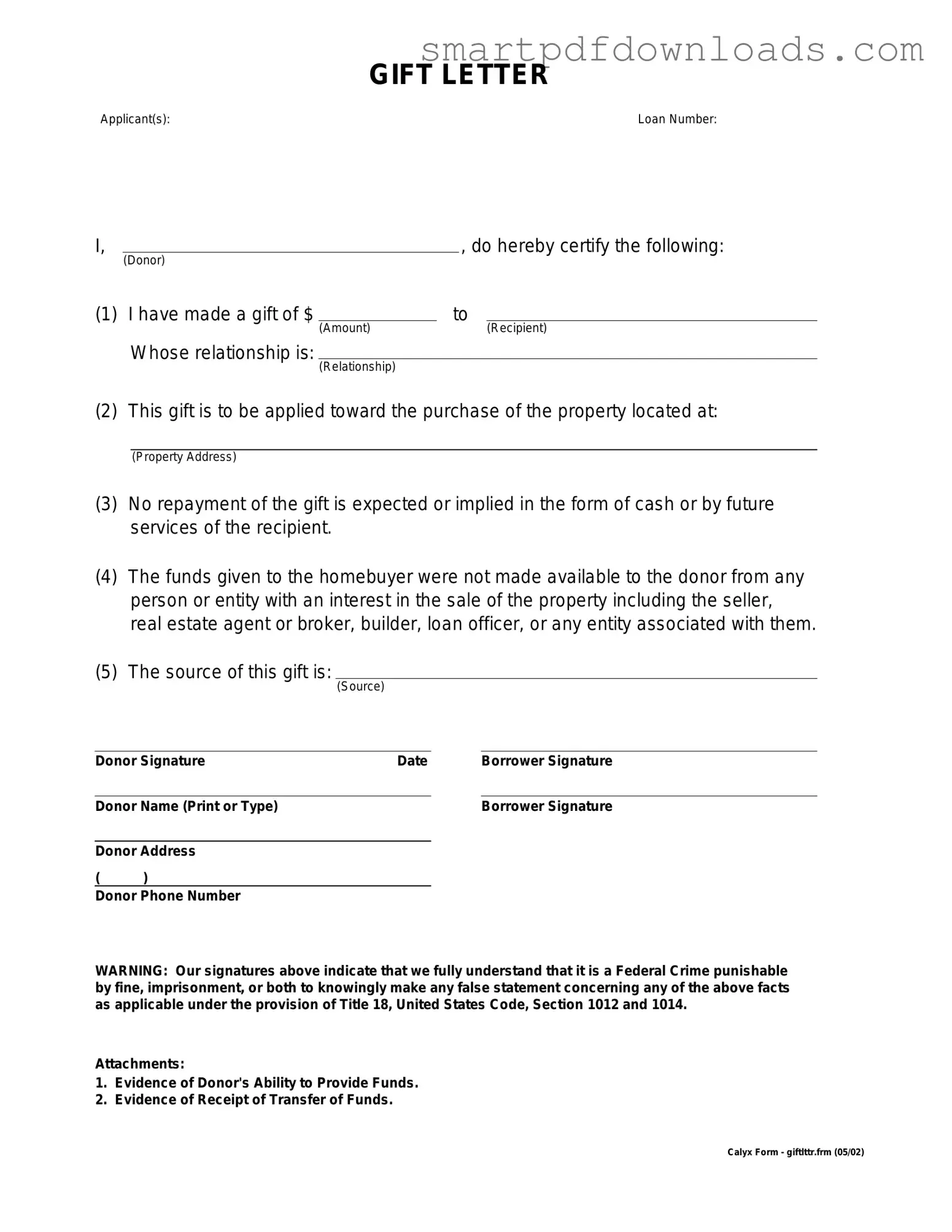

Gift Letter Form

The Gift Letter form is a document used to confirm that a monetary gift has been given to a recipient, often in the context of real estate transactions. This form serves as a declaration from the donor, stating that the funds are indeed a gift and not a loan, which can significantly impact the recipient's financial qualifications. Understanding the importance of this form can help both givers and receivers navigate the complexities of financial transactions with clarity and confidence.

Edit Gift Letter Online

Gift Letter Form

Edit Gift Letter Online

Edit Gift Letter Online

or

⇓ PDF File

Finish the form and move on

Edit Gift Letter online fast, without printing.