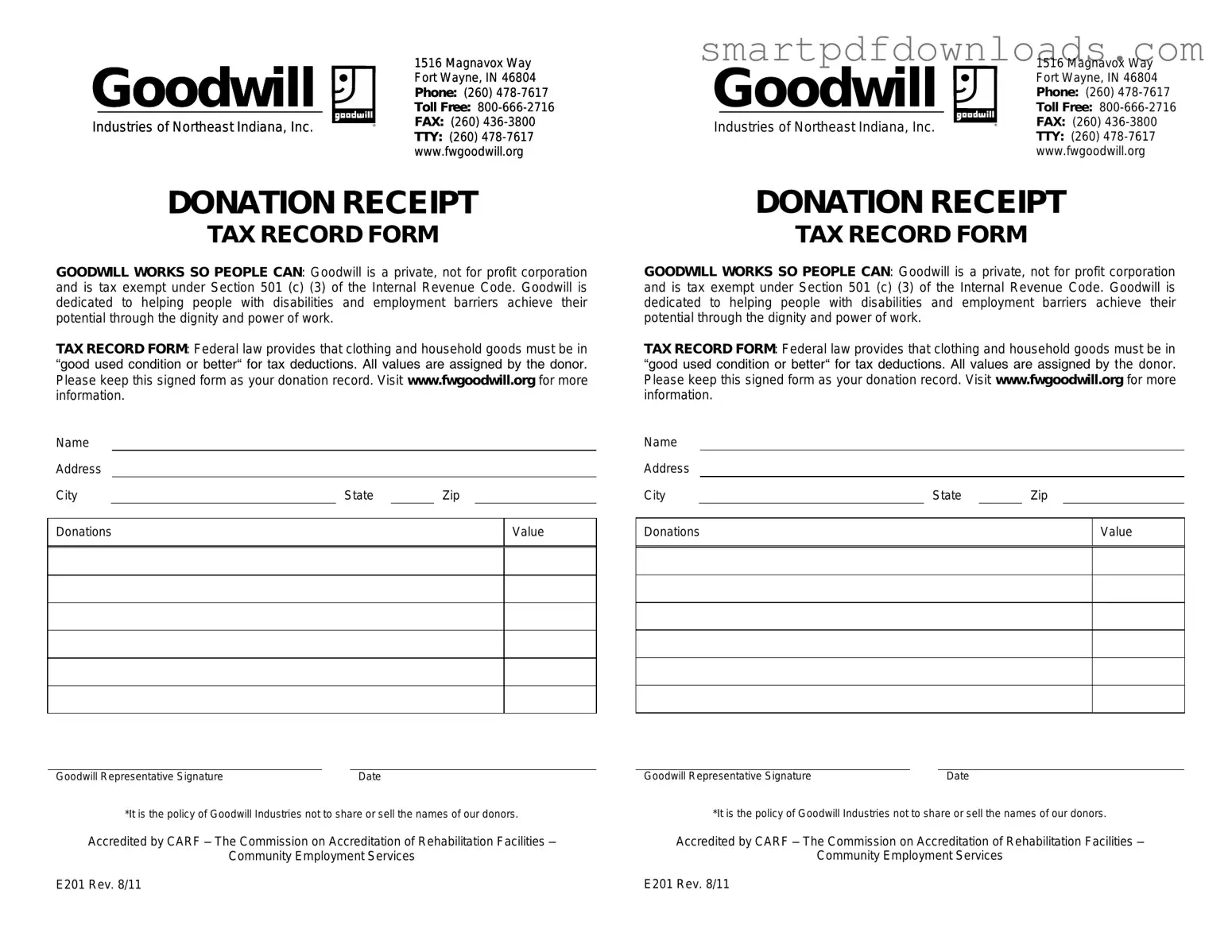

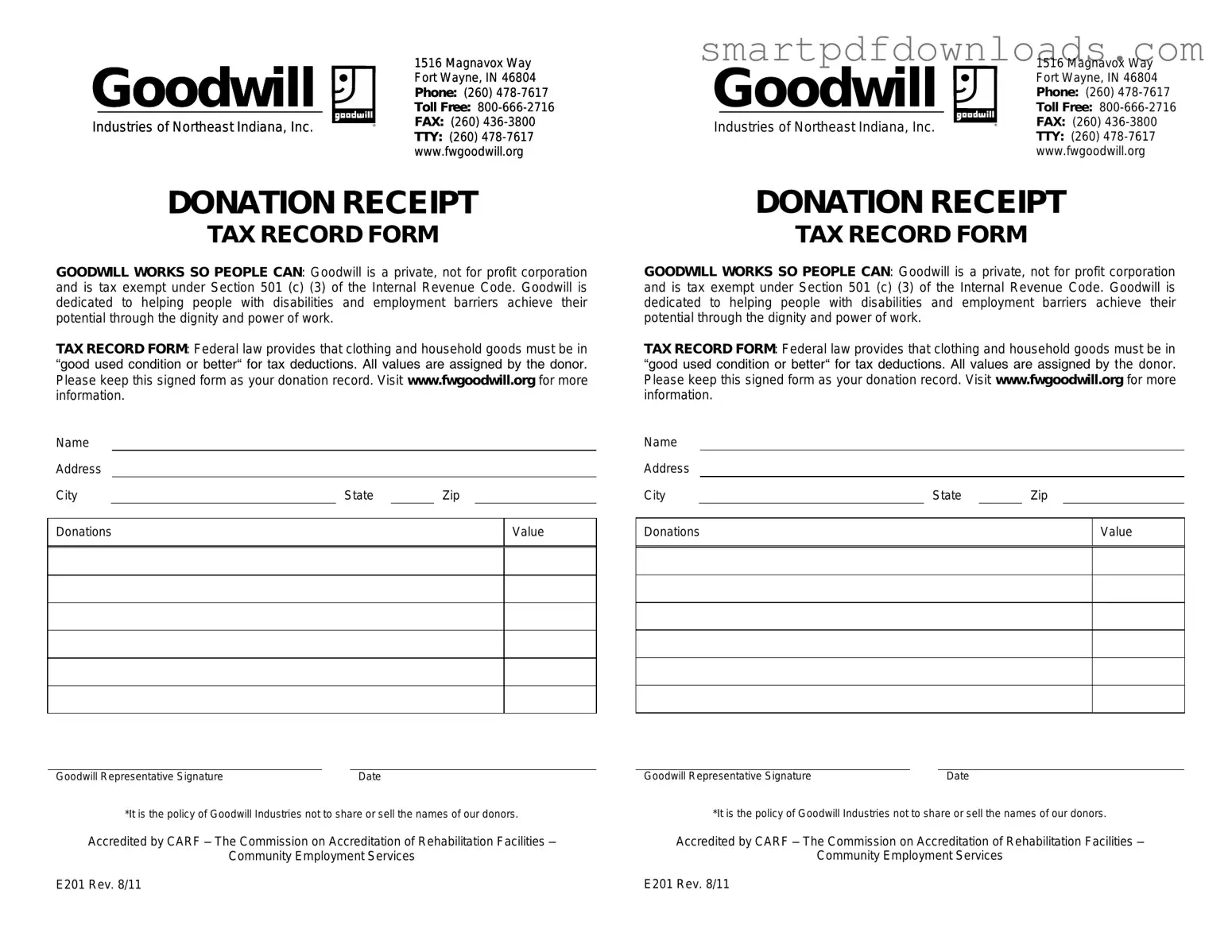

Goodwill donation receipt Form

The Goodwill donation receipt form is a document provided to donors who contribute items to Goodwill Industries. This form serves as proof of the donation, allowing individuals to claim tax deductions when filing their taxes. Understanding how to properly fill out and use this receipt can help maximize the benefits of charitable giving.

Edit Goodwill donation receipt Online

Goodwill donation receipt Form

Edit Goodwill donation receipt Online

Edit Goodwill donation receipt Online

or

⇓ PDF File

Finish the form and move on

Edit Goodwill donation receipt online fast, without printing.