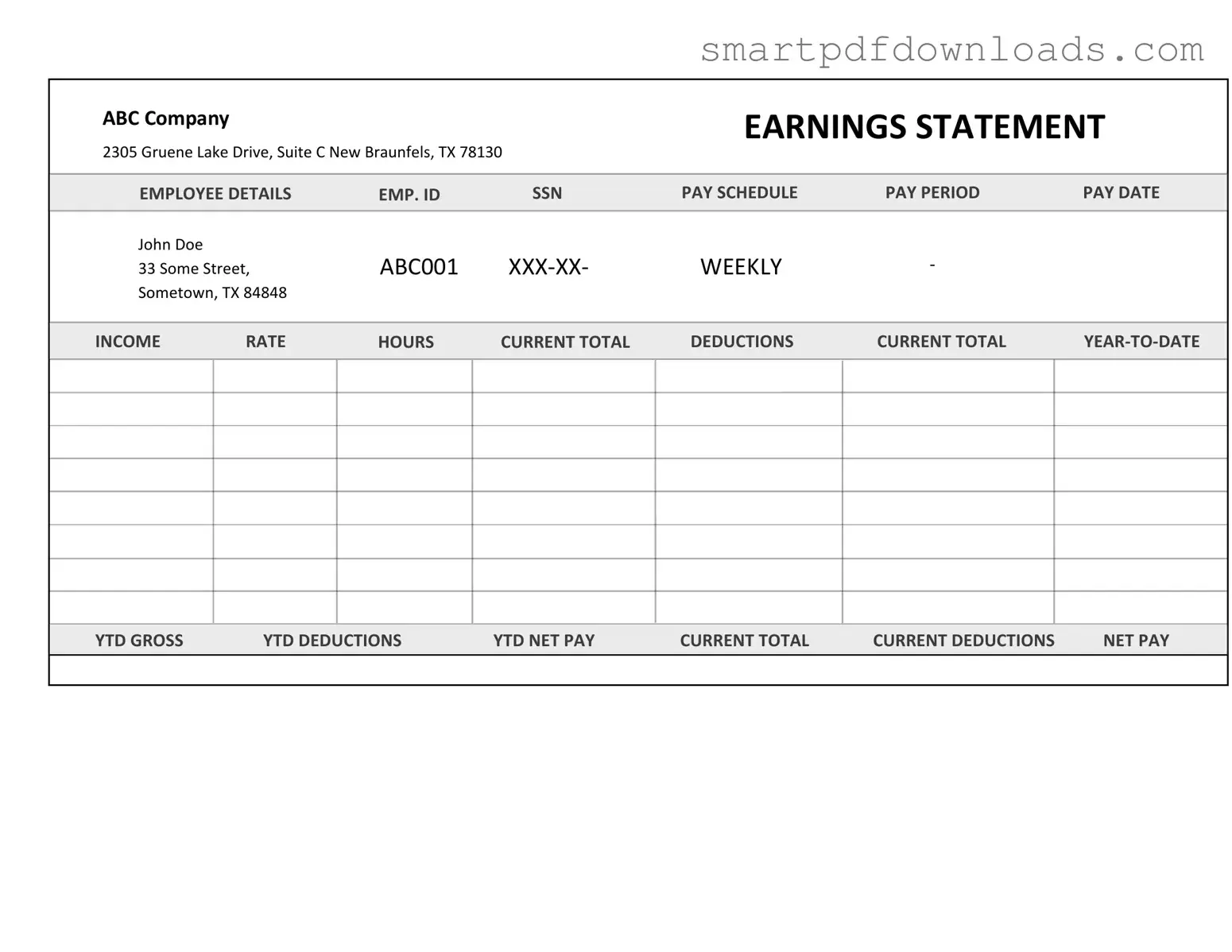

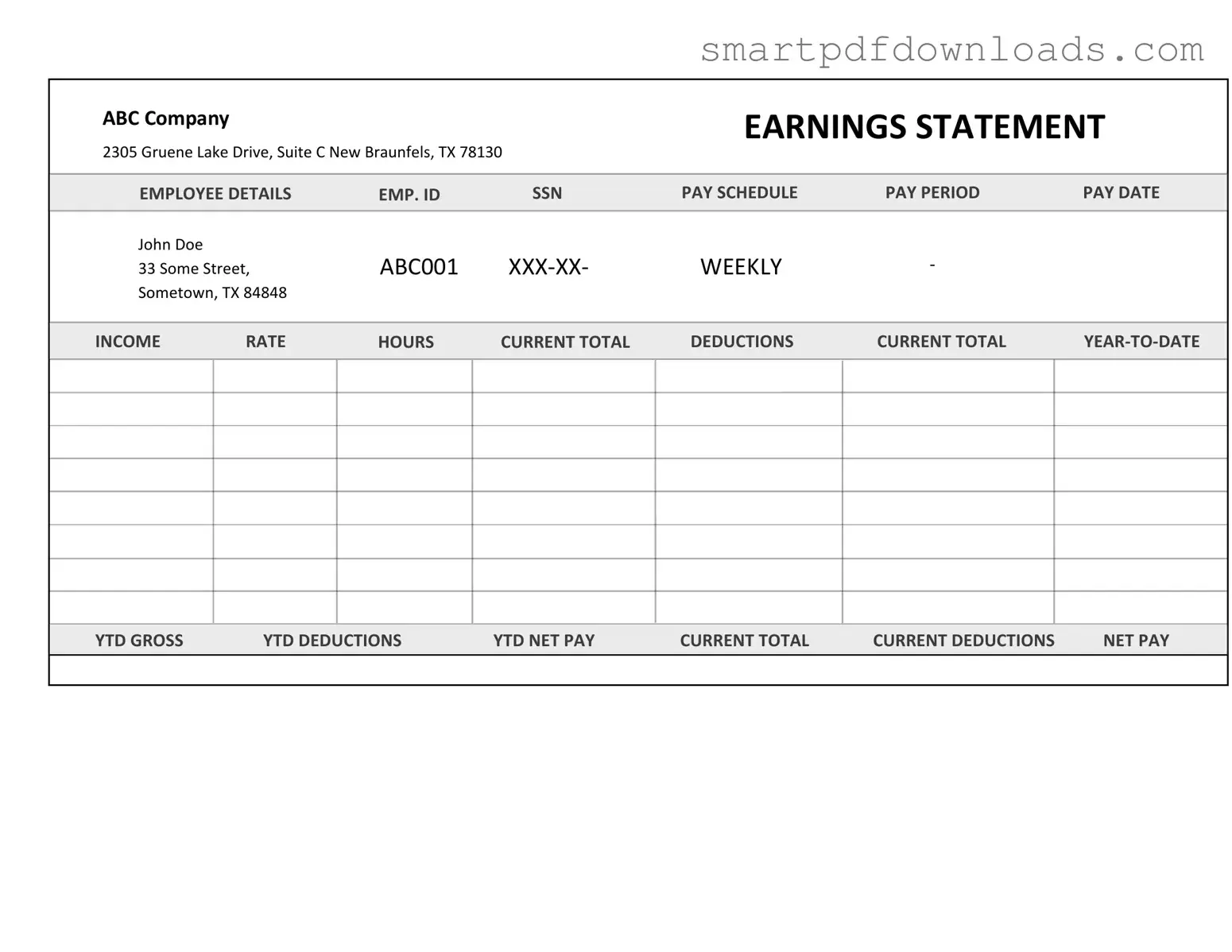

Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form serves as a record of payment for services rendered, providing transparency for both the contractor and the hiring entity. Understanding its components is essential for accurate financial tracking and compliance with tax regulations.

Edit Independent Contractor Pay Stub Online

Independent Contractor Pay Stub Form

Edit Independent Contractor Pay Stub Online

Edit Independent Contractor Pay Stub Online

or

⇓ PDF File

Finish the form and move on

Edit Independent Contractor Pay Stub online fast, without printing.