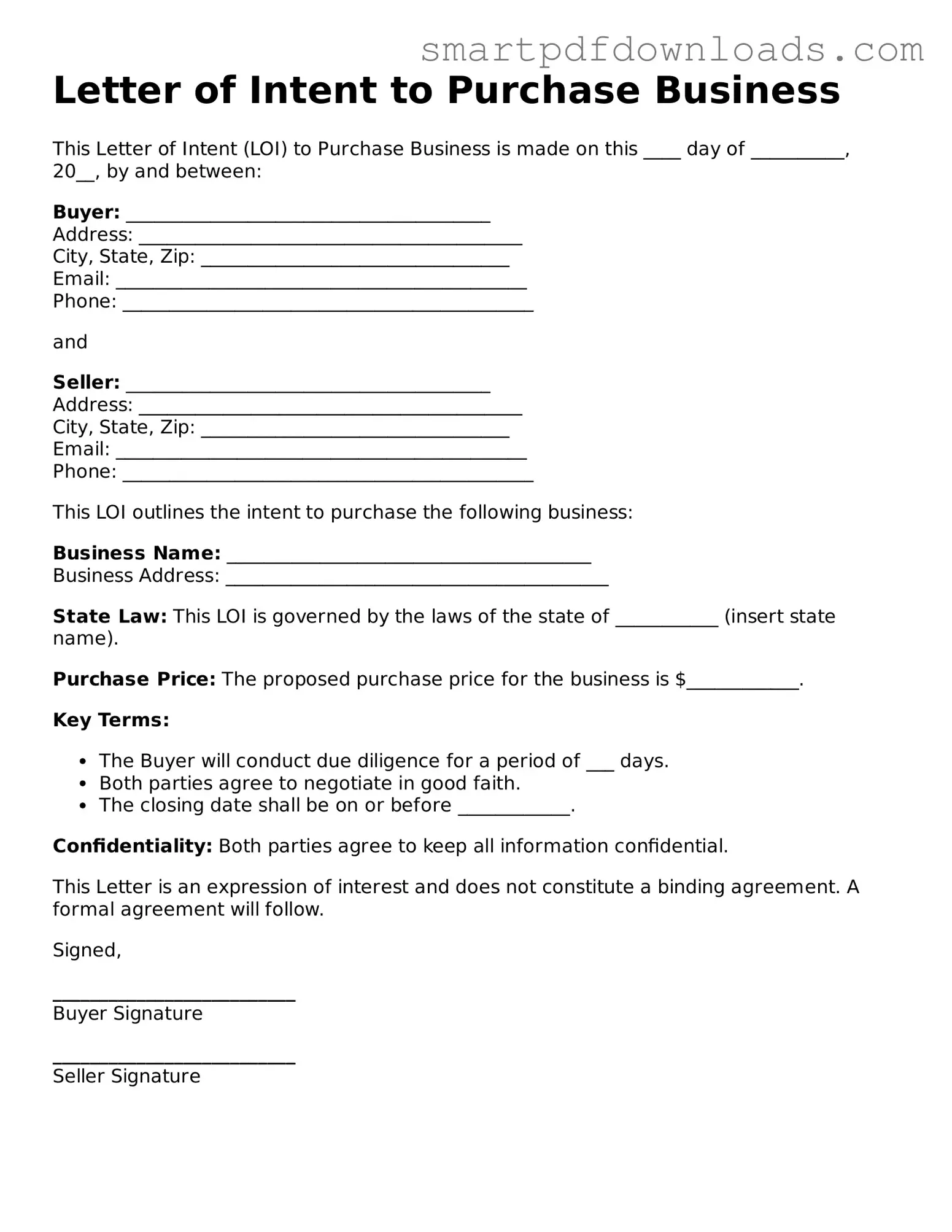

Free Letter of Intent to Purchase Business Form

A Letter of Intent to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. This form serves as a foundation for negotiations, detailing key terms and conditions before finalizing a purchase agreement. By using this document, both parties can clarify their intentions and expectations, paving the way for a smoother transaction.

Edit Letter of Intent to Purchase Business Online

Free Letter of Intent to Purchase Business Form

Edit Letter of Intent to Purchase Business Online

Edit Letter of Intent to Purchase Business Online

or

⇓ PDF File

Finish the form and move on

Edit Letter of Intent to Purchase Business online fast, without printing.