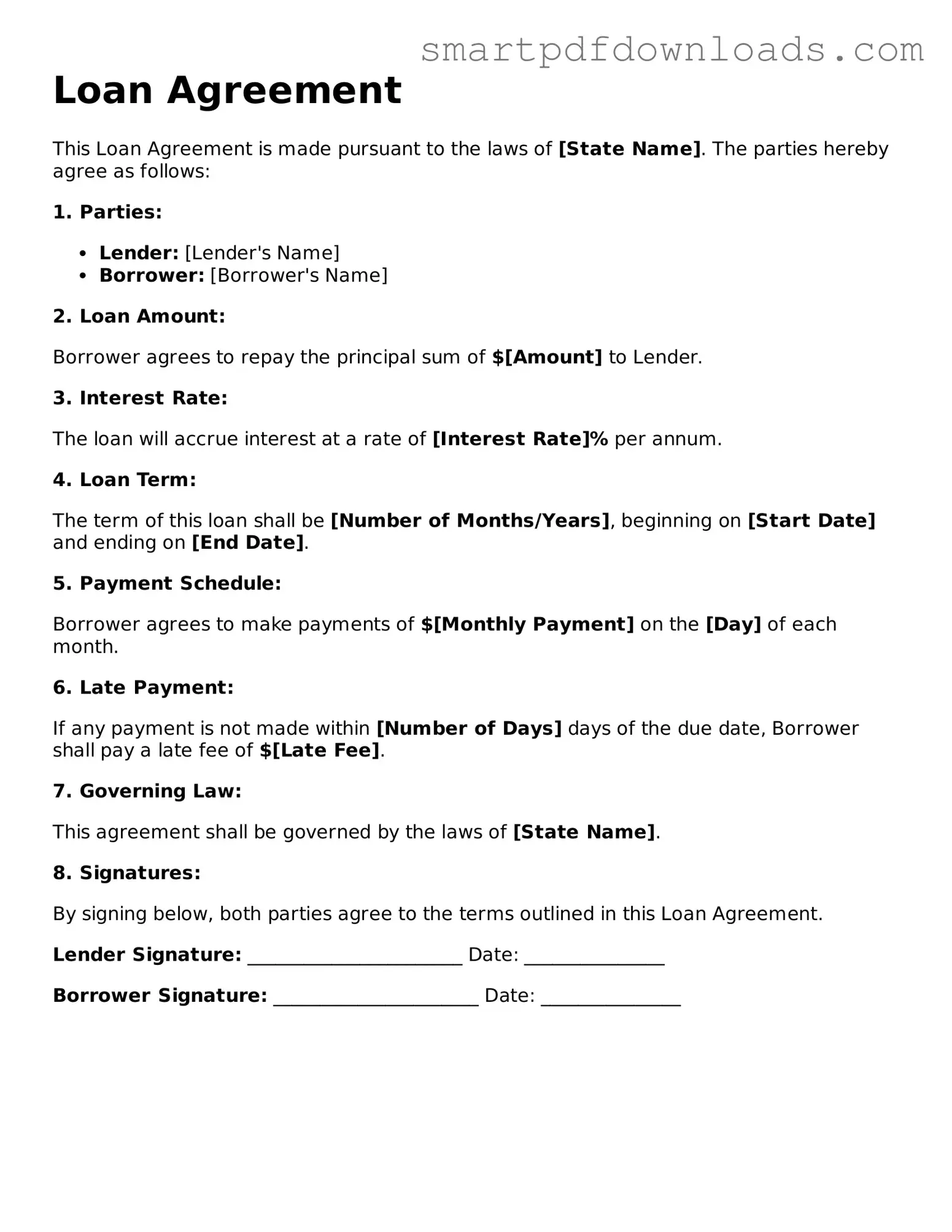

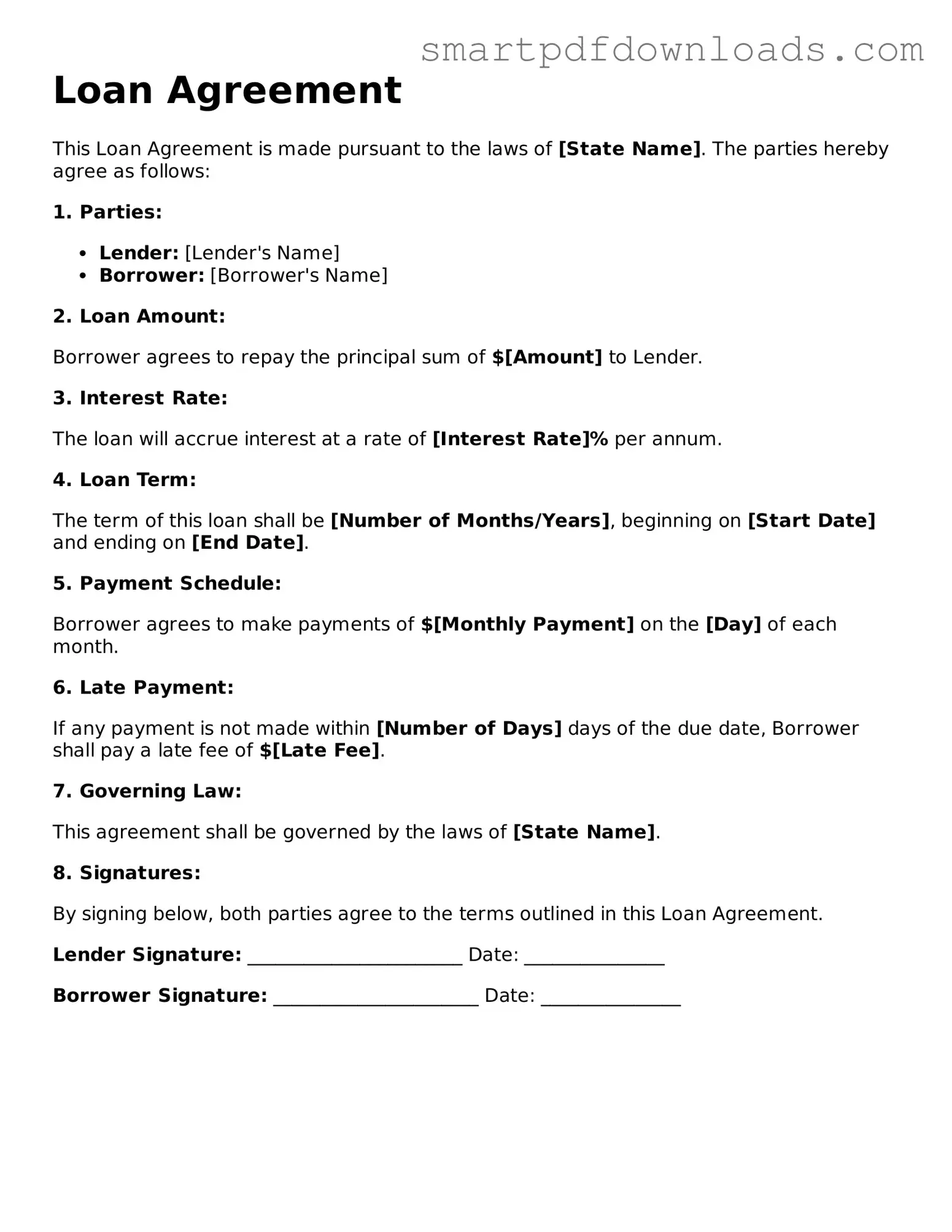

Free Loan Agreement Form

A Loan Agreement form is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. This form specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. Understanding the components of this agreement is crucial for both parties to ensure a clear and enforceable transaction.

Edit Loan Agreement Online

Free Loan Agreement Form

Edit Loan Agreement Online

Edit Loan Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Loan Agreement online fast, without printing.