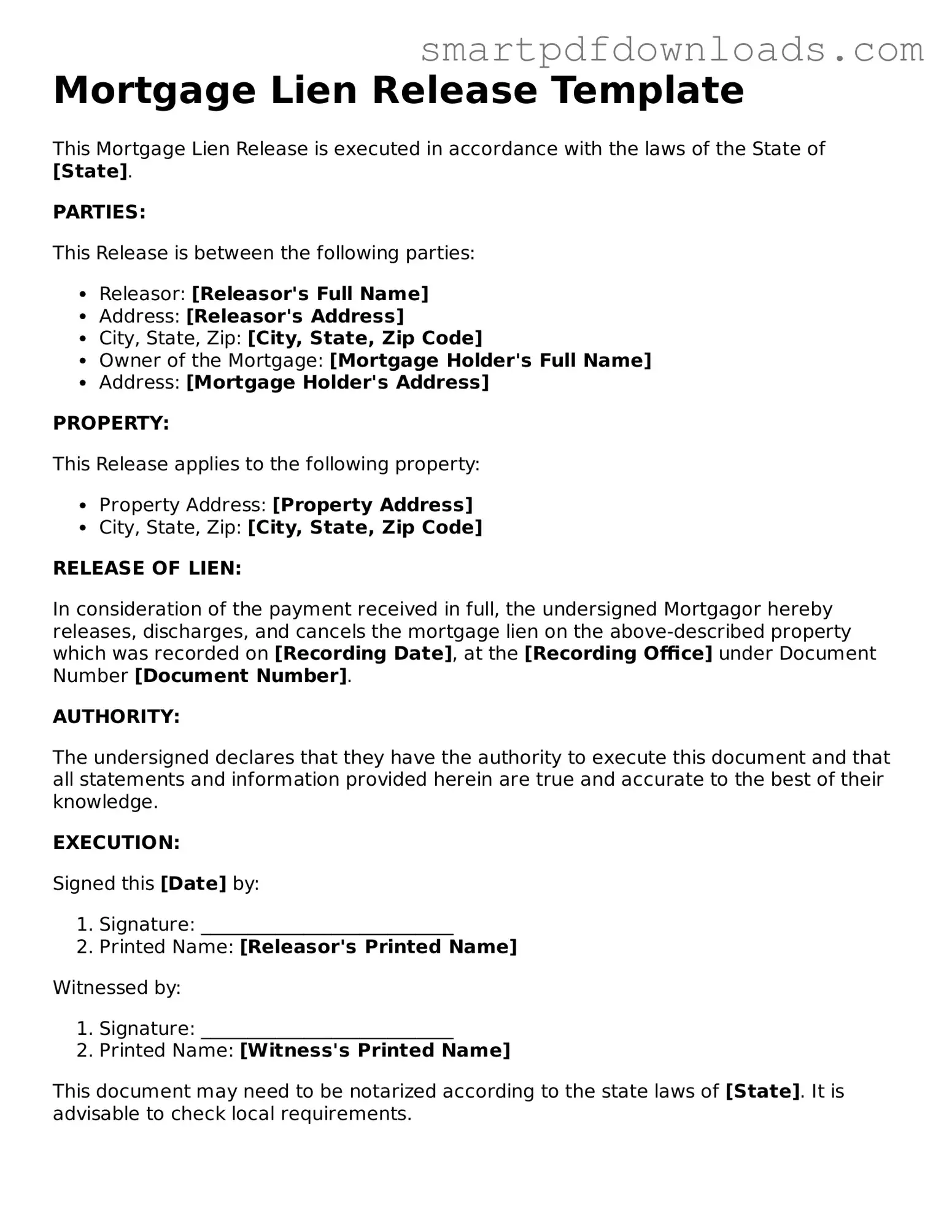

Free Mortgage Lien Release Form

The Mortgage Lien Release form is a legal document that signifies the removal of a mortgage lien from a property once the associated debt has been fully paid. This essential form ensures that the property owner is free from any claims by the lender, allowing for clear ownership. Understanding this process is crucial for homeowners seeking to navigate the complexities of property ownership and financing.

Edit Mortgage Lien Release Online

Free Mortgage Lien Release Form

Edit Mortgage Lien Release Online

Edit Mortgage Lien Release Online

or

⇓ PDF File

Finish the form and move on

Edit Mortgage Lien Release online fast, without printing.