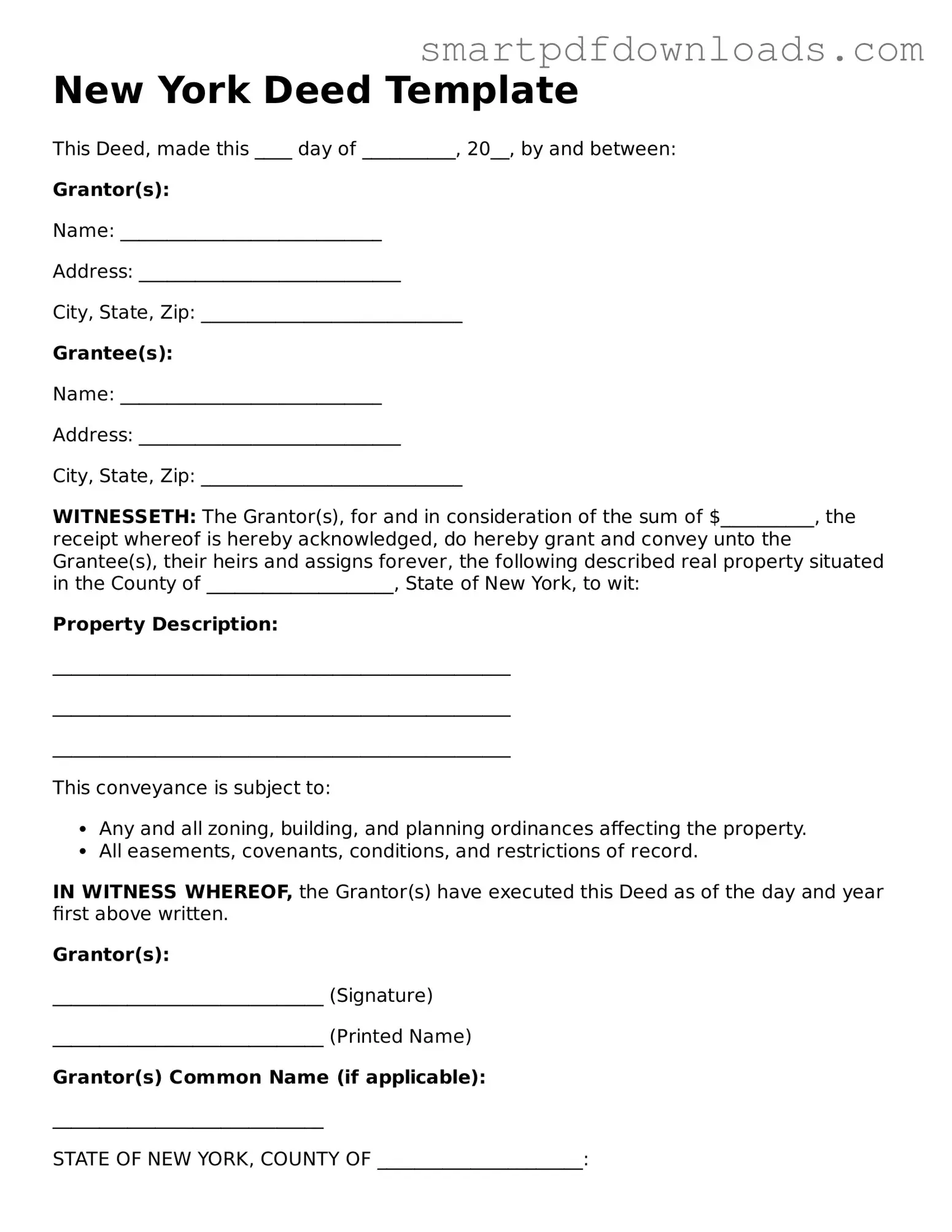

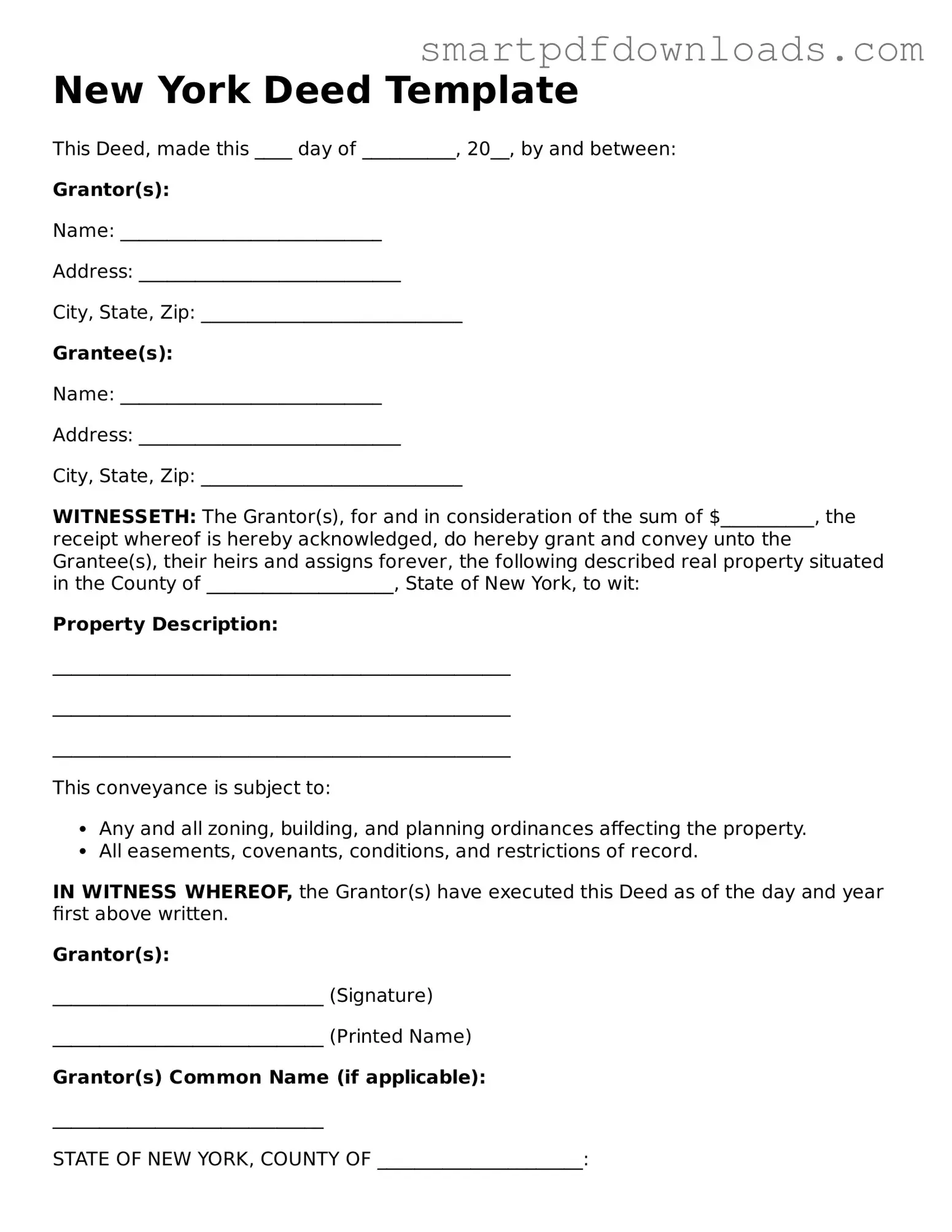

Legal Deed Form for the State of New York

A New York Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines essential details such as the names of the parties involved, a description of the property, and the terms of the transfer. Understanding how to properly complete and file this form is crucial for ensuring a smooth property transaction.

Edit Deed Online

Legal Deed Form for the State of New York

Edit Deed Online

Edit Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Deed online fast, without printing.