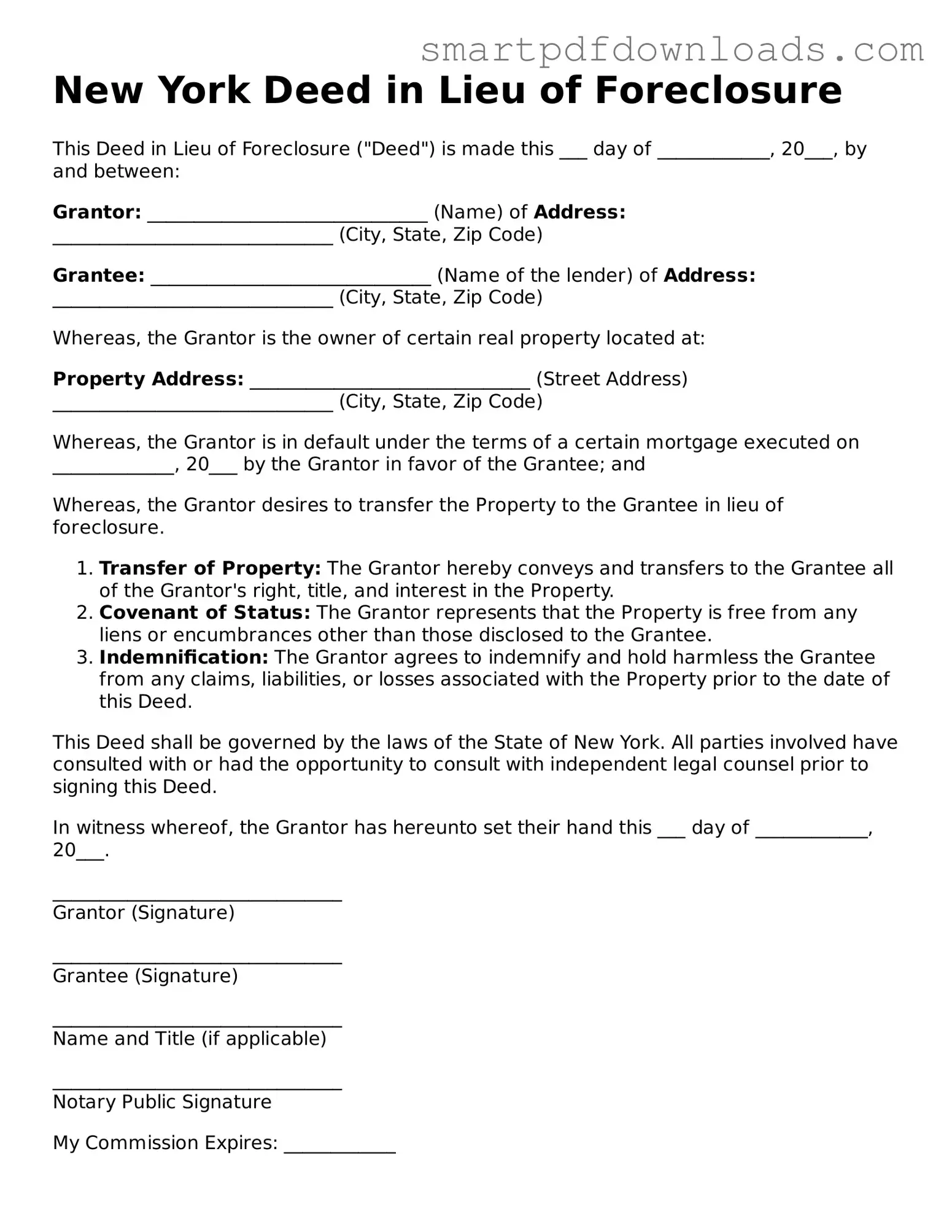

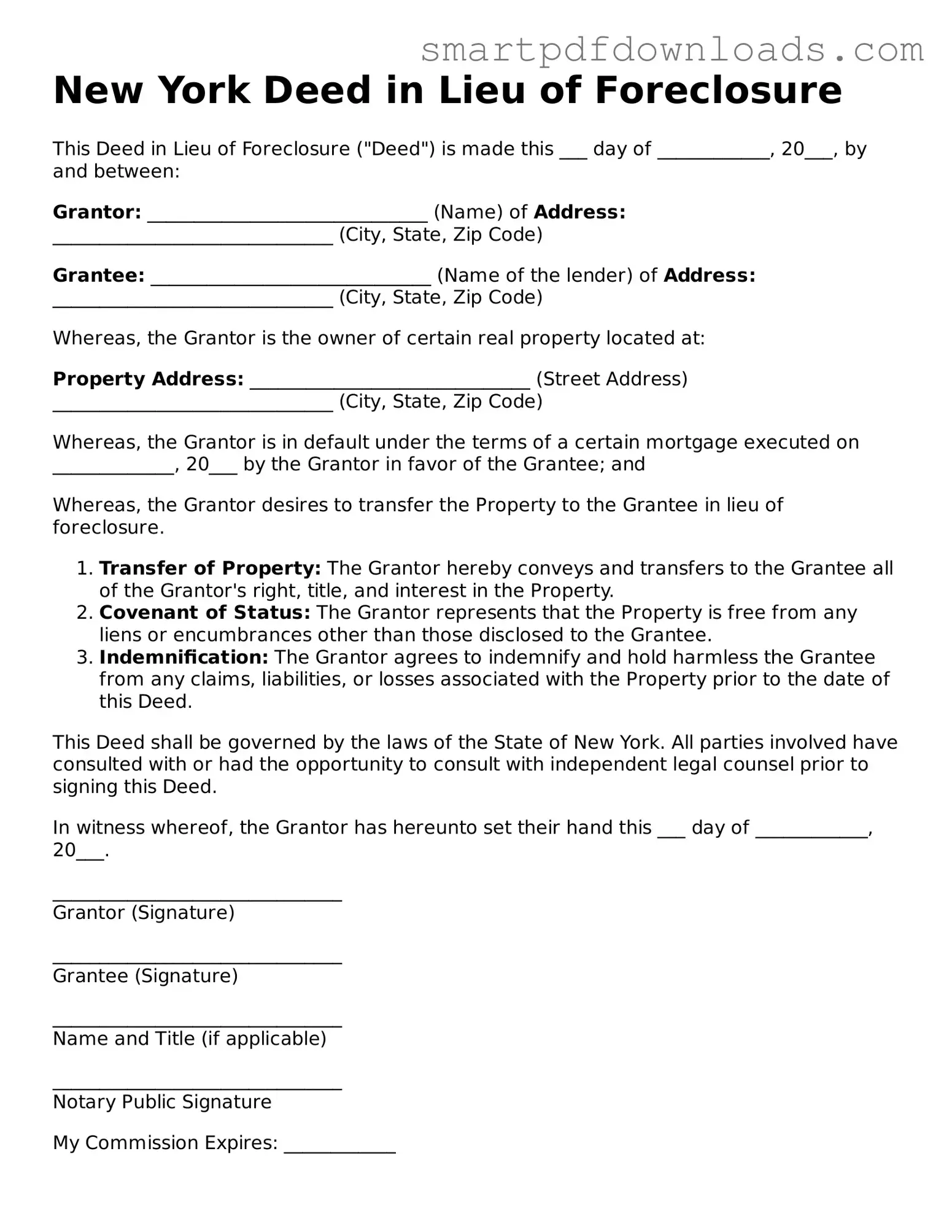

Legal Deed in Lieu of Foreclosure Form for the State of New York

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property back to the lender to avoid the lengthy and often costly foreclosure process. This option can provide a quicker resolution for both parties, allowing the borrower to walk away from the mortgage obligation with less damage to their credit. Understanding the implications and procedures involved in this form can help homeowners make informed decisions during challenging financial times.

Edit Deed in Lieu of Foreclosure Online

Legal Deed in Lieu of Foreclosure Form for the State of New York

Edit Deed in Lieu of Foreclosure Online

Edit Deed in Lieu of Foreclosure Online

or

⇓ PDF File

Finish the form and move on

Edit Deed in Lieu of Foreclosure online fast, without printing.