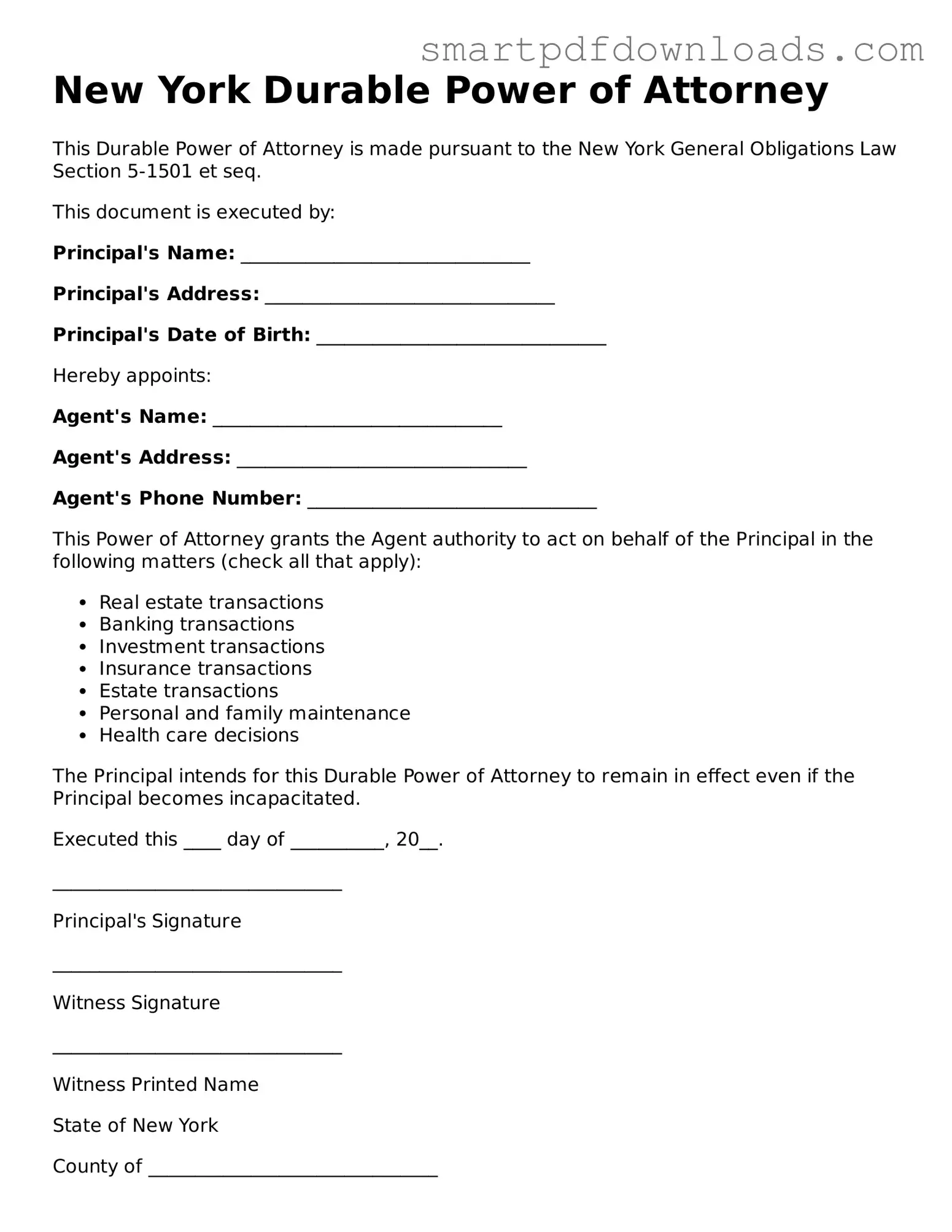

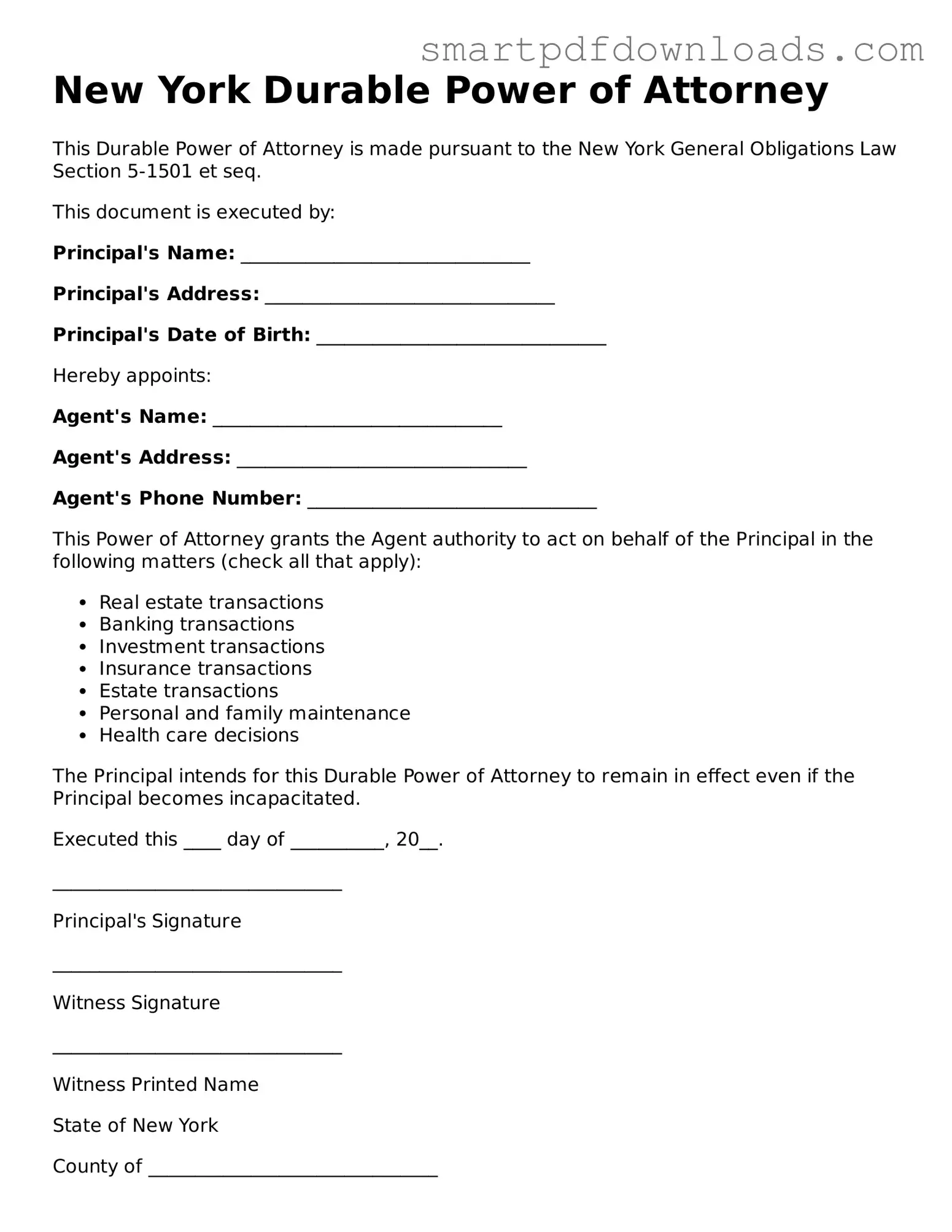

Legal Durable Power of Attorney Form for the State of New York

A New York Durable Power of Attorney form is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent, to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs are managed according to their wishes. Understanding how to properly complete and utilize this form is crucial for anyone looking to secure their financial future.

Edit Durable Power of Attorney Online

Legal Durable Power of Attorney Form for the State of New York

Edit Durable Power of Attorney Online

Edit Durable Power of Attorney Online

or

⇓ PDF File

Finish the form and move on

Edit Durable Power of Attorney online fast, without printing.