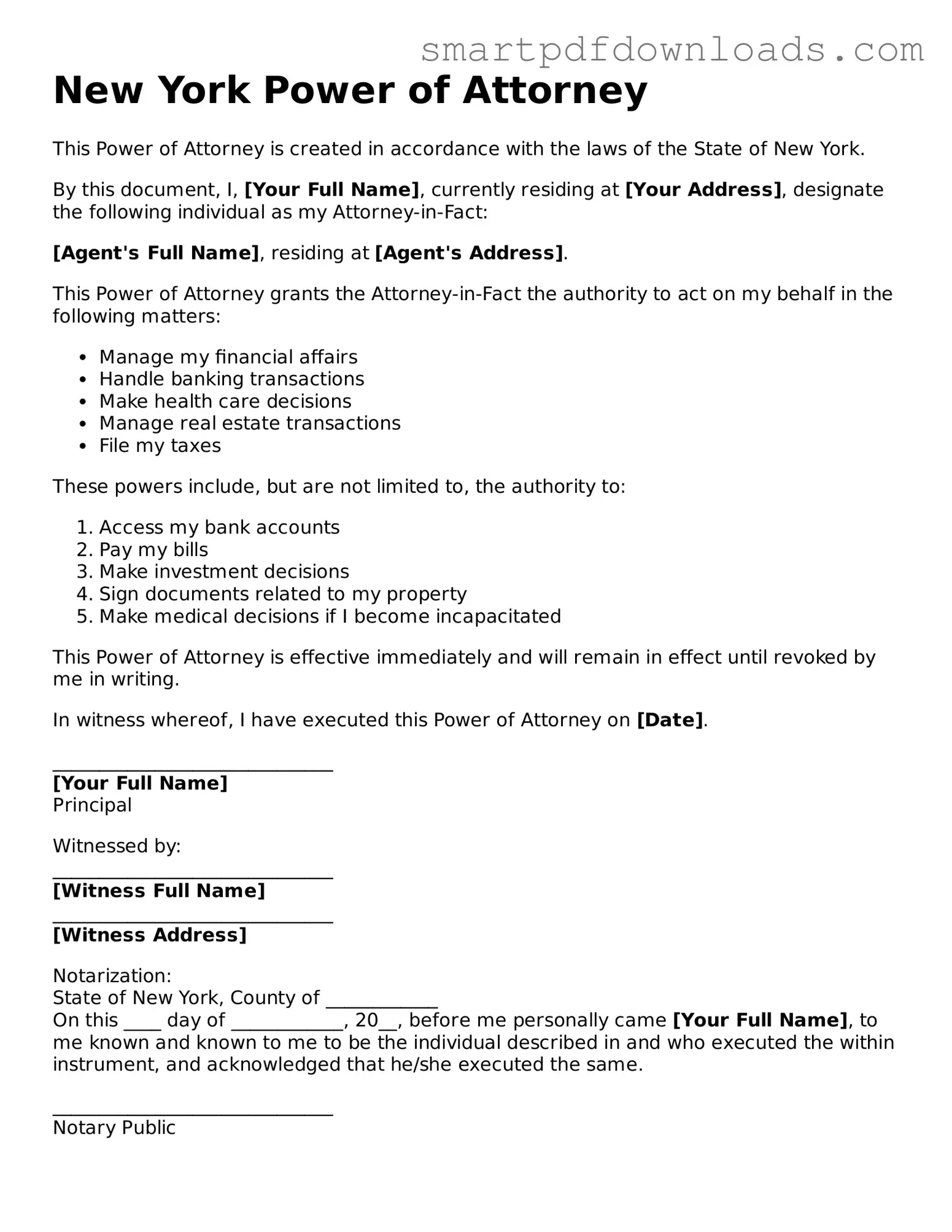

Legal Power of Attorney Form for the State of New York

A Power of Attorney form in New York is a legal document that allows one person to act on behalf of another in financial or legal matters. This arrangement can be crucial in situations where the principal is unable to manage their affairs. Understanding the specifics of this form is essential for anyone considering its use.

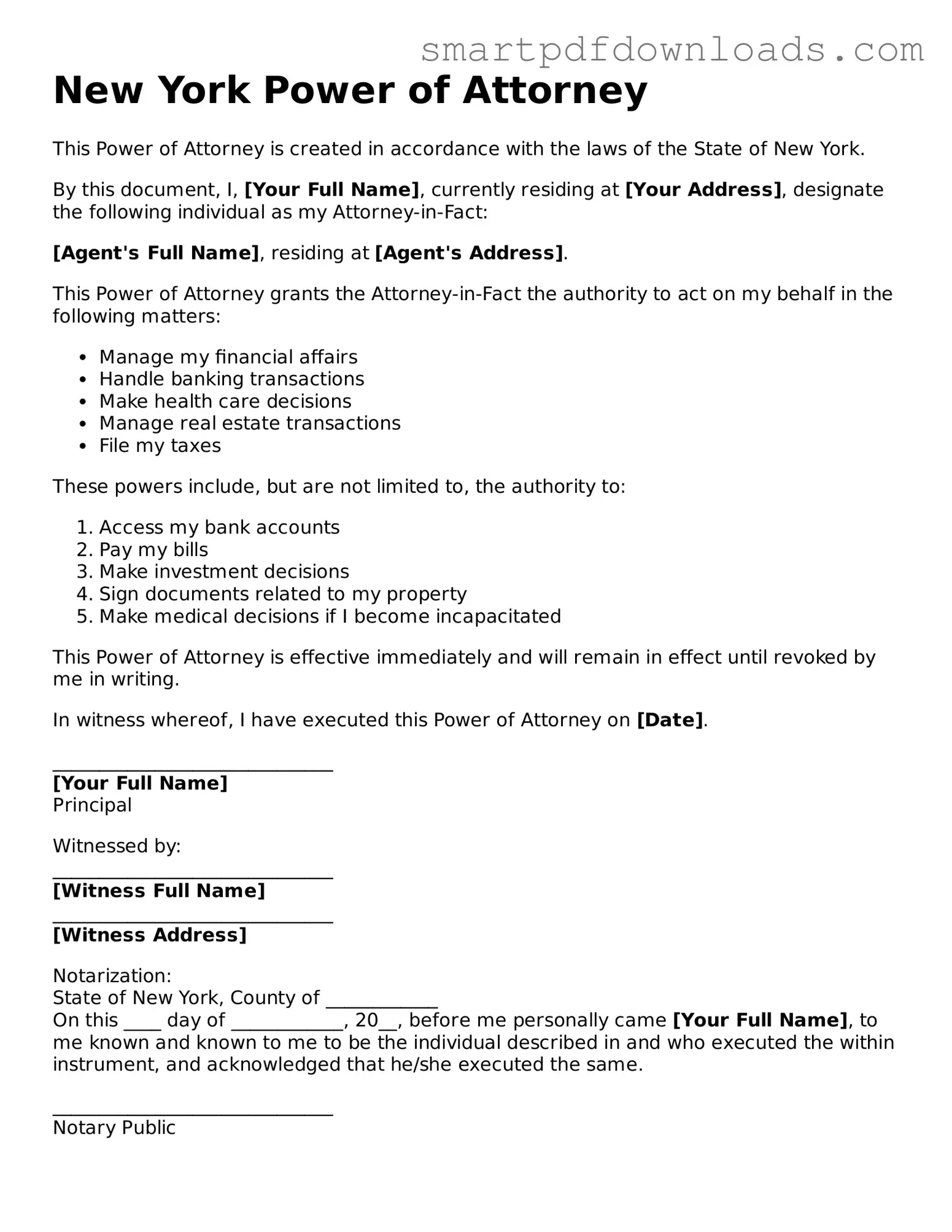

Edit Power of Attorney Online

Legal Power of Attorney Form for the State of New York

Edit Power of Attorney Online

Edit Power of Attorney Online

or

⇓ PDF File

Finish the form and move on

Edit Power of Attorney online fast, without printing.