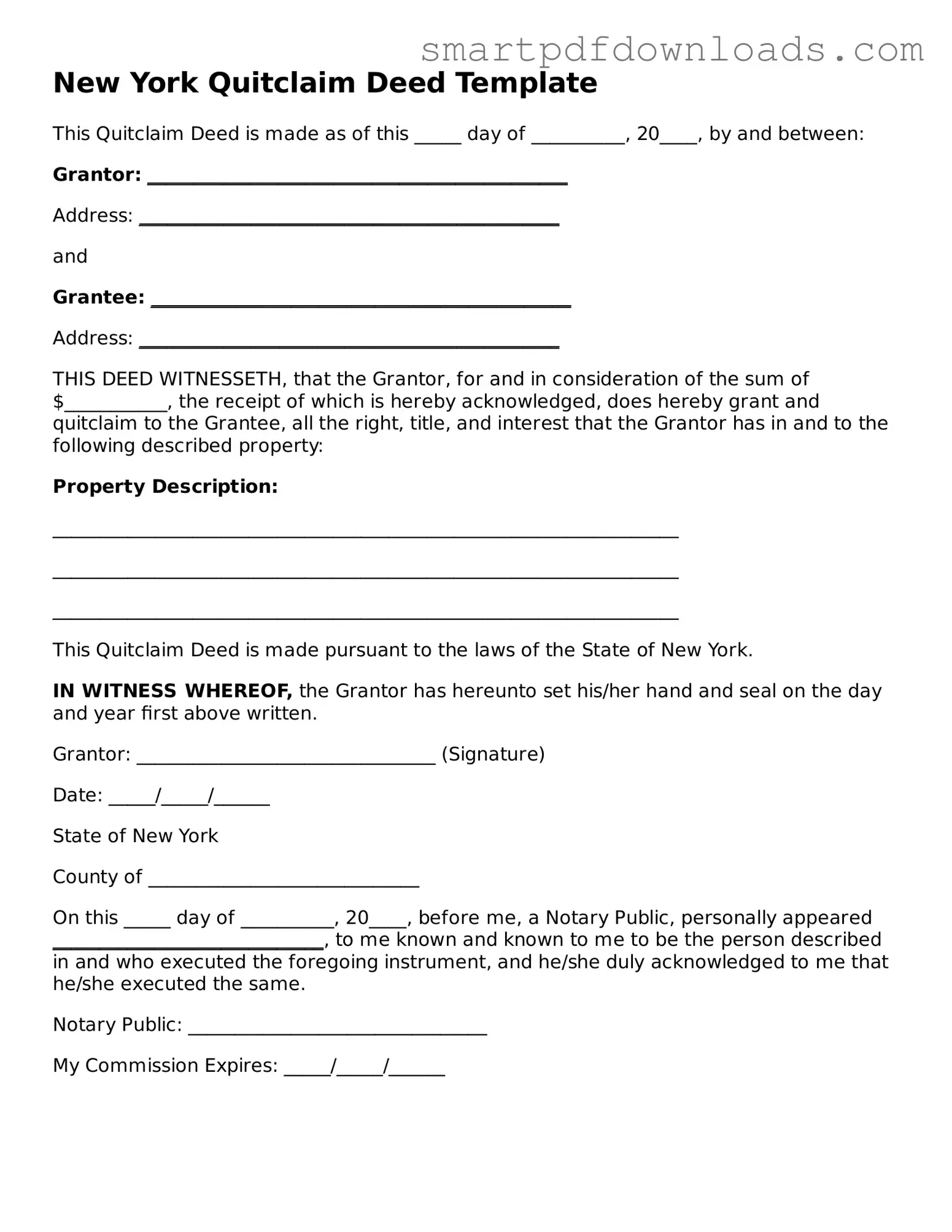

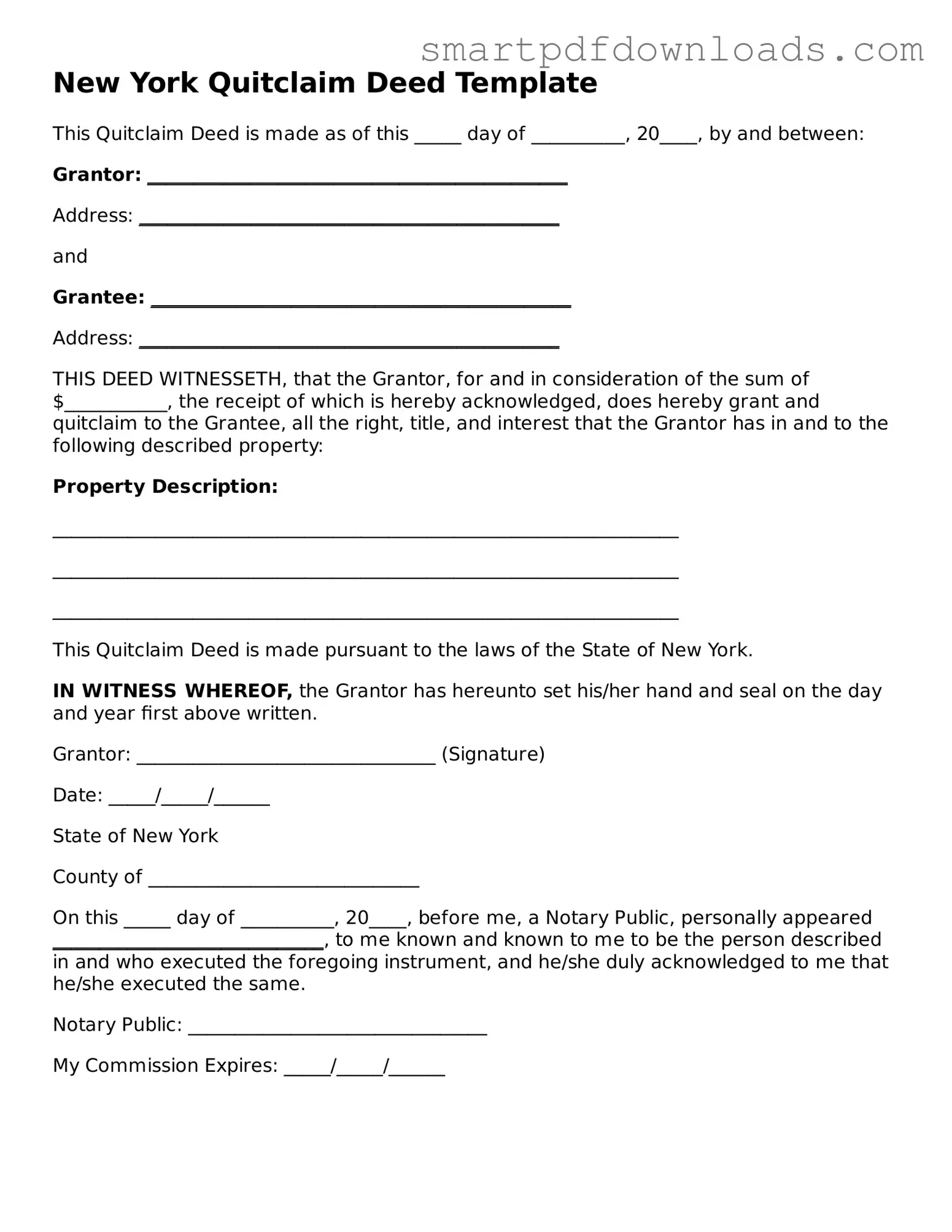

Legal Quitclaim Deed Form for the State of New York

A Quitclaim Deed is a legal document that allows a property owner to transfer their interest in a property to another party without making any warranties about the title. This form is commonly used in situations where the parties know each other, such as between family members or in divorce settlements. Understanding how to properly use and fill out this form is essential for ensuring a smooth transfer of property rights.

Edit Quitclaim Deed Online

Legal Quitclaim Deed Form for the State of New York

Edit Quitclaim Deed Online

Edit Quitclaim Deed Online

or

⇓ PDF File

Finish the form and move on

Edit Quitclaim Deed online fast, without printing.