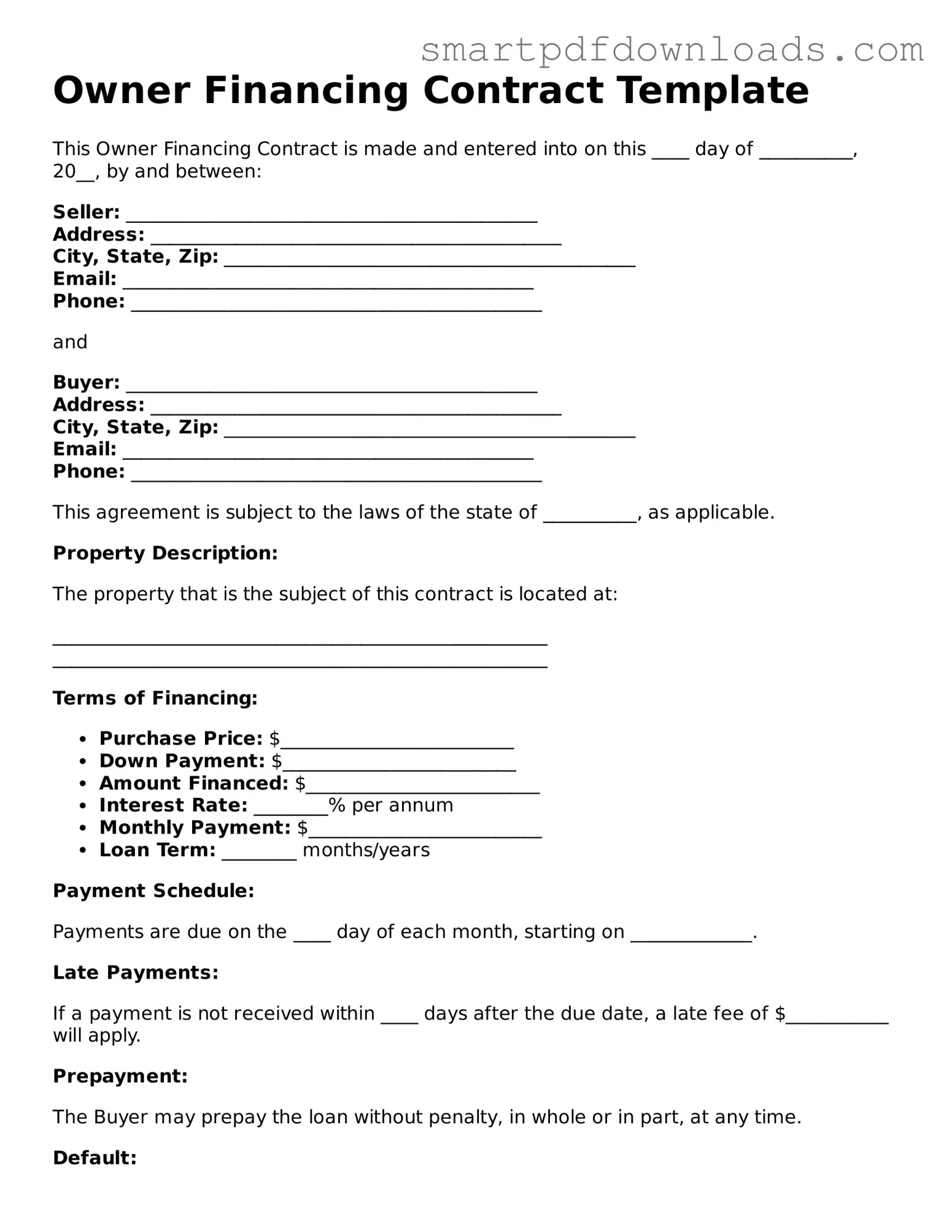

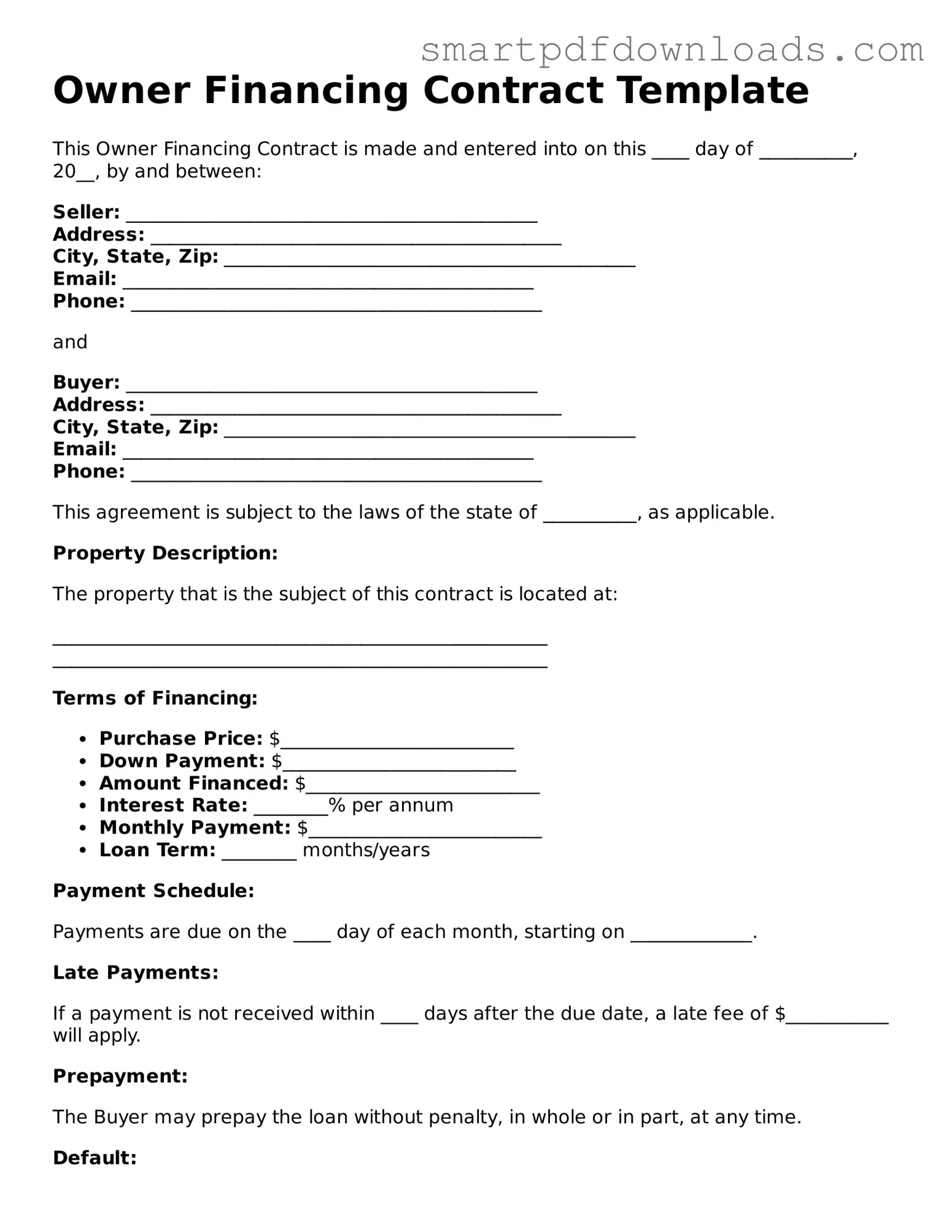

Free Owner Financing Contract Form

An Owner Financing Contract is a legal agreement that allows a property seller to finance the purchase for the buyer, bypassing traditional mortgage lenders. This type of contract can offer flexibility and accessibility for buyers who may face challenges in securing conventional financing. Understanding the key elements of this form is essential for both parties to ensure a smooth transaction.

Edit Owner Financing Contract Online

Free Owner Financing Contract Form

Edit Owner Financing Contract Online

Edit Owner Financing Contract Online

or

⇓ PDF File

Finish the form and move on

Edit Owner Financing Contract online fast, without printing.