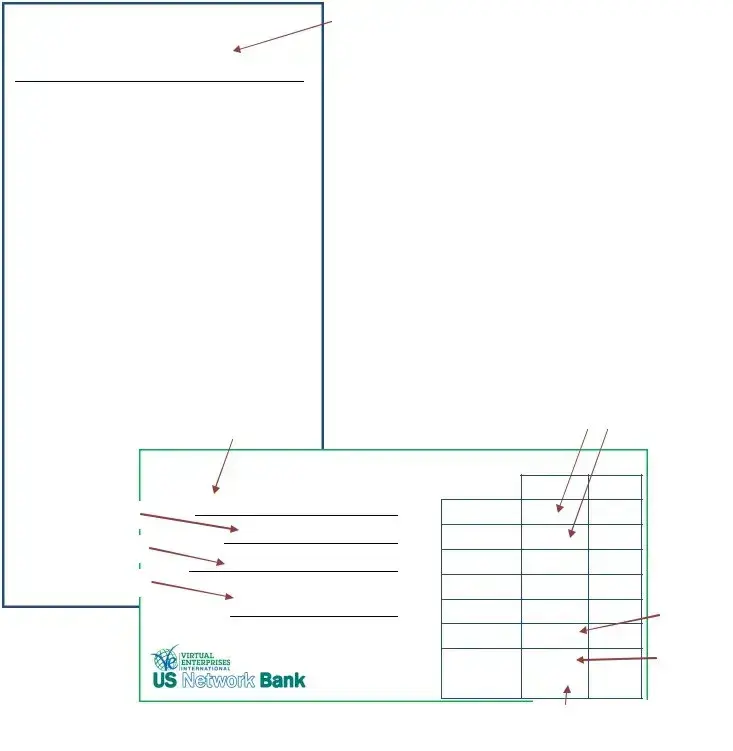

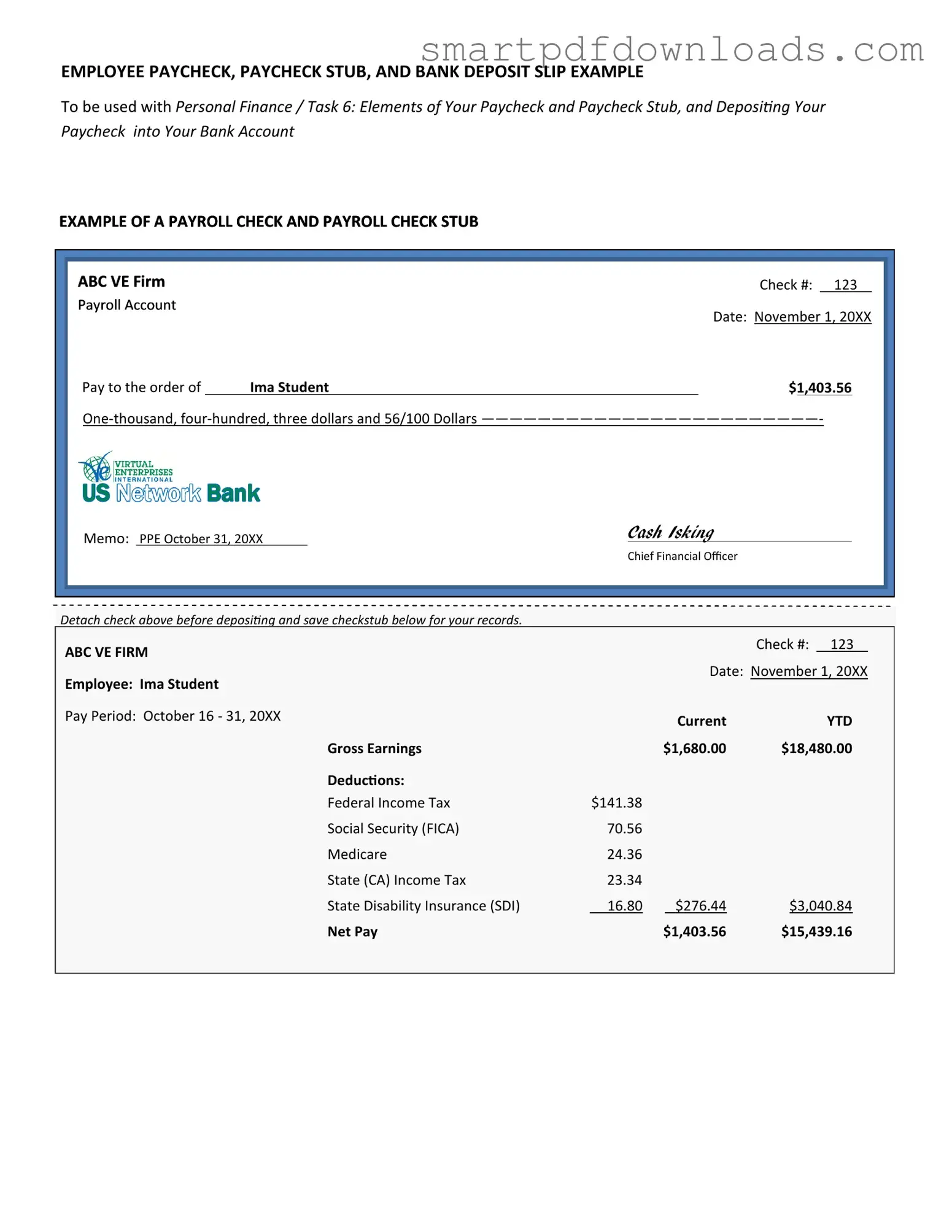

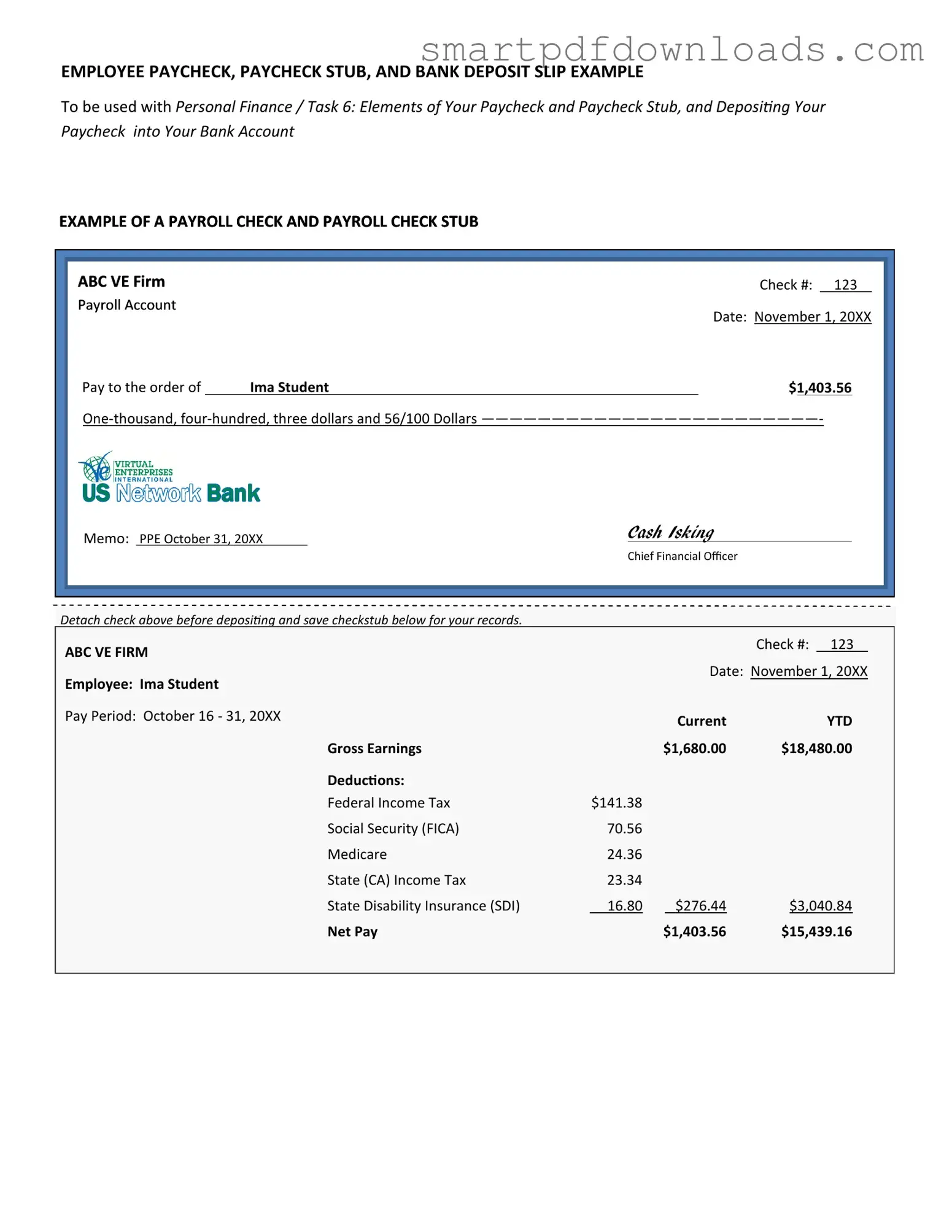

Payroll Check Form

A Payroll Check form is a document used by employers to distribute wages to their employees. This form outlines the amount earned, deductions, and the net pay that the employee will receive. Understanding how to properly complete and manage this form is essential for both employers and employees to ensure accurate compensation and compliance with labor laws.

Edit Payroll Check Online

Payroll Check Form

Edit Payroll Check Online

Edit Payroll Check Online

or

⇓ PDF File

Finish the form and move on

Edit Payroll Check online fast, without printing.