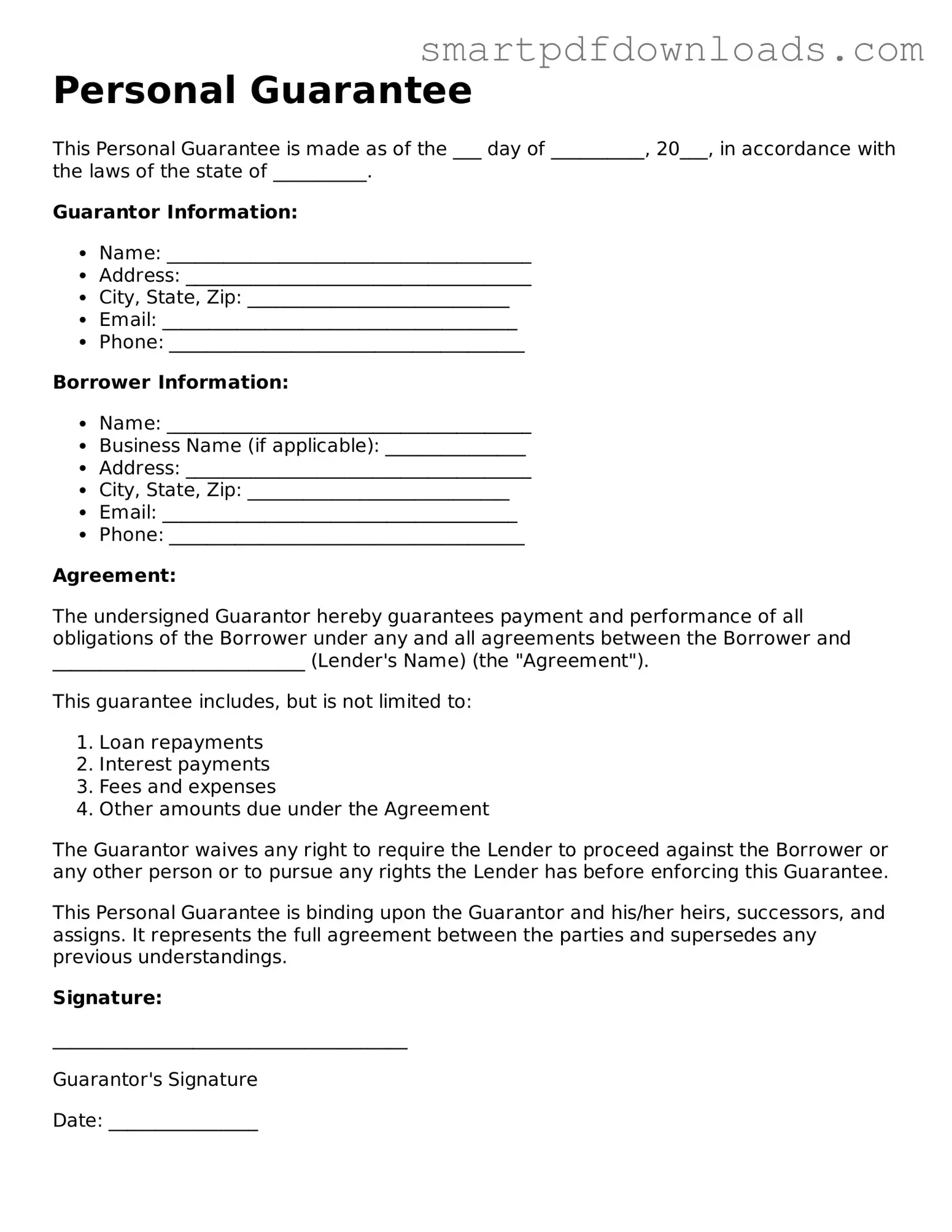

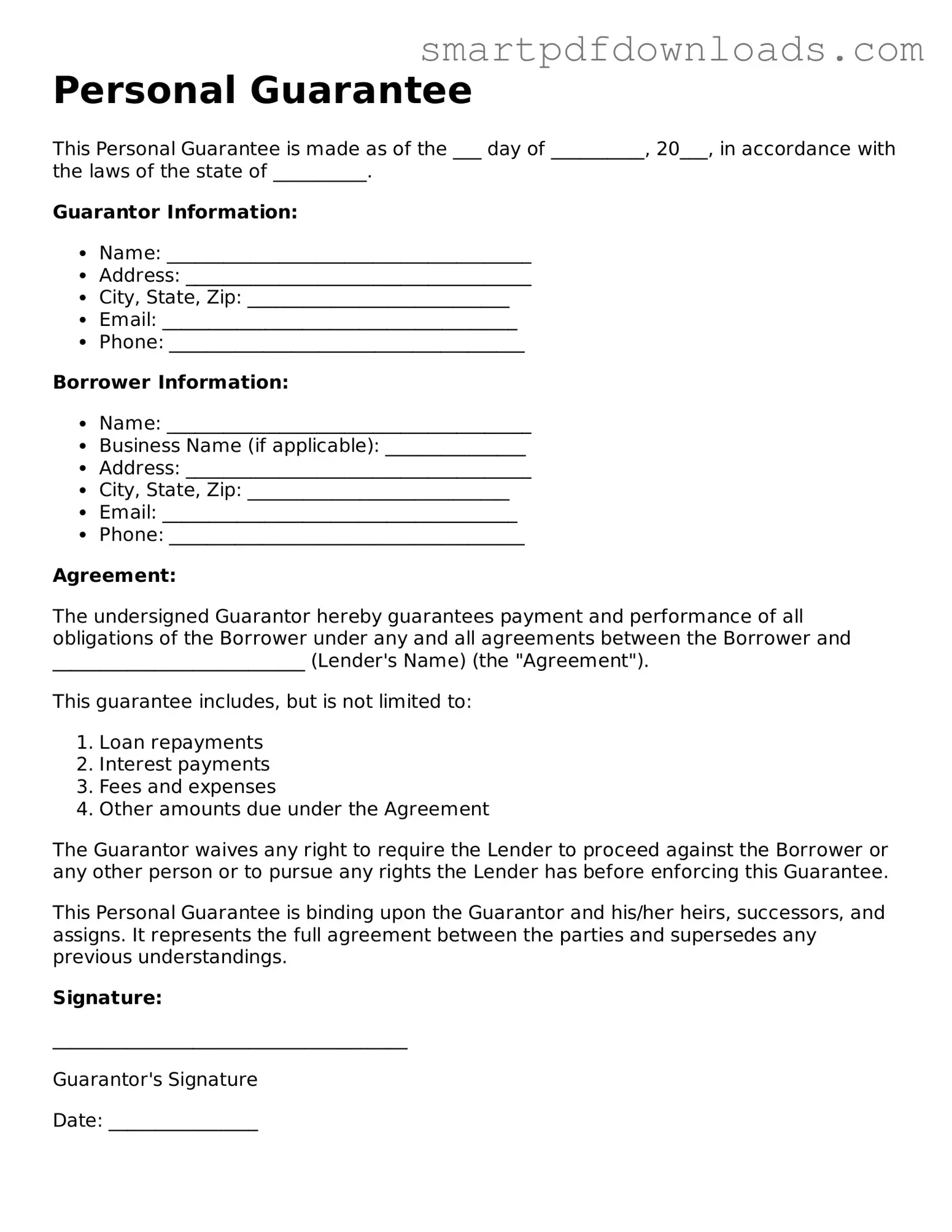

Free Personal Guarantee Form

A Personal Guarantee form is a legal document in which an individual agrees to be responsible for the debt or obligations of another party, typically a business. This form provides lenders and creditors with an added layer of security, ensuring that if the primary borrower defaults, the guarantor will fulfill the financial obligations. Understanding the implications of signing such a document is crucial for anyone considering taking on this responsibility.

Edit Personal Guarantee Online

Free Personal Guarantee Form

Edit Personal Guarantee Online

Edit Personal Guarantee Online

or

⇓ PDF File

Finish the form and move on

Edit Personal Guarantee online fast, without printing.