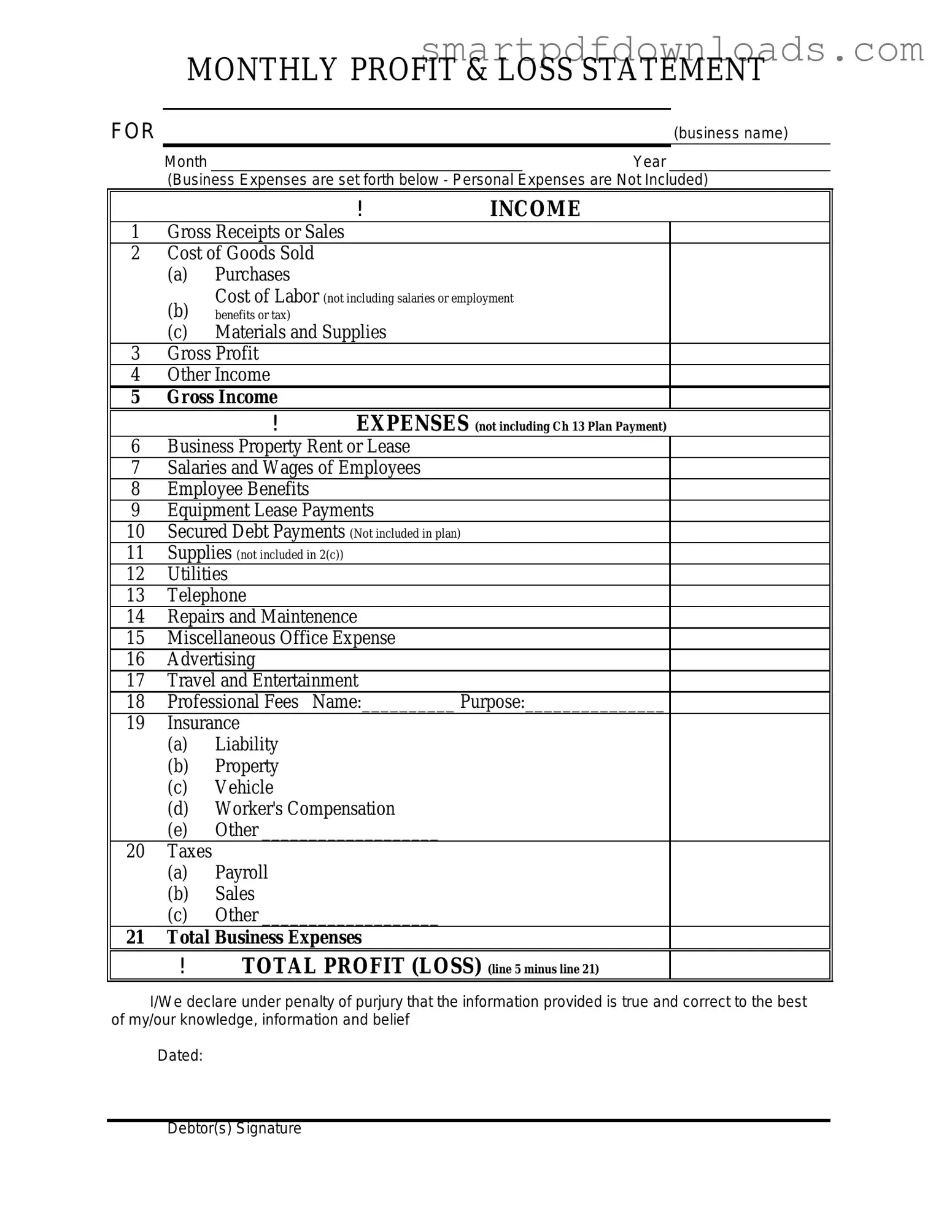

Profit And Loss Form

The Profit and Loss form, often referred to as an income statement, summarizes a company's revenues and expenses over a specific period. This essential financial document provides insights into a business's profitability, helping stakeholders make informed decisions. Understanding its components is crucial for effective financial management.

Edit Profit And Loss Online

Profit And Loss Form

Edit Profit And Loss Online

Edit Profit And Loss Online

or

⇓ PDF File

Finish the form and move on

Edit Profit And Loss online fast, without printing.