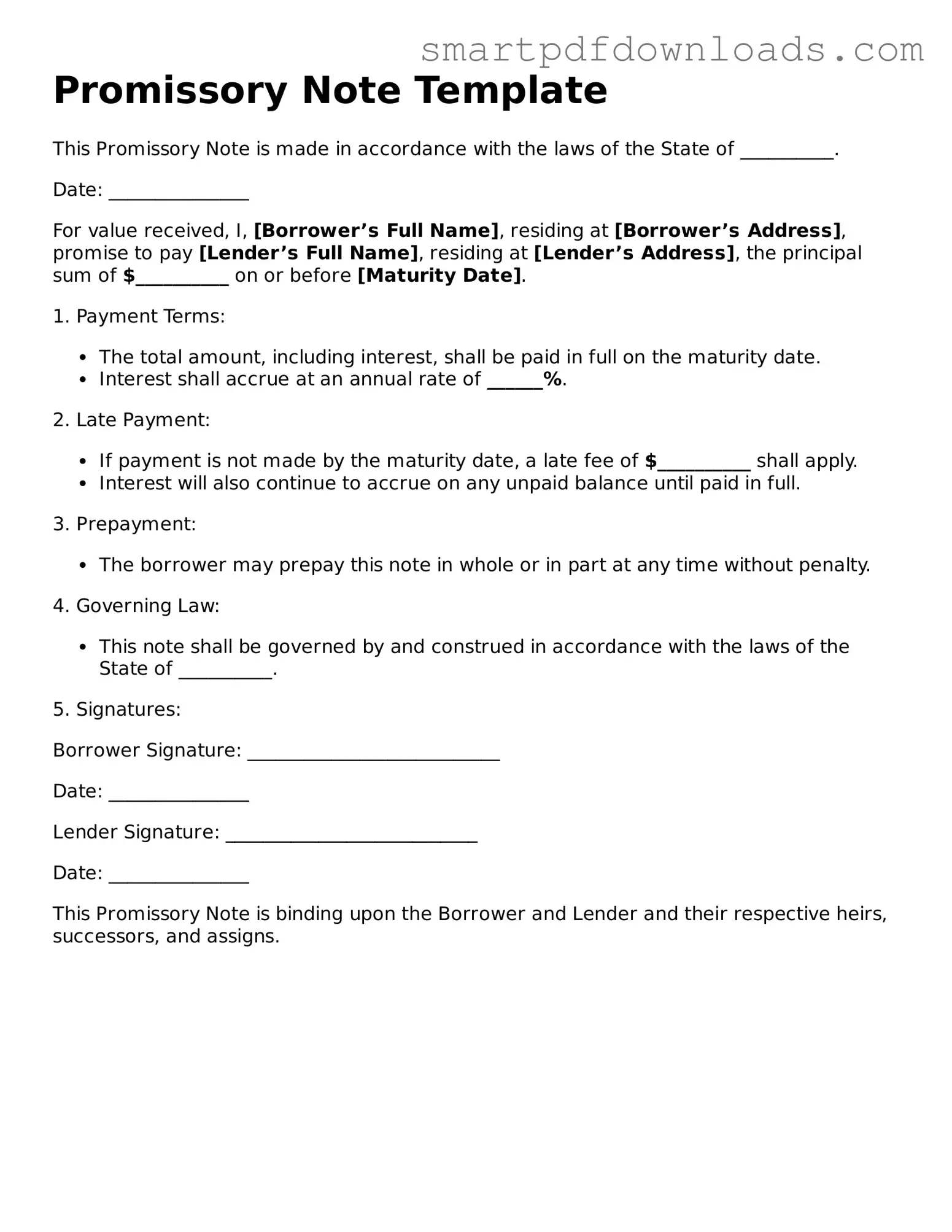

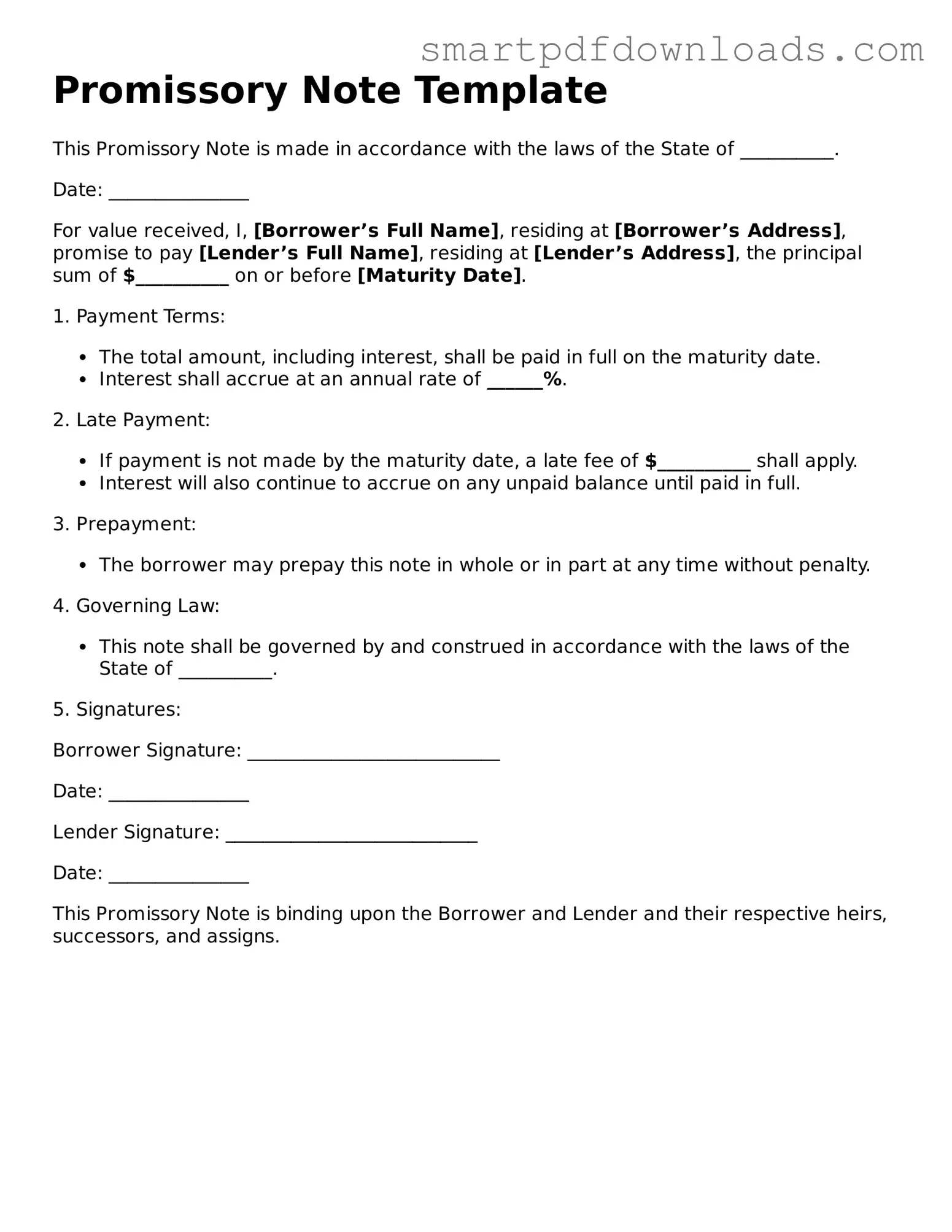

Free Promissory Note Form

A Promissory Note is a written promise to pay a specified amount of money to a designated party at a future date or on demand. This financial instrument serves as a crucial tool in various lending scenarios, providing clarity and security for both borrowers and lenders. Understanding its components and implications is essential for anyone involved in a loan agreement.

Edit Promissory Note Online

Free Promissory Note Form

Edit Promissory Note Online

Edit Promissory Note Online

or

⇓ PDF File

Finish the form and move on

Edit Promissory Note online fast, without printing.