Free Purchase Letter of Intent Form

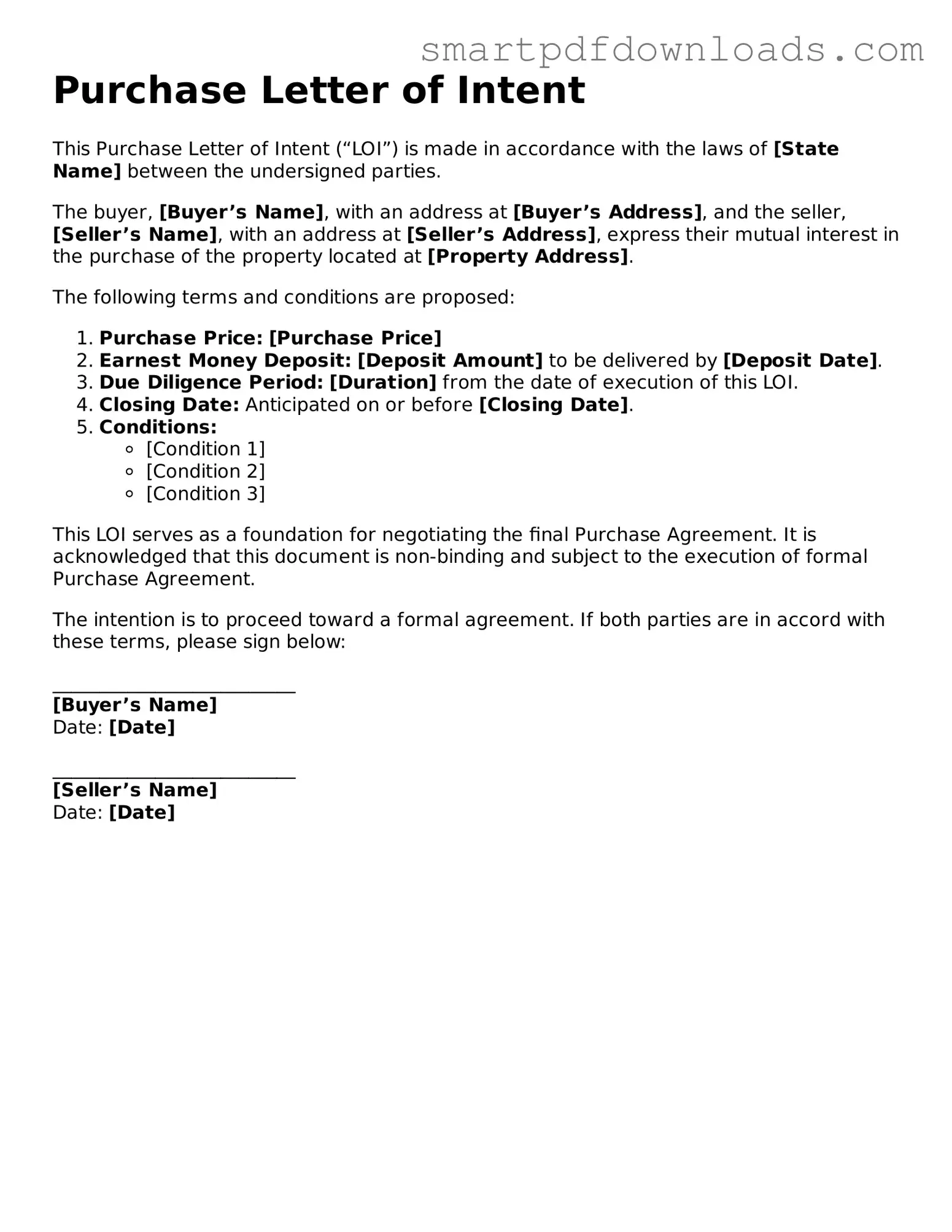

The Purchase Letter of Intent form is a preliminary document used in real estate and business transactions. It outlines the basic terms and conditions that parties agree to before finalizing a purchase agreement. This form serves as a starting point for negotiations, helping to clarify intentions and expectations.

Edit Purchase Letter of Intent Online

Free Purchase Letter of Intent Form

Edit Purchase Letter of Intent Online

Edit Purchase Letter of Intent Online

or

⇓ PDF File

Finish the form and move on

Edit Purchase Letter of Intent online fast, without printing.