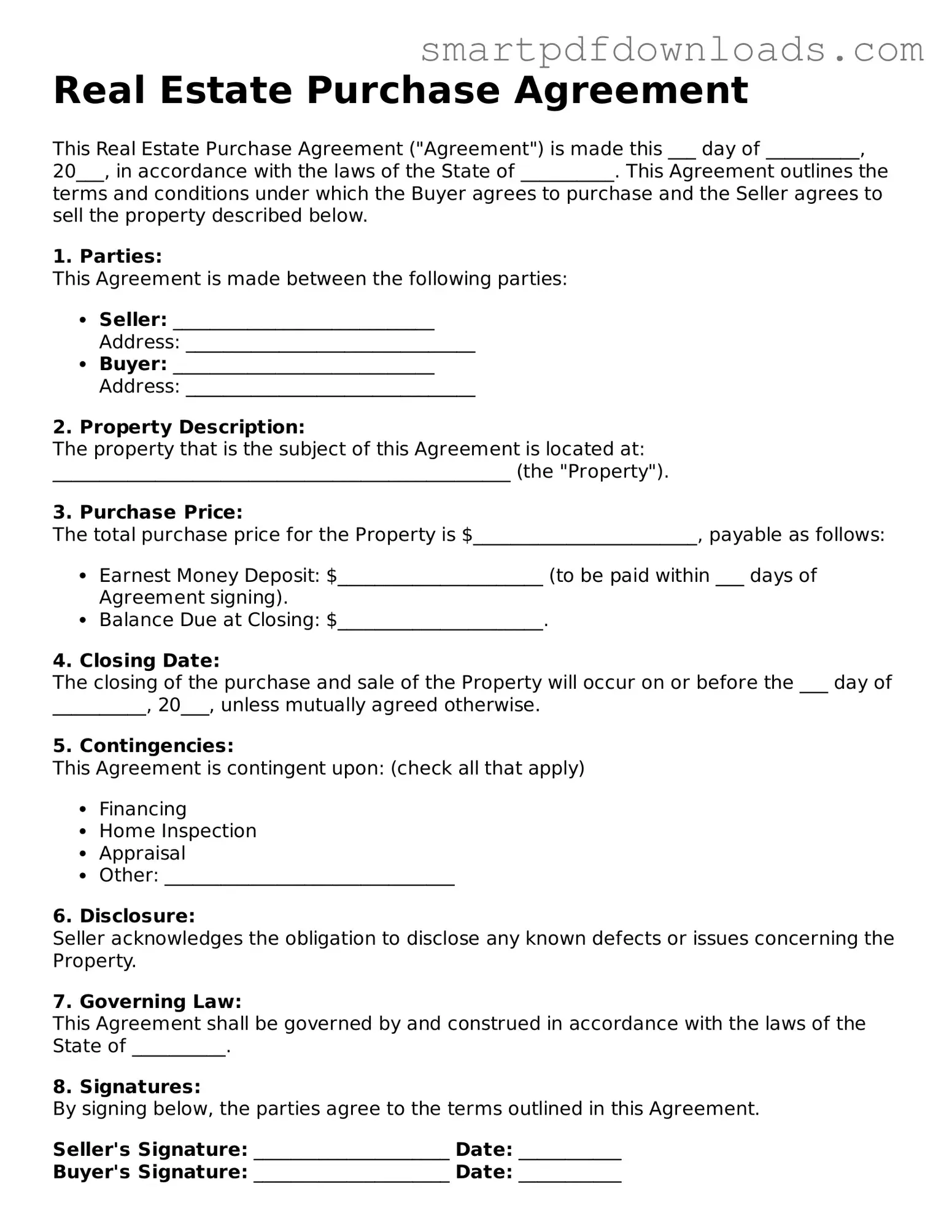

Free Real Estate Purchase Agreement Form

A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a property sale between a buyer and a seller. This agreement serves as a roadmap for the transaction, detailing the price, financing arrangements, and any contingencies. Understanding this form is essential for anyone involved in buying or selling real estate.

Edit Real Estate Purchase Agreement Online

Free Real Estate Purchase Agreement Form

Edit Real Estate Purchase Agreement Online

Edit Real Estate Purchase Agreement Online

or

⇓ PDF File

Finish the form and move on

Edit Real Estate Purchase Agreement online fast, without printing.