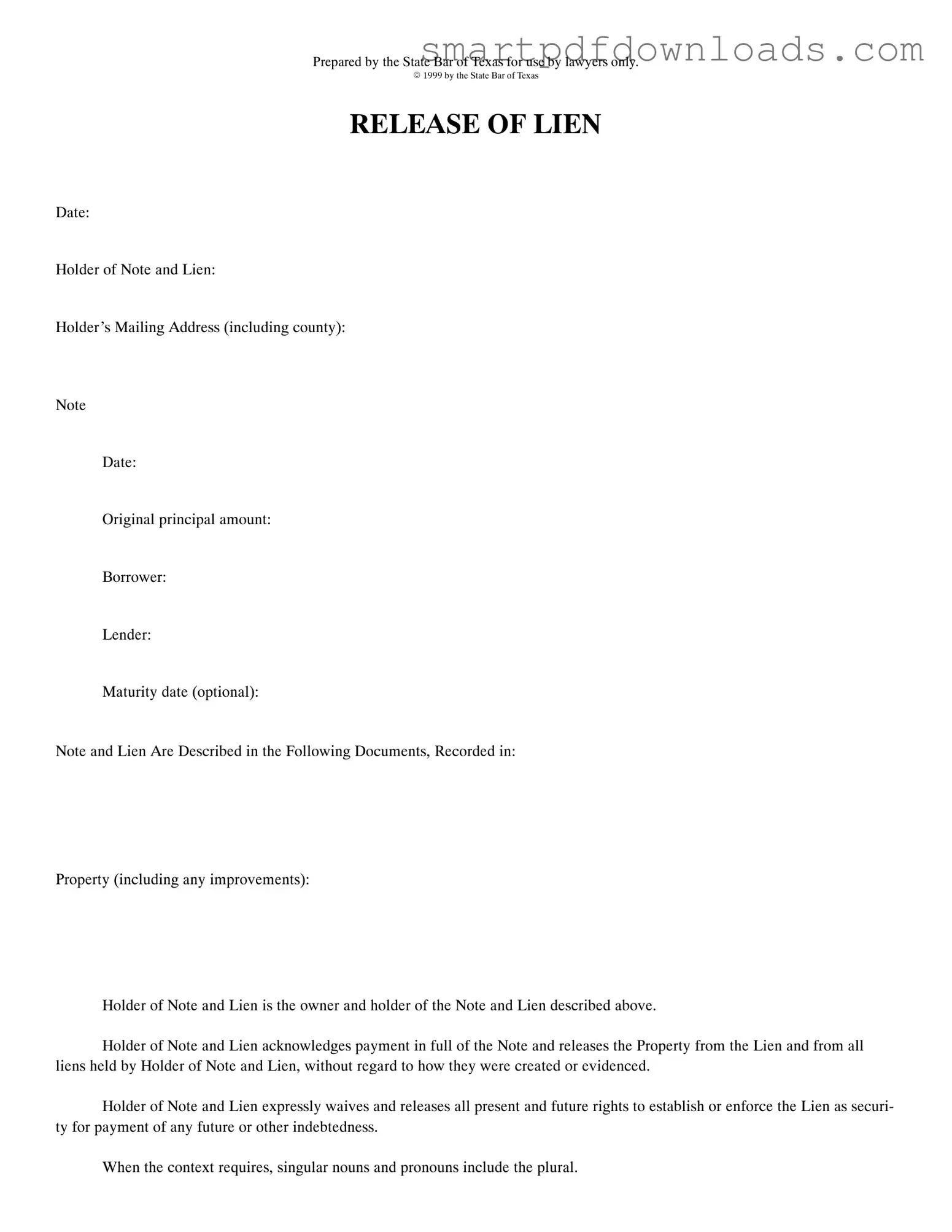

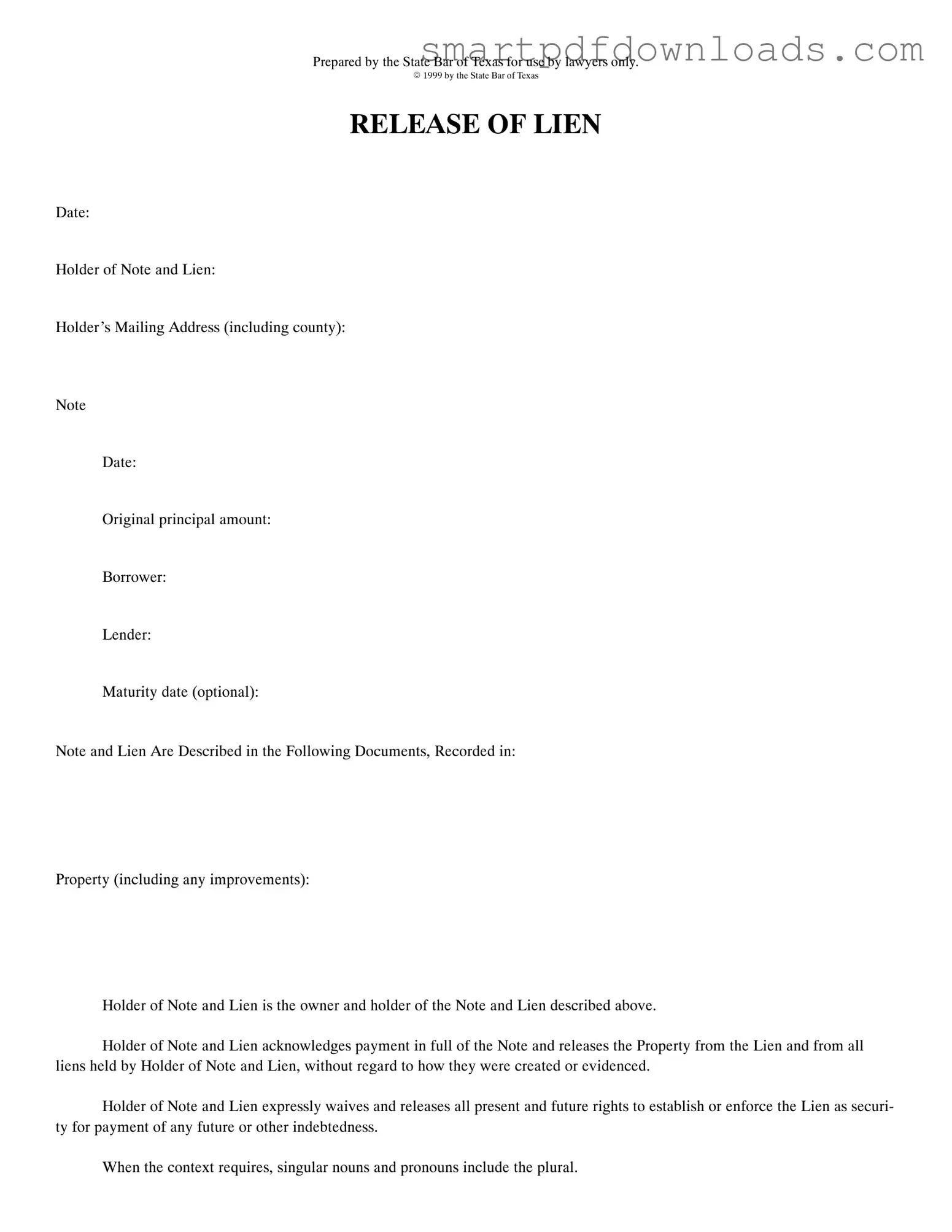

Release Of Lien Texas Form

The Release of Lien Texas form is a legal document used to formally acknowledge that a lien on a property has been paid in full and is therefore released. This document is crucial for property owners who want to clear their title and ensure that no further claims can be made against their property. Understanding this form is essential for anyone involved in real estate transactions in Texas.

Edit Release Of Lien Texas Online

Release Of Lien Texas Form

Edit Release Of Lien Texas Online

Edit Release Of Lien Texas Online

or

⇓ PDF File

Finish the form and move on

Edit Release Of Lien Texas online fast, without printing.