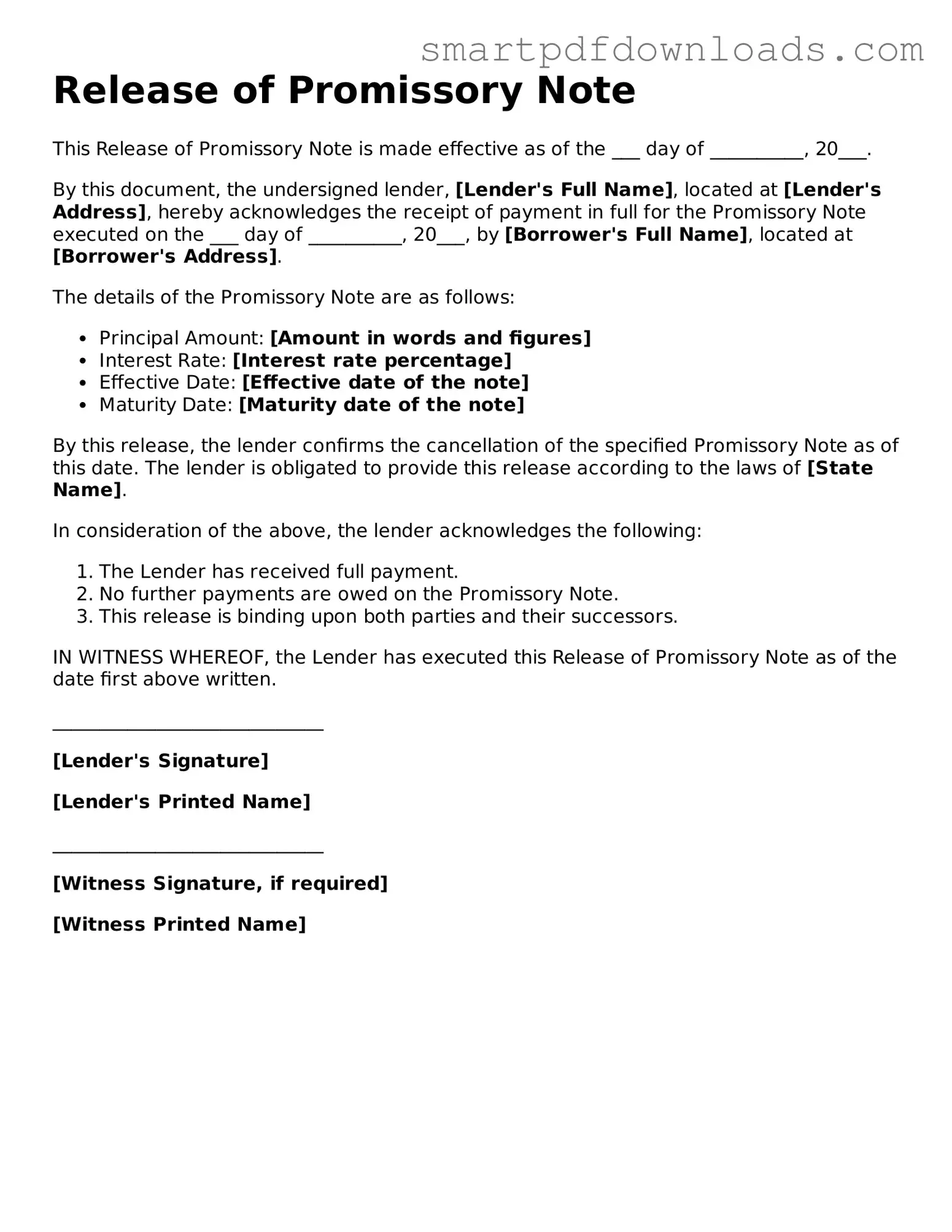

Free Release of Promissory Note Form

A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note, effectively releasing the borrower from their obligation to repay the loan. This form is essential for both lenders and borrowers, as it provides clear evidence that the debt has been satisfied. Understanding the implications of this release can help parties navigate their financial agreements more effectively.

Edit Release of Promissory Note Online

Free Release of Promissory Note Form

Edit Release of Promissory Note Online

Edit Release of Promissory Note Online

or

⇓ PDF File

Finish the form and move on

Edit Release of Promissory Note online fast, without printing.