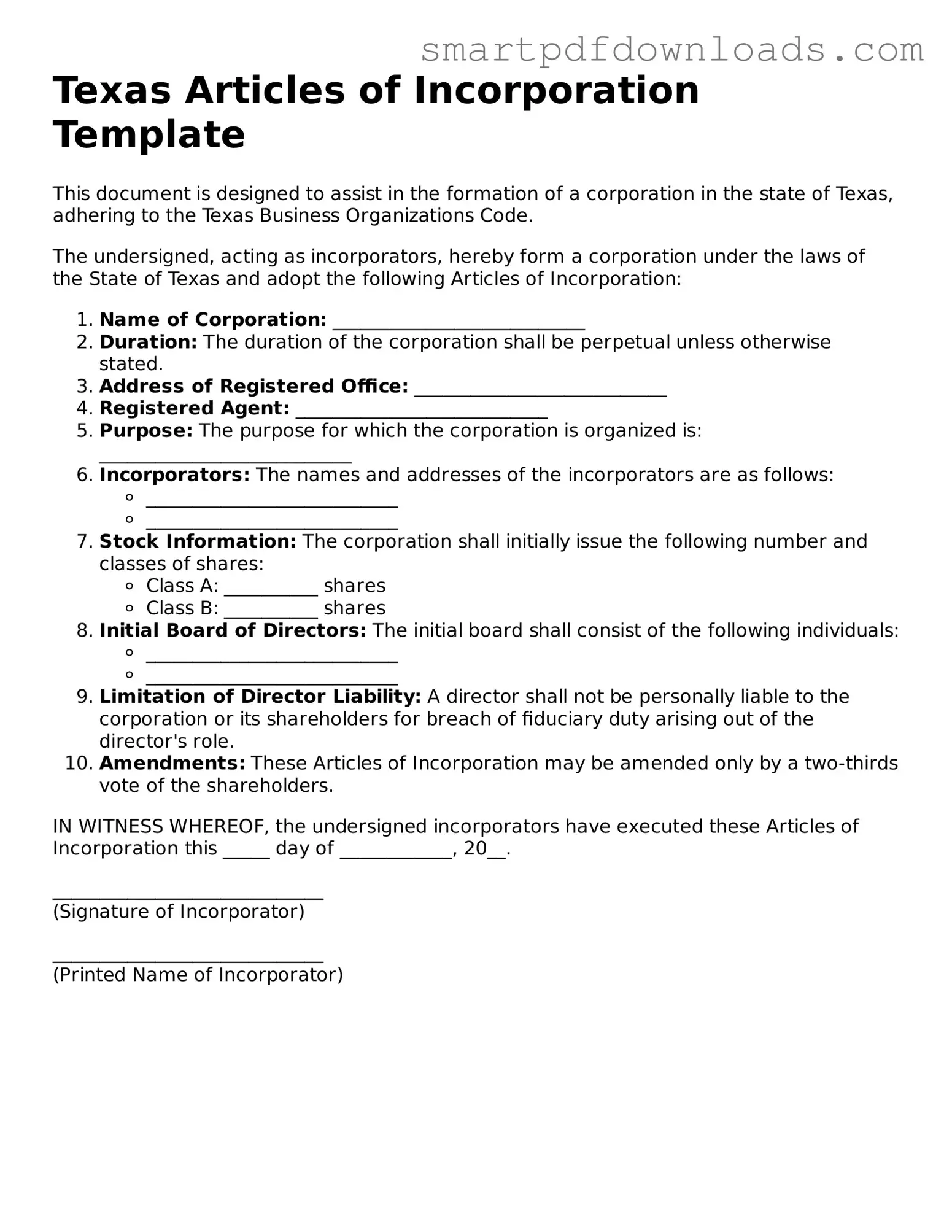

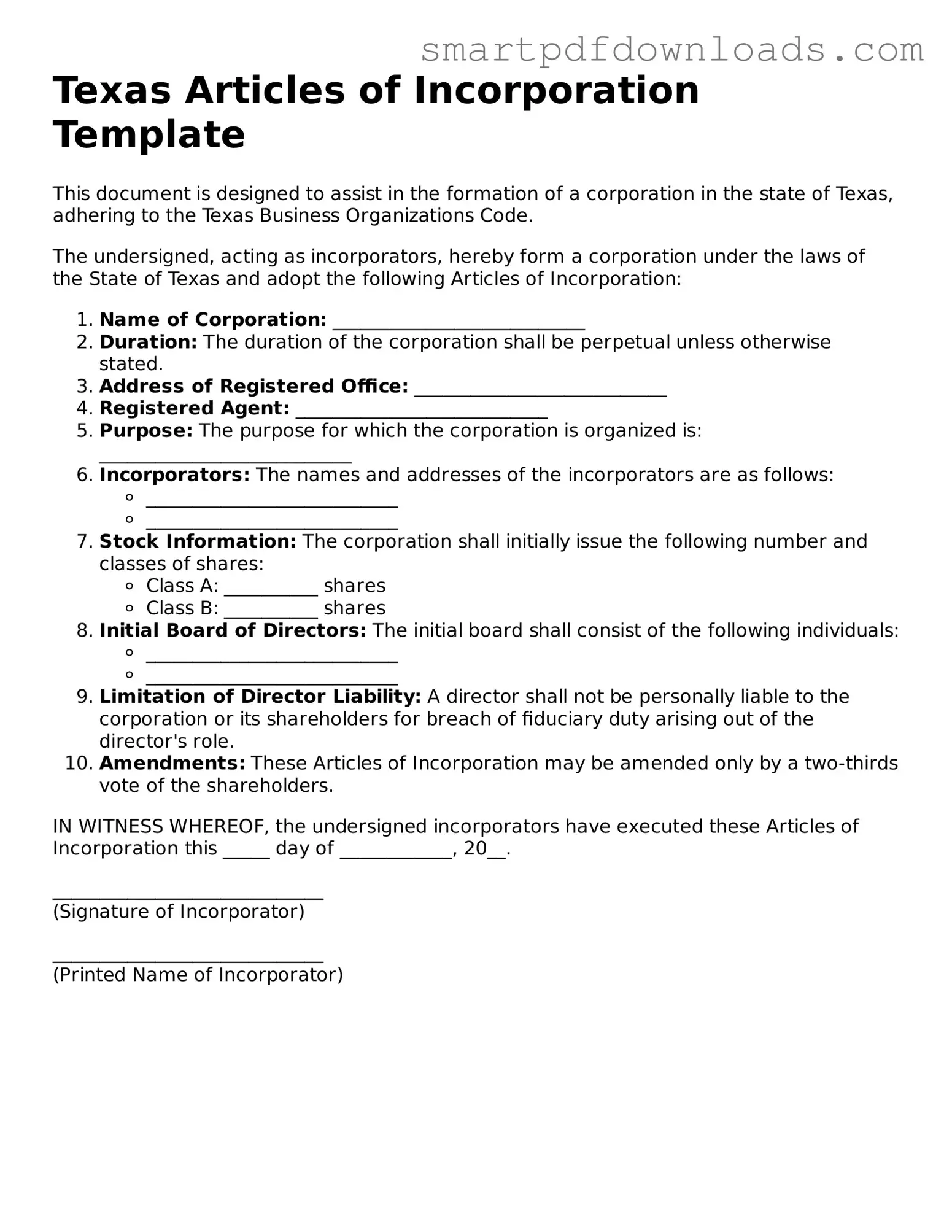

Legal Articles of Incorporation Form for the State of Texas

The Texas Articles of Incorporation form is a crucial document that officially establishes a corporation in the state of Texas. This form outlines essential details about the corporation, including its name, purpose, and the structure of its management. Completing this form correctly is vital for ensuring compliance with state laws and for protecting your business interests.

Edit Articles of Incorporation Online

Legal Articles of Incorporation Form for the State of Texas

Edit Articles of Incorporation Online

Edit Articles of Incorporation Online

or

⇓ PDF File

Finish the form and move on

Edit Articles of Incorporation online fast, without printing.