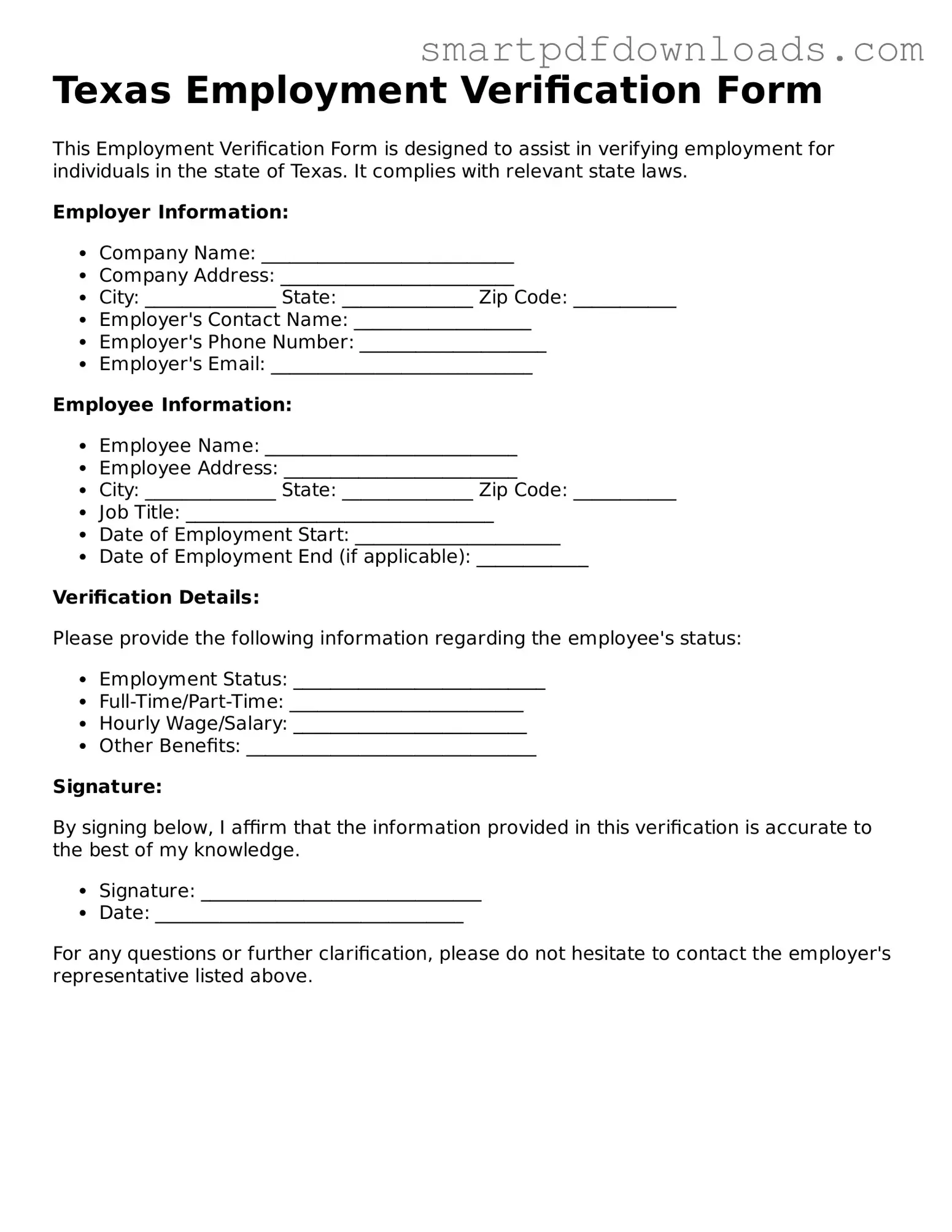

Legal Employment Verification Form for the State of Texas

The Texas Employment Verification form is a document used by employers to confirm the employment status of an individual. This form serves as a crucial tool for both employers and employees, ensuring that accurate information is shared regarding job history and current employment. Understanding its purpose and proper usage can help streamline various employment-related processes.

Edit Employment Verification Online

Legal Employment Verification Form for the State of Texas

Edit Employment Verification Online

Edit Employment Verification Online

or

⇓ PDF File

Finish the form and move on

Edit Employment Verification online fast, without printing.